DEF 14C: Definitive information statements

Published on October 17, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

| ☐ | Preliminary Information Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) | ||||

| ☒ | Definitive Information Statement | ||||

Skye Bioscience, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | ||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

|

| ||

SKYE BIOSCIENCE, INC.

11250 El Camino Real, Suite 100

San Diego, CA 92130

|

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

October 16, 2023

| ||

Dear Skye Bioscience, Inc. Stockholders:

The accompanying Information Statement (the “Information Statement”) is furnished by the Board of Directors (the “Board”) of Skye Bioscience, Inc., a Nevada corporation (the “Company”), to holders of record as of the close of business on September 29, 2023 (the “Stockholders”) of the Company’s common stock, $0.001 par value per share (“Common Stock”), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of this Information Statement is to inform our Stockholders that, on September 29, 2023, the holders of a majority of the voting power of the outstanding capital stock of the Company (the “Majority Stockholders”) acted by written consent in lieu of a special meeting of Stockholders in accordance with Section 78.320 of the Nevada Revised Statutes (“NRS”) to authorize and approve the following:

(1)An amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of Common Stock from 20,000,000 to 100,000,000 shares (the “Authorized Common Stock Amendment”); and

(2)An amendment to the Company’s Amended and Restated 2014 Omnibus Incentive Plan (the “Plan”) increasing the number of shares authorized for issuance under the Plan (the “Plan Amendment”).

No action is required by you. The NRS permit holders of a majority of the voting power of a Nevada corporation to take stockholder action by written consent. Accordingly, the Company will not hold a meeting of its Stockholders to consider or vote upon the Authorized Common Stock Amendment or the Plan Amendment. This Information Statement is furnished solely for the purpose of informing our Stockholders of the actions described herein before such actions take effect in accordance with Rule 14c-2 promulgated under the Exchange Act. In accordance with Rule 14c-2 under the Exchange Act, the actions described herein will become effective no sooner than 20 calendar days following the mailing of the Information Statement. This Information Statement is being distributed to the Stockholders on or about October 16, 2023. We encourage you to read the Information Statement carefully for further information regarding these actions.

Please note that the Majority Stockholders have voted to approve the Authorized Common Stock Amendment and the Plan Amendment. The number of votes held by the Majority Stockholders executing the written consent is sufficient to satisfy the stockholder vote requirement for these actions under applicable law and the Company’s charter documents, so no additional votes will consequently be needed to approve these actions.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

By Order of the Board of Directors

/s/ Punit Dhillon

Punit Dhillon

Chief Executive Officer

San Diego, CA

October 16, 2023

1

SKYE BIOSCIENCE, INC.

11250 El Camino Real, Suite 100

San Diego, CA 92130

|

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934 AND

REGULATION 14C PROMULGATED THEREUNDER

| ||

INTRODUCTORY STATEMENT

Date and Purpose of Written Consent

Skye Bioscience, Inc. (the “Company”) is a Nevada corporation with principal executive offices located at 11250 El Camino Real, Suite 100, San Diego, California 92130. Our telephone number is (858) 410-0266. On September 29, 2023, stockholders holding 6,531,132 shares of our Common Stock, which constitutes a majority of the voting power of the Company as of September 29, 2023, and the Company’s Board of Directors (the “Board”) took action by written consent approving and adopting (i) an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of Common Stock from 20,000,000 to 100,000,000 (the “Authorized Common Stock Amendment”), and (ii) an amendment to our Amended and Restated 2014 Omnibus Incentive Plan (the “Plan”) increasing the number of shares authorized for issuance under the Plan (the “Plan Amendment”).

This Information Statement is being distributed by the Board to the holders of record (the “Stockholders”) of the Company’s Common Stock as of September 29, 2023 (the “Record Date”) to notify the Stockholders that the holders of a majority of the voting power of the outstanding capital stock of the Company entitled to vote on the Authorized Common Stock Amendment and the Plan Amendment (the “Majority Stockholders”) have taken action by written consent, in lieu of a special meeting of the Stockholders, approving the Authorized Common Stock Amendment and the Plan Amendment. The required vote was obtained on September 29, 2023 in accordance with the relevant sections of the Nevada Revised Statutes (“NRS”) and the Company’s Articles of Incorporation and Bylaws. This Information Statement is being delivered only to inform you of the corporate actions described herein in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Section 78.320 of the NRS generally provides that any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written consents is required.

Copies of this Information Statement are expected to be mailed on or about October 16, 2023 to the Stockholders as of September 29, 2023. The filing of a Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State reflecting the Authorized Common Stock Amendment, will not be completed until at least 20 calendar days after the initial mailing of this Information Statement. The Authorized Common Stock Amendment will not take effect until the filing with the Nevada Secretary of State.

Proxies

No proxies are being solicited. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

2

Dissenting Stockholders

Under the NRS, any dissenting stockholders are not entitled to appraisal rights with respect to the approval of the Authorized Common Stock Amendment or the Plan Amendment, and we will not independently provide our stockholders with any such right.

Information Statement Costs

The entire cost of furnishing this Information Statement, including the preparation, assembly and mailing of the Information Statement, will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them, and may reimburse such persons for their reasonable charges and expenses in connection therewith.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE COMPANY’S MAJORITY STOCKHOLDERS HAVE VOTED TO APPROVE THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH ACTIONS UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER DOCUMENTS, SO NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THESE ACTIONS. THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE APPROVAL OF THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT, AND TO PROVIDE YOU WITH INFORMATION ABOUT THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT AND THE BACKGROUND OF THESE CORPORATE ACTIONS.

THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE FAIRNESS OR MERIT OF THESE ACTIONS NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT, AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

3

FORWARD-LOOKING STATEMENTS

This Information Statement and the other reports filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to differ materially from the results, performance or achievements expressed or implied by any such forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or other variations on these words or words of similar import. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light of these uncertainties, stockholders are cautioned not to place undue reliance on the information contained in forward-looking statements. Except as specified in applicable SEC regulations, the Company is not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

4

VOTE REQUIRED TO APPROVE THE PROPOSAL

The approval and adoption of the Authorized Common Stock Amendment and the Plan Amendment required the consent of the holders of a majority of the voting power of the Company. Holders of the Company’s Common Stock are entitled to one (1) vote with respect to each share of Common Stock issued and outstanding. Each holder of the Company’s Preferred Stock is entitled to voting rights equal to the number of shares of Common Stock into which such holder’s Preferred Stock would be convertible on the September 29, 2023.

As of the September 29, 2023, there were 12,338,821 shares of Common Stock and no shares of Preferred Stock issued and outstanding. For the approval of the Authorized Common Stock Amendment and the Plan Amendment, the affirmative vote of a majority of the shares of Common Stock outstanding and entitled to vote was required.

5

MAJORITY STOCKHOLDERS

On September 29, 2023, Stockholders holding 6,531,132 shares of Common Stock, or approximately 53% of the issued and outstanding Common Stock of the Company as of the Record Date, delivered a written consent to us approving and adopting the actions described in this Information Statement. For a detailed breakdown of the beneficial ownership of our Common Stock, please see Security Ownership of Certain Beneficial Owners and Management below.

Pursuant to Section 14(c) of the Exchange Act and the rules promulgated thereunder, the Authorized Common Stock Amendment and the Plan Amendment cannot become effective until at least 20 calendar days after the initial mailing of this Information Statement to stockholders.

6

APPROVAL OF THE

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

General Information

As of the date hereof, pursuant to our Articles of Incorporation, we are authorized to issue up to twenty million (20,000,000) shares of Common Stock. Pursuant to the Authorized Common Stock Amendment, we will increase our authorized shares of Common Stock from twenty million (20,000,000) to one hundred million (100,000,000) shares of Common Stock.

The Majority Stockholders representing a majority of the Company’s outstanding voting stock have given their written consent to increase the authorized number of shares of Common Stock to one hundred million (100,000,000). Under the NRS, the consent of the holders of a majority of the voting power is effective as stockholders’ approval. We will file a Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State in order to increase the number of authorized shares of Common Stock to one hundred million (100,000,000) shares of Common Stock no earlier than (20) calendar days from the date of mailing of this Information Statement. A copy of the form of Certificate of Amendment to the Company’s Articles of Incorporation is attached hereto as Annex A.

The Authorized Common Stock Amendment will not result in any changes to the issued and outstanding shares of Common Stock of the Company, and will only affect the number of shares that may be issued by the Company in the future.

Reasons for the Amendment

The primary purpose of the Authorized Common Stock Amendment is to make available for future issuance by us additional shares of Common Stock and to have a sufficient number of authorized and unissued shares of Common Stock to maintain flexibility in our corporate strategy and planning. We believe that it is in the best interests of our Company and our stockholders to have additional authorized but unissued shares available for issuance to meet business needs as they arise. The Board believes that the availability of additional shares will provide our Company with the flexibility to issue Common Stock for possible future financings, stock dividends or distributions, acquisitions, stock option plans, and other proper corporate purposes that may be identified in the future by the Board, without the possible expense and delay of a special stockholders’ meeting. The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share and, for stockholders who do not purchase additional shares to maintain their pro rata interest in our Company, on such stockholders’ percentage voting power.

The authorized shares of Common Stock in excess of those issued will be available for issuance at such times and for such corporate purposes as the Board may deem advisable, without further action by our Stockholders, except as may be required by applicable law or by the rules of any stock exchange or national securities association trading system on which the securities may be listed or traded. Upon issuance, such shares will have the same rights as the outstanding shares of Common Stock. Holders of Common Stock have no preemptive rights. The availability of additional shares of Common Stock is particularly important in the event that the Board determines to undertake any actions on an expedited basis and thus to avoid the time, expense and delay of seeking stockholder approval in connection with any potential issuance of Common Stock, of which we have none contemplated at this time other than as discussed herein.

Other than as described herein, we have no arrangements, agreements, understandings, or plans at the current time for the issuance or use of the additional shares of Common Stock proposed to be authorized pursuant to the Authorized Common Stock Amendment. The Board does not intend to issue any Common Stock except on terms which the Board deems to be in the best interests of our Company and its then existing stockholders.

Principal Effects on Outstanding Common Stock

The proposal to increase the authorized Common Stock will affect the rights of existing holders of Common Stock to the extent that future issuances of Common Stock will reduce each existing stockholder’s proportionate ownership and may dilute earnings per share of the shares outstanding at the time of any such issuance. The Authorized Common Stock Amendment will be effective upon the filing of the Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State.

7

Potential Anti-Takeover Aspects and Possible Disadvantages of Stockholder Approval of the Increase

The increase in the authorized number of shares of Common Stock could have possible anti-takeover effects. These authorized but unissued shares could, within the limits imposed by applicable law, be issued in one or more transactions that could make a change of control of the Company more difficult, and therefore more unlikely. The additional authorized shares could be used to discourage persons from attempting to gain control of the Company by diluting the voting power of shares then outstanding or increasing the voting power of persons that would support the Board in a potential takeover situation, including by preventing or delaying a proposed business combination that may be opposed by the Board although perceived to be desirable by some stockholders. The Board does not have any current knowledge of any effort by any third party to accumulate our securities or obtain control of the Company by means of a merger, tender offer, solicitation in opposition to management or otherwise.

While the Authorized Common Stock Amendment may have anti-takeover ramifications, our Board believes that the financial flexibility offered by the Authorized Common Stock Amendment outweighs any potential disadvantages. To the extent that the Authorized Common Stock Amendment may have anti-takeover effects, the Authorized Common Stock Amendment may encourage persons seeking to acquire our Company to negotiate directly with the Board, enabling the Board to consider the proposed transaction in a manner that best serves our Stockholders’ interests.

Other than as set forth above, there are currently no plans, arrangements, commitments or understandings for the issuance of additional shares of Common Stock.

Amendment

The first paragraph of Article 3 of the Company’s Articles of Incorporation will be amended to read as follows:

“The aggregate number of shares that the Corporation will have authority to issue is one hundred million two hundred thousand (100,200,000), of which one hundred million (100,000,000) will be common stock, with a par value of $0.001 per share, and two hundred thousand (200,000) will be preferred stock, with a par value of $0.001 per share.”

A copy of the Certificate of Amendment to the Company’s Articles of Incorporation is attached hereto as Annex A.

Vote Required

The affirmative vote of a majority of the shares of outstanding Common Stock entitled to vote was required to approve the Authorized Common Stock Amendment.

No Dissenter’s Rights

Under the NRS, any dissenting stockholders are not entitled to appraisal rights with respect to the Authorized Common Stock Amendment, and we will not independently provide our stockholders with any such right.

8

APPROVAL OF THE AMENDMENT TO THE COMPANY’S

AMENDED AND RESTATED 2014 OMNIBUS INCENTIVE PLAN

TO INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE UNDER THE PLAN

AMENDED AND RESTATED 2014 OMNIBUS INCENTIVE PLAN

TO INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE UNDER THE PLAN

Purpose of the Amendment of the Amended and Restated 2014 Omnibus Incentive Plan

In August 2023, the Company completed the acquisition of Bird Rock Bio, Inc. (“Bird Rock Bio”) and closed a concurrent private placement financing and a convertible note financing (the “Transaction”). Following the completion of the Transaction, the Compensation Committee (the “Compensation Committee”) of our Board, the Board and its advisors undertook a review of the compensation of our executive officers, directors and employees. As a result of this analysis, the Compensation Committee recommended, and the Board approved, additional equity awards for the Company’s executive officers, directors and employees. The total number of equity awards approved by the Board included 832,440 restricted stock units ("RSU") and 321,910 stock options. The aggregate number of shares of Common Stock subject to such awards exceeds the number of remaining shares authorized for issuance under the Plan prior to the Plan Amendment. Accordingly, 587,255 RSUs and 226,935 stock options awarded by the Board are subject to, and contingent upon the effectiveness of the Plan Amendment.

On September 29, 2023, the Majority Stockholders and the Board approved an amendment to the Company’s Amended and Restated 2014 Omnibus Incentive Plan (as amended, the “Plan”) to increase the aggregate number of shares of Common Stock authorized for issuance under the Plan from 547,585 to 1,846,883 shares of Common Stock, while retaining the automatic share replenishment feature, which provides that each January 1 beginning in 2024 and ending on (and including) January 1, 2032 the number of shares will increase by 5% of the outstanding shares of Common Stock as of December 31 of the preceding calendar year, subject to the Board’s right to specify a lesser amount (the “Plan Amendment”). The Plan Amendment will take effect 20 calendar days following the date we first mail this Information Statement to our stockholders.

Our Plan is the only plan under which equity-based compensation may currently be awarded to our employees, officers, directors and consultants. In order to enable us to continue to offer meaningful equity-based incentives to our employees, officers, directors and consultants, the Majority Stockholders and the Board believe it is both necessary and appropriate and in the best interest of our Company and our stockholders to increase the number of shares of our Common Stock available for these purposes.

Summary Description of Amended and Restated 2014 Omnibus Incentive Plan, as Amended

The following is a summary of the principal features of the Plan. All references to the Plan in this section refer to the Plan, as amended by the Plan Amendment. The following description is intended to be a summary of the material provisions of the Plan. It does not purport to be a complete description of all the provisions of the Plan, and is qualified in its entirety by reference to the complete text of the Plan, including the Plan Amendment evidenced by Amendment No. 1 to the Plan, which is attached hereto as Annex B. Capitalized terms used in the following summary and not otherwise defined in this Information Statement have the meanings set forth in the Plan.

Purpose and Eligible Participants. The purpose of the Plan is to attract, retain and reward high-quality executives, employees, non-employee directors and consultants who provide services to the Company and its subsidiaries, and to motivate our executives, non-employee directors, employees and consultants to achieve long-term corporate objectives, by enabling such persons to acquire a proprietary interest in the Company. All employees (including executive officers), non-employee directors, and consultants of the Company are eligible to participate in the Plan.

As of September 29, 2023, there were six non-employee directors, nine employees and one consultant who were eligible to be selected to receive awards under the Plan.

Types of Awards. The Plan permits the grant of the following types of awards (“Awards”), in the amounts and upon the terms determined by the Committee:

Options. Options may either be incentive stock options (“ISOs”) which are specifically designated as such for purposes of compliance with Section 422 of the Internal Revenue Code or non-qualified stock options (“NSOs”). Options may be granted in such number, at such price, and subject to such conditions as may be established by the Committee. The exercise price of each Option shall be determined by the Committee, provided that such price will not be less than the fair market value of a share on the date of the grant. The term for the Options may be set by the Committee, but in no event shall an Option be exercisable more than ten (10) years from the date of grant. Recipients of Options have no rights as stockholders with respect to any shares covered by the Options until the recipients or transferees have become holders of record of any such shares.

Stock Appreciation Rights. Generally, upon exercise of a stock appreciation right (“SAR”), the recipient will receive cash, shares of the Company’s Common Stock, or a combination of cash and Common Stock, with a value equal to the excess of: (i) the fair market value of a share of Common Stock on the date of the exercise,

9

over (ii) the exercise price or grant price of such SAR. The exercise price or grant price of a SAR and all other terms and conditions will be established by the Committee in its sole discretion, subject to and in accordance with the terms of the Plan.

Restricted Stock Awards. Restricted stock awards consist of shares granted to a participant that are subject to one or more risks of forfeiture and/or transfer restriction, which may be based upon performance standards, periods of service, retention by the Participant of ownership of a specified number of shares of Common Stock, or other criteria as may be established by the Committee. Recipients of restricted stock awards are entitled to vote and receive dividends attributable to the shares underlying the Award beginning on the grant date, provided that any Common Stock distributed as a dividend or otherwise with respect to any restricted shares shall be subject to the same restrictions as such restricted shares.

Restricted Stock Units. Restricted stock units consist of a right to receive shares in the future subject to such terms, conditions and restrictions as the Committee may establish, which may be based on performance standards, periods of service, retention by the Participant of ownership of a specified number of shares of Common Stock, or other criteria. Recipients of restricted stock units have no rights as stockholder with respect to any shares covered by the Award until the lapse or release of all restrictions applicable to the Award and the issuance of shares of Common Stock in respect of such Award.

Performance Awards. Performance awards consist of the right to receive payment (in cash or shares of Common Stock, or a combination of cash and Common Stock) upon achievement of performance objectives during a performance period established by the Committee, which shall be two or more fiscal or calendar years. Recipients of performance awards have no rights as stockholders with respect to any shares covered by the Award until the issuance of shares of Common Stock, if any, in respect of such Award.

Other Awards. Other stock-based awards, consisting of stock purchase rights, awards of Common Stock, or awards valued in whole or in part by reference to, or otherwise based on, Common Stock, may be granted either alone or in addition to or in conjunction with other awards under the Plan. Subject to the provisions of the Plan, the Committee shall have sole and complete authority to determine the persons to whom and the time or times at which such awards shall be made, the number of shares of Common Stock to be granted pursuant to such awards, and all other conditions of the awards. Any such award shall be confirmed by an award agreement executed by the Committee and the participant, which award agreement will contain such provisions as the Committee determines to be necessary or appropriate to carry out the intent of this Plan.

Number of Shares. Subject to adjustment as provided in the Plan, the current number of shares of Common Stock available for issuance in connection with Awards granted under the Plan is 547,585, provided that each January 1 beginning in 2023 and ending on (and including) January 1, 2032 the number of shares will increase by 5% of the outstanding shares of Common Stock as of December 31 of the preceding calendar year. The Plan Amendment will increase the aggregate number of shares of Common Stock authorized for issuance under the Plan to 1,846,883 shares of Common Stock, while retaining the automatic share replenishment feature which provides that each January 1 beginning in 2024 and ending on (and including) January 1, 2032 the number of shares will increase by 5% of the outstanding shares of Common Stock as of the prior December 31 of the preceding calendar year. Notwithstanding the foregoing, the Board may act prior to January 1 of a given year to provide that there will be no January 1 increase for such year or that the increase for the year will be a lesser number of shares of Common Stock than provided above. Any shares of Common Stock offered under the Plan shall consist of authorized and unissued shares of Common Stock, or issued Common Stock that shall have been reacquired by the Company.

Subject to adjustment as provided in the Plan, the current maximum number of shares of Common Stock that may be issued pursuant to the exercise of Incentive Stock Options is 547,585, provided that such number will automatically increase on January 1 of each year, for a period of no more than ten years, commencing on January 1, 2023 and ending on (and including) January 1, 2032 in an amount equal to 5% of the total number of shares of Common Stock outstanding on June 14, 2022, which was the date the amended and restated Plan (prior to the latest amendment described herein) became effective. The Plan Amendment will increase the aggregate number of shares of Common Stock that may be issued pursuant to the exercise of Incentive Stock Options to 1,846,883, provided that each January 1 beginning in 2024 and ending on (and including) January 1, 2032 the number of shares will increase by 5% of the outstanding shares of Common Stock as of June 14, 2022. Notwithstanding the foregoing, the Board may act prior to January 1 of a given year to provide that there will be no January 1 increase for such year or that the increase for the year will be a lesser number of shares of Common Stock than provided above. As of September 29, 2023, the closing price of a share of our Common Stock as reported on OTCQB was $4.09 per share.

Administration. Subject to the terms of the Plan, the Compensation Committee of the Board of Directors (the “Committee") will generally administer the Plan. The Committee has full power and authority to determine when and to whom awards will be granted, including the type, amount, form of payment and other terms and conditions of

10

each award, consistent with the provisions of the Plan. In addition, the Committee has the authority to interpret the Plan and the awards granted under the Plan, and establish rules and regulations for the administration of the Plan. The Committee may delegate certain administrative duties associated with the Plan to our officers, including the maintenance of records of the awards and the interpretation of the terms of the awards. The Committee shall consider such factors as it deems pertinent in determining the type and amount of their respective awards.

Amendments. The Board has the complete power and authority to amend the Plan at any time, provided that the Board shall not, without the requisite approval of the Company’s stockholders, make any amendment which requires stockholder approval under the Code or under any other applicable law or rule of any stock exchange on which the Company’s Common Stock is listed.

Term. The Plan shall remain in effect until June 14, 2032, or until terminated by action of the Board, whichever occurs earlier. The Board has the authority to terminate the Plan at any time.

Change in Control. Unless otherwise provided in the terms of the applicable Award agreement, upon a Change in Control of the Company, as defined in the Plan, no accelerated vesting of any outstanding Options or SARs shall occur, no acceleration of the termination of any restrictions applicable to restricted stock awards and restricted stock units shall occur, and no accelerated vesting of any outstanding performance awards shall occur.

Transfer Restrictions. A Participant’s rights and interests under the Plan may not be assigned or transferred other than by will or the laws of descent and distribution, and during the lifetime of the Participant, only the Participant personally (or the Participant’s personal representative) may exercise rights under the Plan.

U.S. Federal Income Tax Consequences

The following discussion of tax consequences relates only to U.S. federal income tax matters. The tax consequences of participating in the Plan may vary according to country of participation. Also, the tax consequences of participating in the Plan may vary with respect to individual situations and it should be noted that income tax laws, regulations and interpretations thereof change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

Stock Options and Stock Appreciation Rights

Some of the options issued under the Plan are intended to constitute “incentive stock options” within the meaning of Section 422 of the Code, while other options granted under the Plan are non-qualified stock options. The Code provides for tax treatment of stock options qualifying as incentive stock options that may be more favorable to employees than the tax treatment accorded non-qualified stock options. Generally, upon the exercise of an incentive stock option, the optionee will recognize no income for U.S. federal income tax purposes, although the optionee may subsequently recognize income if the shares are disposed of prior to the holding period described below. The difference between the exercise price of the incentive stock option and the fair market value of the stock at the time of purchase is an item of tax preference that may require payment of an alternative minimum tax.

On the sale of shares acquired by exercise of an incentive stock option (assuming that the sale does not occur within two years following the date of grant of the option or within one year following the date of exercise), any gain will be taxed to the optionee as long-term capital gain. Except with respect to death or permanent and total disability (in which case the optionee has one year to exercise and obtain incentive stock option treatment), an optionee has three months after termination of employment in which to exercise an incentive stock option and retain incentive stock option tax treatment at exercise. An option exercised more than three months after an optionee’s termination of employment, including termination due to retirement, cannot qualify for the tax treatment accorded incentive stock options. Such option would be treated as a non-qualified stock option instead.

In contrast, upon the exercise of a non-qualified option, the optionee recognizes taxable income (subject to withholding) in an amount equal to the difference between the fair market value of the shares on the date of exercise and the exercise price. Upon any sale of such shares by the optionee, any difference between the sale price and the fair market value of the shares on the date of exercise of the non-qualified option will be treated generally as capital gain or loss.

11

Participants will not realize taxable income upon the grant of a stock appreciation right. Upon the exercise of a stock appreciation right, the participant will recognize ordinary income (subject to withholding by the Company) in an amount equal to the cash or fair market value of the shares of stock received on the date of exercise of the stock appreciation right. The participant will generally have a tax basis in any shares of stock received on the exercise of a stock appreciation right that equals the fair market value of such shares on the date of exercise. Subject to the limitations discussed below, the Company will be entitled to a deduction for U.S. federal income tax purposes that corresponds as to timing and amount with the compensation income recognized by the participant under the foregoing rules.

Subject to the discussion below under “Certain Tax Code Limitations on Deductibility,” under rules applicable to U.S. corporations, no deduction is available to the employer corporation upon the grant or exercise of an incentive stock option (although a deduction may be available if the employee sells the shares so purchased before the applicable holding period expires), whereas, upon exercise of a non -qualified stock option or stock appreciation right, the employer corporation is entitled to a deduction in an amount equal to the income recognized by the employee.

Stock Awards

A participant generally will not have taxable income upon the grant of stock awards, such as restricted stock or restricted stock units. Instead, he or she will recognize ordinary compensation income in the first taxable year in which his or her interest in the stock underlying the award becomes either (i) freely transferable or (ii) no longer subject to substantial risk of forfeiture. In general, a participant will recognize ordinary compensation income in an amount equal to the fair market value of the stock when it first becomes transferable or is no longer subject to a substantial risk of forfeiture, unless the participant makes an election to be taxed on the fair market value of the stock underlying the award when it is received.

An employee will be subject to withholding for federal, and generally for state and local, income taxes at the time the employee recognizes income under the rules described above with respect to an award of restricted stock or restricted stock units. The tax basis of a participant in the stock received will equal the amount recognized by the employee as compensation income under the rules described in the preceding paragraph, and the employee’s holding period in such shares will commence on the date income is so recognized. Upon later disposition of stock received that has been held for the requisite holding period, the employee will generally recognize capital gain or loss equal to the difference between the amount received in the disposition and the amount previously recognized as compensation income.

Subject to the discussion below under “Certain Tax Code Limitations on Deductibility,” we will be entitled to a deduction for U.S. federal income tax purposes that corresponds as to timing and amount with the compensation income recognized by the participant under the foregoing rules to the extent the deduction is allocable to “effectively connected income” which is subject to U.S. federal income tax.

Certain Tax Code Limitations on Deductibility

Section 162(m), as amended by the Tax Cuts and Jobs Act (the “TCJA”), no longer provides for the exclusion of certain performance-based compensation from Section 162(m)’s $1 million limit on tax deductibility for compensation paid to “covered employees.” Accordingly, with respect to performance-based compensation granted or awarded after November 2, 2017, the availability of the exclusion under Section 162(m) is no longer a consideration with respect to deductibility structuring performance awards. The Committee may award compensation that is or may become non-deductible, and expects to consider whether it believes such grants are in the best interest of the Company, balancing tax efficiency with long-term strategic objectives.

Code Section 409A

Section 409A of the Code generally provides that any deferred compensation arrangement must satisfy specific requirements, both in operation and in form, regarding (1) the timing of payment, (2) the advance election of deferrals, and (3) restrictions on the acceleration of payment. Failure to comply with Section 409A may result in the early taxation (plus interest) to the participant of deferred compensation and the imposition of a 20% penalty on the participant on such deferred amounts included in the participant’s income. We intend to structure awards under the Plan in a manner that is designed to be exempt from or comply with Section 409A.

12

Code Section 457A

Section 457A of the Code has significantly changed the rules applicable to deferred compensation paid to U.S. persons by certain foreign corporations and other entities. We expect that stock options, stock-settled stock appreciation rights, restricted stock and restricted stock units granted under the Plan will be exempt from Section 457A. However, stock appreciation rights that may be settled in cash may be subject to Section 457A, as well as cash awards or stock units that are not paid within one year after vesting.

Section 457A requires that any compensation paid under a deferred compensation plan of a nonqualified entity must be included in the participant’s income at the time such amounts are no longer subject to a substantial risk of forfeiture. Therefore, stock appreciation rights that may be settled in cash as well as cash awards or stock units that are not paid within one year after vesting may result in income inclusion upon vesting, even though the participant has not exercised the stock appreciation right or received delivery of cash or shares of stock at that time. We currently intend to grant awards that are exempt from Section 457A.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF AN INDIVIDUAL’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE.

Future Awards under the Plan

Awards under the Plan are granted at the discretion of the Board or the Committee appointed to administer the Plan. Accordingly, future awards under the Plan are not determinable.

Vote Required

The affirmative vote of a majority of the shares of outstanding Common Stock entitled to vote was required to approve the Plan Amendment.

No Dissenter’s Rights

Under the NRS, dissenting stockholders are not entitled to appraisal rights with respect to the Plan Amendment, and we will not independently provide our stockholders with any such right.

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the compensation earned for services rendered to us for the fiscal years ended December 31, 2022 and 2021 of our named executive officers as determined in accordance with SEC rules.

| SUMMARY COMPENSATION TABLE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name and Principal Position |

Year Ended |

Salary ($) |

Bonus ($) (4) |

Stock Awards ($) (1) |

Option Awards ($) (1) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||||||||||||||||||||||||||||

| Kaitlyn Arsenault | 2022 | 325,856 | 130,031 | — | — | — | — | — | 455,887 | |||||||||||||||||||||||||||||||||||||||||||||||

| Chief Financial Officer (2) | 2021 | 75,000 | 19,031 | 58,000 | 269,240 | — | — | 181,473 | 602,744 | |||||||||||||||||||||||||||||||||||||||||||||||

| Punit Dhillon | 2022 | 432,577 | 298,000 | — | — | — | — | 2,500 | 733,077 | |||||||||||||||||||||||||||||||||||||||||||||||

| Chief Executive Officer (3) | 2021 | 400,000 | 220,521 | 116,000 | 160,680 | — | — | 2,500 | 899,701 | |||||||||||||||||||||||||||||||||||||||||||||||

_________

| (1) | Amounts reflect the full grant date fair value of stock options and awards, computed in accordance with ASC Topic 718 - Stock based compensation, rather than the amounts paid to or realized by the named individual. | ||||

| (2) | For the year ended December 31, 2021, other compensation consists of consulting fees charged to the Company by KA Consulting, Inc. and RoseRyan, Inc. for Ms. Arsenault's services. |

||||

| (3) | For the years ended December 31, 2022 and 2021, other compensation consists of personal tax preparation fee reimbursements per the executives employment agreement. |

||||

| (4) | In connection with the acquisition of Emerald Health Therapeutics, Inc., the Board approved transaction bonuses to be paid to our Chief Financial Officer and Chief Executive Officer of $111,000 and $148,000, respectively, upon the closing of the acquisition. As the acquisition of Emerald Health Therapeutics, Inc. was completed on November 10, 2022, the amounts stated included the transaction bonuses. |

||||

Employment and Severance Arrangements

Employment Agreements and Equity Awards

On August 7, 2020, we entered into an employment agreement with Mr. Punit Dhillon, our Chief Executive Officer. The agreement provides for an annual base salary of $400,000 per year and an annual discretionary bonus up to fifty percent (50%) of his base salary based on Mr. Dhillon’s achievement of annual corporate milestones agreed to by the Board. Effective June 1, 2022, Mr. Dhillon's annual base salary was increased to $450,000 per year and his annual discretionary bonus eligibility was increased to sixty percent (60%) of his base salary. Mr. Dhillon will also receive the normal benefits available to other similarly situated executives and will be entitled to severance pay under the circumstances described below.

Mr. Dhillon’s employment with the Company is at-will. Except for termination of Mr. Dhillon’s employment for “Cause,” “By Death”, “By Disability” (as such terms are defined in his employment agreement), Mr. Dhillon will be entitled to a severance payment equal to twenty-four (24) months of his then current base salary, less applicable statutory deductions and withholdings if terminated by the Company.

In connection with his appointment, the Company granted Mr. Dhillon options to purchase 36,000 shares of the Company’s common stock at an exercise price of $11.25 per share (the then market price of the Company’s shares), with 10% of such options vested immediately upon grant and the remaining 90% vesting equally on each six-month anniversary of the grant date over the following four and a half years from the grant date.

14

During the year ended December 31, 2021, Mr. Dhillon was granted 8,000 restricted stock units and 12,360 stock options. The restricted stock units vest in three equal annual installments commencing on the first anniversary of the grant date, which was December 14, 2021. The stock options vest 25% on the one year anniversary of the grant date and 1/48th monthly thereafter.

On August 25, 2023, Mr. Dhillon was granted 81,110 RSUs and 9,013 stock options. The RSUs are subject to the following performance based milestones: 25% will vest if the Company’s market capitalization reaches $125,000,000, an additional 25% will vest if the Company’s market capitalization reaches $250,000,000, an additional 25% if the Company’s market capitalization reaches $400,000,000 and the remaining 25% will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater; provided, however, that no RSUs shall vest until the compensation committee of the Board determines that shares can be sold into the market to cover withholding tax obligations associated with the vesting of the RSUs. All of the RSUs will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater. The stock options vest 1/48th monthly over a four year period beginning August 24, 2023.

On August 25, 2023, Mr. Dhillon was also granted 194,270 RSUs and 21,586 stock options which are subject to, and contingent upon, the effectiveness of the Plan Amendment. The RSUs are subject to the following performance based milestones: 25% will vest if the Company’s market capitalization reaches $125,000,000, an additional 25% will vest if the Company’s market capitalization reaches $250,000,000, an additional 25% if the Company’s market capitalization reaches $400,000,000 and the remaining 25% will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater; provided, however, that no RSUs shall vest until the compensation committee of the Board determines that shares can be sold into the market to cover withholding tax obligations associated with the vesting of the RSUs. All of the RSUs will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater. The stock options vest 1/48th monthly over a four year period beginning August 24, 2023.

On October 4, 2021, we entered into an employment agreement with Ms. Kaitlyn Arsenault, our Chief Financial Officer. On May 11, 2023, the Company approved an amendment to Ms. Arsenault’s employment agreement to amend Ms. Arsenault’s severance benefits. The agreement provides for an annual base salary of $300,000 per year and an annual discretionary bonus of up to thirty five percent (35%) of her base salary based in part on Ms. Arsenault’s achievement of milestones agreed to by the Board. Effective June 1, 2022, Ms. Arsenault's annual base salary was increased to $340,000 per year and her annual discretionary bonus eligibility was increased to forty percent (40%) of her base salary. Ms. Arsenault will also receive the normal benefits available to other similarly situated executives and will be entitled to severance pay under the circumstances described below.

Ms. Arsenault’s employment with the Company is at-will. Except for termination of Ms. Arsenault’s employment for “Cause,” “By Death” or “By Disability” (as such terms are defined in her employment agreement), (a) in the event that following a “Change of Control” (as defined in the Plan) Ms. Arsenault’s employment is terminated by the Company, she will be entitled to a severance payment equal to twelve (12) months of her then current base salary less applicable statutory deductions and withholdings, and (b) in the event that prior to a Change of Control, Ms. Arsenault’s employment is terminated by the Company, she will be entitled to a severance payment equal to (i) six (6) months of her then current base salary, less applicable statutory deductions and withholdings, if such termination occurs prior to April 4, 2023, (ii) nine (9) months of her then current base salary, less applicable statutory deductions and withholdings, if such termination occurs on or after April 4, 2023 and before October 4, 2024, and (iii) twelve (12) months of her then current base salary, less applicable statutory deductions and withholdings, if such termination occurs on or after October 4, 2024.

In connection with her appointment, the Company granted Ms. Arsenault options to purchase 6,400 shares of the Company’s common stock at an exercise price of $22.50 per share (the then market price of the Company’s shares), with 10% of such options vested immediately upon grant and the remaining 90% vesting equally in semi-annual installments over four years from issuance.

During the year ended December 31, 2021, Ms. Arsenault was granted 4,000 restricted stock units and 7,080 stock options. The restricted stock units vest in three equal annual installments commencing on the first anniversary of the grant date, which was December 14, 2021. The stock options vest 25% on the one year anniversary of the grant date and 1/48th monthly thereafter.

On September 15, 2021, prior to Ms. Arsenault's appointment as CFO, Ms. Arsenault was granted 1,600 stock options in connection with her consulting arrangement with us. The stock options vest 10% on the grant date and 90% in equal annual installments thereafter over a period of four years.

15

On August 25, 2023, Ms. Arsenault was granted 53,529 RSUs and 13,383 stock options. The RSUs are subject to the following performance based milestones: 25% will vest if the Company’s market capitalization reaches $125,000,000, an additional 25% will vest if the Company’s market capitalization reaches $250,000,000, an additional 25% if the Company’s market capitalization reaches $400,000,000 and the remaining 25% will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater; provided, however, that no RSUs shall vest until the compensation committee of the Board determines that shares can be sold into the market to cover withholding tax obligations associated with the vesting of the RSUs. All of the RSUs will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater. The stock options vest 1/48th monthly over a four year period beginning August 24, 2023.

On August 25, 2023, Ms. Arsenault was also granted 128,209 RSUs and 32,053 stock options which are subject to, and contingent upon, the effectiveness of the Plan Amendment. The RSUs are subject to the following performance based milestones: 25% will vest if the Company’s market capitalization reaches $125,000,000, an additional 25% will vest if the Company’s market capitalization reaches $250,000,000, an additional 25% if the Company’s market capitalization reaches $400,000,000 and the remaining 25% will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater; provided, however, that no RSUs shall vest until the compensation committee of the Board determines that shares can be sold into the market to cover withholding tax obligations associated with the vesting of the RSUs. All of the RSUs will vest if the Company consummates an exit transaction that values the Company at $500,000,000 or greater. The stock options vest 1/48th monthly over a four year period beginning August 24, 2023.

Severance Arrangements

In February 2015, we adopted a change in control severance plan, in which our named executive officers participate, that provides for the payment of severance benefits if the executive’s service is terminated within twelve months following a change in control, either due to a termination without cause or upon resignation for a good reason (as each term is defined in the plan).

In either such event, and provided the executive timely executes and does not revoke a general release of claims against us, he or she will be entitled to receive: (i) a lump sum cash payment equal to at least six months’ of the executive’s monthly compensation, plus an additional month for each full year of service over six years, (ii) Company-paid premiums for continued health insurance for a period equal to the length of the cash severance period or, if earlier, when executive becomes covered under a subsequent employer’s healthcare plan, and (iii) full vesting of all then-outstanding unvested stock options and restricted stock awards.

16

Outstanding Equity Awards at Fiscal Year-end

As of December 31, 2022, our named executive officers held the following outstanding Company equity awards.

| Option Awards | |||||||||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Un- exercisable |

Option Exercise Price |

Option Expiration Date |

Number of Shares of Stock Not Vested (#) |

Market Value of Shares Not Vested ($)(1) |

||||||||||||||||||||||||||||||||||||||||

| Punit Dhillon, | 10/10/2018 (2) | 800 | — | $76.25 | 10/10/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Chief Executive Officer/Chairman | 8/7/2020 (3) | 18,000 | 18,000 | $11.25 | 8/7/2030 | ||||||||||||||||||||||||||||||||||||||||||

| 12/14/2021 (4) | 3,090 | 9,270 | $14.50 | 12/14/2031 | |||||||||||||||||||||||||||||||||||||||||||

| 12/14/2021 (5) | 5,333 | 21,333 | |||||||||||||||||||||||||||||||||||||||||||||

| Kaitlyn Arsenault | 9/15/2021 (6) | 520 | 1,080 | $30.00 | 9/15/2031 | ||||||||||||||||||||||||||||||||||||||||||

| Chief Financial Officer | 10/4/2021 (7) | 2,080 | 4,320 | $22.50 | 10/4/2031 | ||||||||||||||||||||||||||||||||||||||||||

| 12/14/2021 (4) | 1,770 | 5,310 | $14.50 | 12/14/2031 | |||||||||||||||||||||||||||||||||||||||||||

| 12/14/2021 (5) | 2,667 | 10,667 | |||||||||||||||||||||||||||||||||||||||||||||

_____________

| (1) | The market value of shares that have not vested is calculated based on the per share closing price of our common stock on December 31, 2022. |

||||

| (2) | The options specified above vest as follows: 1/12th each month on the anniversary of the grant date. | ||||

| (3) | The options specified above vest as follows: 10% vests on the grant date and 90% vests in equal semi-annually installments thereafter over four years. | ||||

| (4) | The options specified above vest as follows: 25% vests on the one year anniversary of the grant date and 1/48th vests monthly thereafter over three years following the one year anniversary of the grant date. | ||||

| (5) | The restricted stock units specified above vest as follows: 33% on each grant date anniversary over three years. | ||||

| (6) | The options specified above vest as follows: 10% vests on the grant date and 90% vests in equal annual installments thereafter over four years. | ||||

| (7) | The options specified above vest as follows: 10% vests on the grant date and 90% vests in equal semi-annually installments thereafter over four years. | ||||

Exercises of Options

There were no exercises of stock options by our named executive officers during the year ended December 31, 2022.

17

Existing Plan Benefits – Awards to Certain Persons Granted as of October 13, 2023

The table below sets forth summary information concerning the number of shares of our common stock subject to stock options granted to certain persons under the Plan as of October 13, 2023.

| Name and Position | Number of Stock Options |

Number of

Restricted Stock Units

|

|||||||||||||||

| Punit Dhillon, Chief Executive Officer and Director | 85,999 | 280,713 | |||||||||||||||

| Kaitlyn Arsenault, Chief Financial Officer | 60,516 | 184,404 | |||||||||||||||

| All current executive officers as a group (2) persons | 146,515 | 465,117 | |||||||||||||||

| All current non-executive directors as a group (6) persons | 107,705 | 246,252 | |||||||||||||||

| All current non-executive officer employees as a group (2) persons | 82,399 | 131,741 | |||||||||||||||

Equity Compensation Plan Information

The table below includes the following information as of December 31, 2022 for the Plan. Shares available for issuance under the Plan can be granted pursuant to stock options, stock appreciation rights, restricted stock, restricted stock unit awards, performance awards and other stock-based or cash-based awards, as selected by the plan administrator.

| Plan category | Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted- average exercise price of outstanding options, warrants and rights (b) |

Number of shares of common stock remaining available for future issuance under equity compensation plans (excluding shares of common stock reflected in column (a)) (c) |

|||||||||||||||||

| Equity compensation plans approved by security holders | ||||||||||||||||||||

| 2014 Amended and Restated Omnibus Incentive Plan | 182,647 | $0.17 | 169,100 | |||||||||||||||||

| 2022 Employee Stock Purchase Plan | — | — | 112,000 | |||||||||||||||||

| Total | 182,647 | $0.17 | 281,100 | |||||||||||||||||

As of December 31, 2022, 425 shares had been issued upon exercise of options granted under the Plan, options to purchase 171,981 shares were outstanding, and 169,100 shares remained available for future grant. As of December 31, 2022, 16,000 RSUs have been issued under the Plan.

Director Compensation

As of October 13, 2023, our policy for the compensation of our non-employee directors is as follows:

Each non-employee director receives a cash retainer of $40,000 on an annual basis.

Upon election to the Board, non-employee directors receive a one-time award of 20,000 stock options which vest in twelve equal monthly installments. In subsequent annual periods, each non-employee director receives a grant of 20,000 common stock options which vest in twelve equal monthly installments.

Non-employee directors who serve as members of special committees of the Board receive additional compensation as follows:

•Audit Committee: $10,000 per year ($20,000 for the chair)

•Compensation Committee: $3,500 per year ($10,000 for the chair)

18

•Nominating and Corporate Governance Committee: $2,500 per year ($5,000 for the chair)

The table below summarizes the compensation paid by us to our non-employee directors for the year ended December 31, 2022. Mr. Dhillon, our employee director, does not receive additional compensation for his services as a member of our Board:

| DIRECTOR COMPENSATION | |||||||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($) (1) |

All Other Compensation ($)(6) |

Total ($) |

||||||||||||||||||||||||||||||

| Jim Heppell(2) | 24,069 | — | 73,368 | 47,512 | 144,949 | ||||||||||||||||||||||||||||||

| Margaret Dalesandro(3) | 67,500 | — | — | — | 67,500 | ||||||||||||||||||||||||||||||

| Praveen Tyle(4) | 86,000 | — | — | — | 86,000 | ||||||||||||||||||||||||||||||

| Keith Ward(5) | 66,944 | — | — | — | 66,944 | ||||||||||||||||||||||||||||||

| Bobby Rai | 5,617 | — | — | — | 5,617 | ||||||||||||||||||||||||||||||

_________

| (1) |

As of December 31, 2022, each non-employee director was entitled to an annual grant of 1,000 common stock options, all of which vest in twelve equal monthly installments. The amounts reported under “Option Awards” in the above table reflect the grant date fair value of these awards as determined in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation - Stock Compensation. The value of stock option awards was estimated using the Black-Scholes option pricing model. The valuation assumptions used in the valuation of options granted may be found in Note 7 to our financial statements included in the annual report on Form 10-K for the year ended December 31, 2022. The annual Board member grants for the year ended December 31, 2022, were approved in 2023.

|

||||

| (2) | On May 18, 2022, Mr. Heppell resigned from our Board and concurrently entered into a consulting agreement with us pursuant to which Mr. Heppell would provide mutually agreed upon services related to the wind down of EHT. In connection with the consulting agreement, Mr. Heppell was granted options to purchase 16,000 shares of common stock. These options have an exercise price of $10.00, and were subject to certain performance vesting and other vesting conditions pursuant to the consulting agreement. The vesting conditions of the stock option award provided that 50% of the options were vested upon grant and the remaining 50% (the "Second Tranche") would vest upon the sale of a real estate asset held by EHT at an amount greater than or equal to an amount specified in the Arrangement Agreement (the "Vesting Condition"). On February 9, 2023, the closing date of the sale of the real estate asset held by EHT, the Second Tranche of stock options was cancelled as the Vesting Condition was not satisfied. The value of the stock option award was estimated using the Black-Scholes option pricing model. In addition, on September 14, 2021, Mr. Heppell was granted options to purchase 600 shares of common stock. These options have an exercise price of $30.00, vest monthly over one year and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $18,300. In addition, on August 7, 2020, Mr. Heppell was granted options to purchase 4,000 shares of common stock. These options have an exercise price of $12.50, vest 10% on the date of grant with the remaining 90% vesting semi-annually over two years and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $40,000. In addition, on October 10, 2018, Mr. Heppell was granted options to purchase 800 shares of common stock. These options have an exercise price of $77.50, are fully vested and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $45,000. The aggregate number of shares issuable upon exercise of option awards outstanding at December 31, 2022 for Mr. Heppell was 21,400, of which 13,400 were fully vested. |

||||

19

| (3) | On September 14, 2021, Dr. Dalesandro was granted options to purchase 600 shares of common stock. These options have an exercise price of $30.00, vest monthly over one year and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $18,300. In addition, on August 7, 2020, Dr. Dalesandro was granted options to purchase 1,000 shares of common stock. These options have an exercise price of $12.50 and vest 10% on the date of grant with the remaining 90% vesting semi-annually over two years and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $10,000. The aggregate number of shares issuable upon exercise of option awards outstanding at December 31, 2022 for Dr. Dalesandro was 1,600, of which 1,600 were fully vested. |

||||

| (4) | On September 14, 2021, Dr. Tyle was granted options to purchase 100 shares of common stock. These options have an exercise price of $30.00, vest monthly over one year and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $3,050. In addition, on July 22, 2021, Dr. Tyle was granted options to purchase 1,000 shares of common stock. These options have an exercise price of $35.00 and vest 10% on the date of grant with the remaining 90% vesting semi-annually over two years and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $34,750. The aggregate number of shares issuable upon exercise of option awards outstanding at December 31, 2022 for Dr. Tyle was 1,100, of which 650 were fully vested. |

||||

| (5) | On December 14, 2021, Dr. Ward was granted options to purchase 1,000 shares of common stock. These options have an exercise price of $15.00, vest monthly over one year and have a term of 10 years from the grant date. The value of the stock option award was estimated using the Black-Scholes option pricing model and totaled $12,750. The aggregate number of shares issuable upon exercise of option awards outstanding at December 31, 2022 for Dr. Ward was 1,000, of which 1,000 were fully vested. |

||||

| (6) | Under the consulting agreement, Mr. Heppell is entitled to a monthly fee of $6,300, which was increased to $16,600 per month upon the closing of the Acquisition. The consulting agreement provides Mr. Heppell with a termination payment in an amount equal to the monthly fees through the then-remaining term of the agreement if Mr. Heppell’s engagement is terminated by the Company without cause. The consulting contract has been accounted for as an in-substance severance arrangement and $139,615 is recognized in severance expense during the year ended December 31, 2022. The monthly fee for Mr. Heppell's consulting agreement was adjusted to include the increased fee payments when the Acquisition closed. As of December 31, 2022, $47,512 has been paid to Mr. Heppell and $16,600 is owed and recognized in accounts payable - related party. The remaining portion of the consulting contract of $75,503 is accrued for in other current liabilities - related party. The consulting agreement with Mr. Heppell was terminated on February 9, 2023. | ||||

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K (the “Pay Versus Performance Rule”), we are providing the following information about the relationship between executive compensation actually paid for our principal executive officer (“PEO”) and Non-PEO named executive officers (“NEOs”) and certain financial performance of the Company for the fiscal years listed below.

| Fiscal Year |

Summary Compensation Table Total for PEO (1) |

Compensation Actually Paid to PEO (2) |

Average Summary Compensation Table Total for non-PEO NEOs (3) |

Average Compensation Actually Paid to non-PEO NEO (4) |

Value of Initial Fixed $100 Investment Based on Total Shareholder Return (5) |

Net Income (Loss) (6) |

||||||||||||||

| (a) | ($) (b) | ($) (c) | ($) (d) | ($) (e) | ($) (f) | ($) (g) | ||||||||||||||

| 2022 | 733,077 | 369,466 | 455,887 | 301,376 | 40.50 | (19,481,602) | ||||||||||||||

| 2021 | 899,701 | 1,087,573 | 363,547 | 316,184 | 130.00 | (8,522,182) | ||||||||||||||

(1) The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Dhillon (our Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Summary Compensation Table.”

(2) The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Dhillon, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not

20

reflect the actual amount of compensation earned by or paid to Mr. Dhillon during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Dhillon’s total compensation for each year to determine the compensation actually paid:

| Fiscal Year |

Reported Summary Compensation Table Total For PEO ($) |

Deduction of Reported Value of Equity Awards (a) ($) |

Equity Award Adjustments (b) ($) |

Compensation Actually Paid to PEO ($) |

||||||||||

| 2022 | 733,077 | — | (363,611) | 369,466 | ||||||||||

| 2021 | 899,701 | (276,680) | 464,552 | 1,087,573 | ||||||||||

(a) The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” and “Option Awards” columns in the Summary Compensation Table for the applicable year.

(b) The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; and (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows:

| Fiscal Year |

Year End Fair Value of Equity Awards Granted During the Fiscal Year ($) (i) |

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) (ii) |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year ($) (iii) |

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) (iv) |

Total Equity Award Adjustments ($) |

||||||||||||

| 2022 | — | (283,189) | — | (80,422) | (363,611) | ||||||||||||

| 2021 | 248,541 | 56,566 | — | 159,445 | 464,552 | ||||||||||||

(3) The dollar amounts reported in column (d) are (i) for 2022, the amounts of total compensation reported for Ms. Arsenault (our Chief Financial Officer) for 2022 in the “Total” column of the Summary Compensation Table and (ii) for 2021, the average of the amounts of total compensation reported for Ms. Arsenault (our Chief Financial Officer) and Richard Janney (our Former Interim Principal Accounting Officer) for 2021 in the "Total" column of the Summary Compensation Table in the Company's annual report on Form 10-K for the year ended December 31, 2021.

(4) The dollar amounts reported in column (e) represent the amount of “compensation actually paid” to Ms. Arsenault in 2022 and the average amount of "compensation actually paid" to Ms. Arsenault and Mr. Janney in 2021, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Ms. Arsenault or Mr. Janney during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Ms. Arsenault’s and Mr. Janney's total compensation for the applicable year to determine the compensation actually paid, using the same methodology descried above in Note 2:

| Fiscal Year |

Average of Reported Summary Compensation Table Total For Non-PEO NEOs ($) |

Deduction of Average of Reported Value of Equity Awards ($) |

Equity Award Adjustments (a) ($) |

Average Compensation Actually Paid to Non-PEO NEOs ($) |

||||||||||

| 2022 | 455,887 | — | (154,511) | 301,376 | ||||||||||

| 2021 | 363,547 | (163,620) | 116,257 | 316,184 | ||||||||||

21

(a) The amounts deducted or added in calculating the total equity award adjustments are as follows:

| Fiscal Year |

Year End Fair Value of Equity Awards Granted During the Fiscal Year ($) (i) |

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) (ii) |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year ($) (iii) |

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) (iv) |

Total Equity Award Adjustments ($) |

||||||||||||

| 2022 | — | (116,501) | — | (38,010) | (154,511) | ||||||||||||

| 2021 | 107,762 | — | 8,495 | — | 116,257 | ||||||||||||

(5) Cumulative total shareholder return (“TSR”) is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period.

(6) The dollar amounts reported represent the amount of net income (loss) reflected in the Company’s audited financial statements for the applicable year.

Analysis of the Information Presented in the Pay Versus Performance Table

In accordance with Item 402(v) of Regulation S-K, the Company is providing the following descriptions of the relationships between information presented in the Pay Versus Performance table.

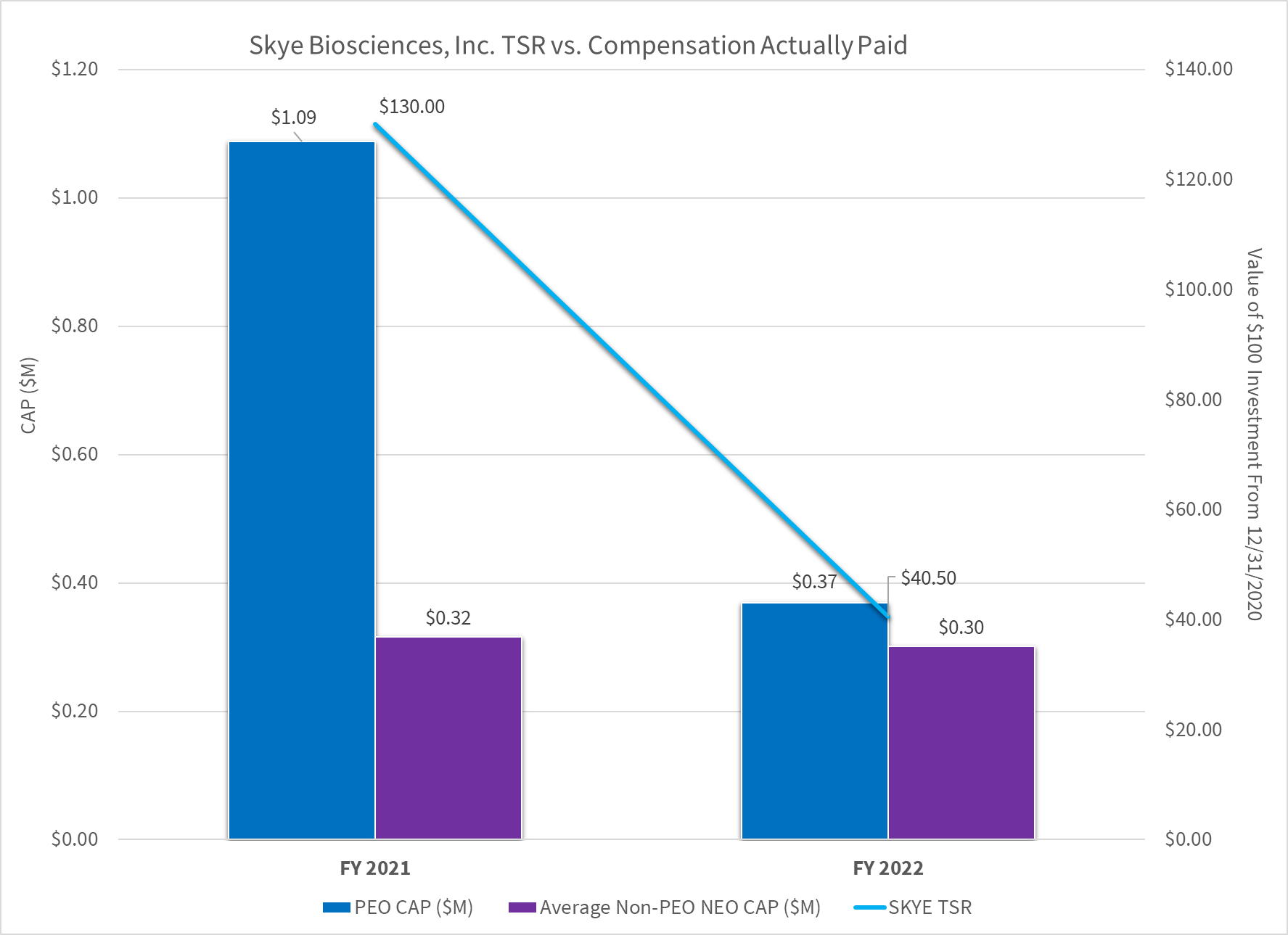

Compensation Actually Paid and Cumulative TSR of the Company

The graph below sets forth the relationship between the amount of Compensation Actually Paid to our PEO, the average amount of Compensation Actually Paid to our Non-PEO NEO, and the Company’s cumulative TSR over the two most recently completed fiscal years.

22

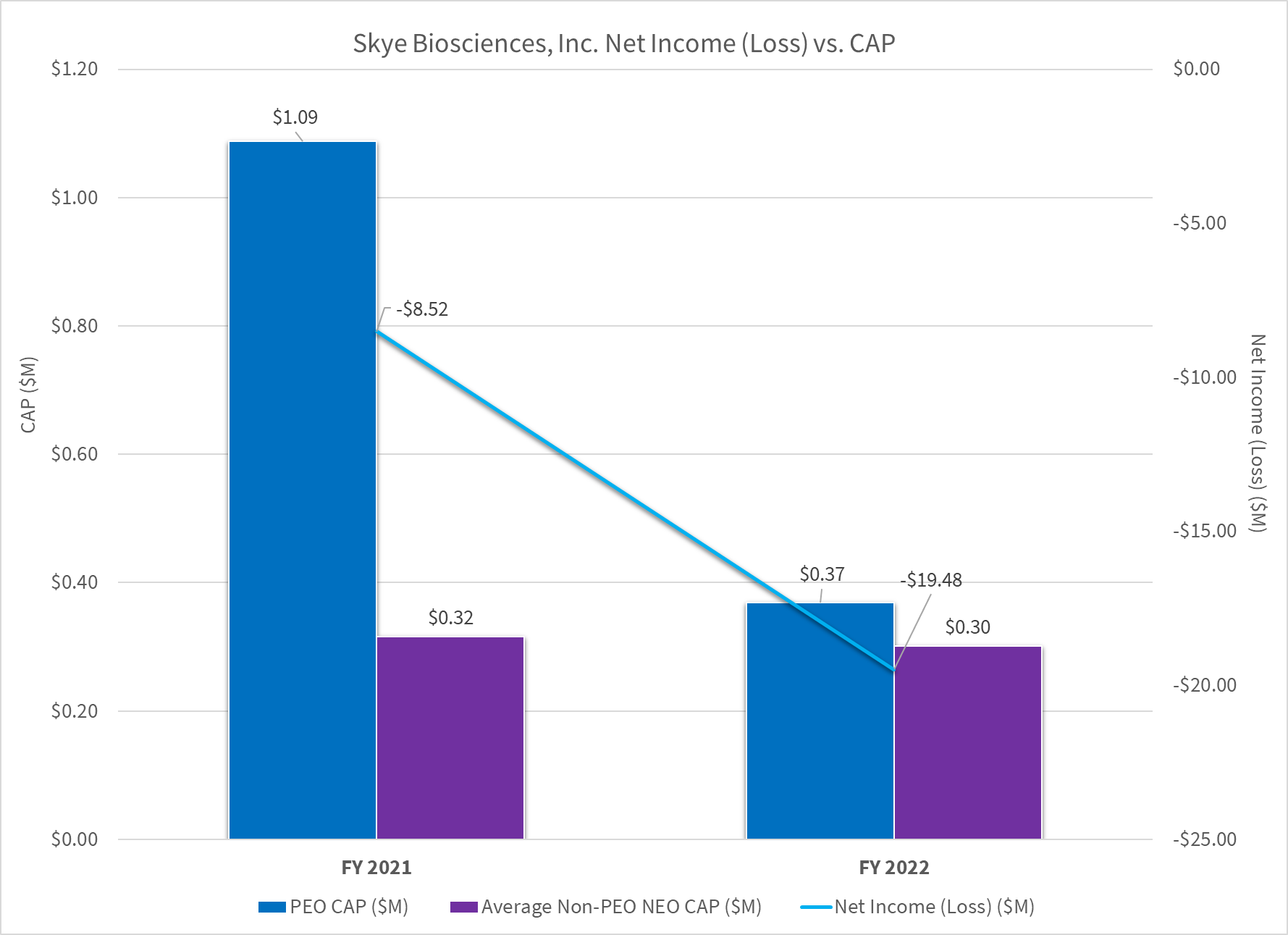

Compensation Actually Paid and Net Income

The graph below sets forth the amount of Compensation Actually Paid to our PEO, the amount of Compensation Actually Paid to our Non-PEO NEO, and our net income during the two most recently completed fiscal years.

23

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of October 13, 2023, with respect to the beneficial ownership of our Common Stock for (i) each director and officer, (ii) all of our directors and officers as a group, and (iii) each person known to us to own beneficially five percent (5%) or more of the outstanding shares of our Common Stock. As of October 13, 2023, there were 12,338,821 shares of Common Stock outstanding.

To our knowledge, except as indicated in the footnotes to this table or pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to the shares of Common Stock shown as beneficially owned by them. Unless otherwise indicated, the address of each beneficial owner listed below is c/o Skye Bioscience, Inc., 11250 El Camino Real, Suite 100, San Diego, CA 92130.

|

Name and Address of

Beneficial Owner (1)

|

Beneficial Ownership |

Percent of Class |

||||||||||||

| Directors and Officers | ||||||||||||||

Punit Dhillon (2) |

65,690 | *% | ||||||||||||

Kaitlyn Arsenault (3) |

9,964 | *% | ||||||||||||

| Dr. Margaret Dalesandro (4) | 4,073 | *% | ||||||||||||

| Dr. Praveen Tyle (5) | 3,573 | *% | ||||||||||||

| Dr. Keith Ward (6) | 3,473 | *% | ||||||||||||

| Dr. Deborah Charych (7) | 2,223 | *% | ||||||||||||

Paul Grayson |

— | *% | ||||||||||||

Andrew Schwab (8) |