DEF 14A: Definitive proxy statements

Published on April 25, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o

Preliminary Proxy Statement

o

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

o

Definitive Additional Materials

o

Soliciting Material Pursuant to §240.14a-12

SKYE BIOSCIENCE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x

No fee required.

o

Fee paid previously with preliminary materials.

o

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

|

11250 El Camino Real, Suite 100, San Diego, CA 92130, (858) 410-0266 | ||||

2025 Stockholder Letter

To the Stockholders’ of Skye Bioscience, Inc.:

In the past twelve months, we have taken decisive steps to build what we believe can be the most compelling CB1-targeted therapeutic program in obesity. With urgency and precision, we have been executing our clinical development plan around nimacimab—a first-in-class, peripherally restricted CB1 inhibitor antibody—designed to solve what we believe to be one of the most persistent challenges in the obesity epidemic: achieving long-term, tolerable, and metabolically effective weight loss.

We know what is expected of us. Investors do not want grand narratives; they want strategic clarity, execution, and data. That’s why we have delivered—on time and ahead of plan—milestones that underscore the seriousness of our intent and the caliber of our team. This letter outlines what we have done, why CB1 matters, and how we intend to move forward with focus and discipline.

Bird Rock Acquisition and Reset: August 2023

Our August 2023 acquisition of Bird Rock Bio, Inc. (“Bird Rock Bio”) was strategic and singular in purpose—its only asset, nimacimab, represented a unique chance to revive the CB1 inhibition class with an antibody engineered for peripheral selectivity without CNS penetration and with strong preclinical and early clinical proof of metabolic benefit. Within 90 days of closing the acquisition of Bird Rock Bio, we submitted an IND with the Division of Diabetes, Lipid Disorders and Obesity and had secured clearance from the agency to proceed with our planned clinical protocol by January 2024. We subsequently raised gross proceeds of $90 million in financing from top-tier healthcare investors.

Adding to our leadership team and changing our board of directors, we adopted a complete focus on one goal: proving that peripherally restricted CB1 inhibition could drive durable weight loss, avoid central side effects, and offer a differentiated mechanism to the crowded incretin-centric space of anti-obesity drugs.

Execution in 2024: Delivering on the CBeyond™ Trial

We launched our Phase 2a clinical trial for nimacimab, CBeyond™, in August 2024. Our goals were clear: initiate a multi-center, placebo-controlled, randomized study evaluating nimacimab with and without semaglutide, evaluate for a meaningful weight loss difference, and generate top-line data in under 15 months.

Enrollment was completed in February 2025, four months ahead of schedule. The trial randomized 136 patients, exceeding our 120-patient plan. We are now positioned to deliver 26-week top-line results in late Q3 or early Q4 2025—without requiring interim analysis. This performance reflects both strong patient demand and our team's clinical operations discipline.

The study now also includes a 26-week extension, enabling 52-week long-term efficacy and safety readouts in 2026, and will provide us with further insight to design future clinical trials.

Why Nimacimab, Why Now?

We believe obesity requires chronic therapy. But today’s leading treatments—GLP-1 receptor agonists—face challenges with tolerability, accessibility, lean mass loss, and discontinuation rates exceeding 50% within one year. CB1 inhibition has the potential to address these issues from a different mechanistic angle: emphasizing fat metabolism, not appetite suppression alone.

The CB1 pathway is central to energy storage and adipocyte signaling, and it is CB1 receptors in peripheral tissue that plays a critical role in these functions. To our knowledge, nimacimab is the only antibody in development that selectively targets peripheral CB1 for inhibition. Preclinical studies showed significant reductions in fat mass, improved glycemic markers, and preservation of lean mass. We also demonstrated superior exclusion from the brain—with nimacimab being 600-fold below the concentration to inhibit signaling in the brain (IC90)—and have seen no neuropsychiatric adverse events in studies to date.

In short: nimacimab can potentially be used chronically, and complement GLP-1s or stand alone. We believe nimacimab can enable the next wave of safe, sustainable anti-obesity medicines.

The Road Ahead: Data, Differentiation, and Development

We look forward to the forthcoming data in 2025. We expect to deliver additional preclinical data that further validates nimacimab’s mechanism of action—specifically its role in weight loss, promoting fat metabolism, preserving lean mass, and improving metabolic parameters in diet-induced obesity models, without the need for inhibition of centrally located CB1 receptors. Reported findings already have reinforced, and we believe additional data will further support, the foundation of our clinical hypothesis and continue to support our regulatory strategy.

By late Q3 or early Q4 2025, we expect to deliver top-line results from the CBeyond™ study. If our hypothesis holds—demonstrating durable weight loss with a clean safety profile—we intend to proceed directly to Phase 2b planning. Preparations are already underway: CRO engagement, regulatory planning, protocol development, and manufacturing scale-up are in progress.

We believe our balance sheet is strong, with our cash runway projected through at least Q1 2027. We intend to remain disciplined in capital allocation, focusing on programs that build our pipeline with a clear path to registration and commercial value.

Positioned to Lead

The obesity space is crowded if you look at it through a lens focused on GLP-1 drugs commercialized or under development. Fundamentally, however, the obesity market is very large, is growing, and has heterogeneous segments of patients with distinct and unmet needs. We believe there is an important role for complementary therapies that are mechanistically distinct from incretin approaches. And nimacimab—if successful—has the potential to become the benchmark CB1 therapeutic: effective in metabolically important tissue in the periphery, safe, durable, and combinable.

We are operating with urgency and clarity because we understand the magnitude of the opportunity. Our team and board are aligned behind a singular goal: to establish Skye as the category-defining leader in metabolic therapeutics. Every resource is directed toward executing this plan with discipline and precision. We’re focused on the fundamentals—delivering data, scaling thoughtfully, and staying ahead of the science.

Thank you for your continued support. We look forward to sharing more in the coming months.

Sincerely,

/s/ Punit Dhillon

Chief Executive Officer

This proxy statement, including the letter from our CEO, contains forward-looking statements based upon current expectations that involve risks, uncertainties and assumptions. For more information, see the section entitled “Forward-Looking Statements.”

|

11250 El Camino Real, Suite 100, San Diego, CA 92130, (858) 410-0266 | ||||

Dear Stockholder:

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Date:

Wednesday, June 6, 2025

Time:

10:00 a.m.,PT

Place:

Virtual Internet

YOUR VOTE

IS IMPORTANT

IS IMPORTANT

Please vote your shares whether or not you plan to participate in the meeting.

The 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Skye Bioscience, Inc., a Nevada corporation (the “Company”, “we,” “us,” and “our”), will be held as a virtual meeting via live webcast on the Internet on June 6, 2025, at 10:00 a.m. Pacific Time. Because the Annual Meeting is completely virtual and being conducted via the Internet, you will not be able to attend in person, but you will be able to participate online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SKYE2025. For instructions on how to participate in and vote your shares during the Annual Meeting, see the information in the accompanying Proxy Statement in the Section entitled, “General Information about the Annual Meeting and Voting – How can I participate in and vote at the Annual Meeting?”

The Annual Meeting is being held for the following purposes:

| 1 | to elect each of the six nominees named in the attached proxy statement as members of the Company’s Board of Directors for a one-year term expiring at the 2026 annual meeting of stockholders; | |||||||

| 2 | to consider and vote upon the ratification of the selection of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2025; | |||||||

| 3 | to consider and vote upon, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission; | |||||||

| 4 | to consider and vote upon, on an advisory basis, whether the stockholder vote to approve the compensation of the named executive officers as required by Section 14A(a)(2) of the Securities Exchange Act of 1934, as amended, should occur every one, two or three years; and | |||||||

| 5 | to transact such other business as may be properly brought before the meeting or any adjournment or postponement thereof. | |||||||

The foregoing items of business are more fully described in the attached proxy statement, which forms a part of this notice and is incorporated herein by reference. Our Board of Directors has fixed the close of business on April 11, 2025, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

We have elected to take advantage of the Securities and Exchange Commission (“SEC”) rules that allow us to use the Internet as our primary means of providing our proxy materials to stockholders. The electronic delivery of our proxy materials will significantly reduce our printing and mailing costs and the environmental impact of the circulation of our proxy materials. Consequently, most stockholders will not receive paper copies of our proxy materials, unless requested. We will instead send to these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing and reviewing the proxy materials on the Internet, including our proxy statement and annual report, and for voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials free of charge, if they so choose.

The Notice of Internet Availability of Proxy Materials will also provide the date and time of the Annual Meeting; the matters to be acted upon at the meeting and our board of directors’ recommendation with regard to each matter; a toll-free number, an email address and a website where stockholders may request a paper or email copy of the proxy statement, our annual report to stockholders and a form of proxy relating to the Annual Meeting; information on how to access the form of proxy; and information on how to participate in the Annual Meeting.

Your vote is important. Whether or not you expect to participate in our Annual Meeting, please vote as soon as possible in advance of the Annual Meeting by Internet or telephone as described in the accompanying proxy materials or, if you request that the proxy materials be mailed to you, by signing, dating and returning the proxy card enclosed with those materials. If you plan to participate in our Annual Meeting and wish to vote your shares during the Annual Meeting, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to participate in the meeting. We appreciate your continued support of the Company.

By Order of the Board of Directors,

/s/ Punit Dhillon

Punit Dhillon

Chief Executive Officer and Director

Chief Executive Officer and Director

San Diego, California

April 25, 2025

Table of Contents

Proxy Statement for the Skye Bioscience, Inc. 2025 Annual Meeting of Stockholders

To Be Held On June 6, 2025

The board of directors (the “Board of Directors” or “Board”) of Skye Bioscience, Inc. (the “Company,” “we,” “us,” and “our”) is soliciting your proxy for use at the 2025 annual meeting of stockholders (the “Annual Meeting”) to be held on June 6, 2025, at 10:00 a.m., Pacific Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to participate in the Annual Meeting online and submit your questions in advance or during the meeting. For instructions on how to participate in and vote your shares during the Annual Meeting, see the information in the accompanying Proxy Statement in the Section entitled, “General Information about the Annual Meeting and Voting – How can I participate in and vote at the Annual Meeting?”

We intend to mail proxy materials on or about April 25, 2025 to all stockholders of record entitled to vote at the Annual Meeting, including a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and annual report online and how to vote online. If you receive such a Notice by mail, you will not receive a printed copy of the proxy materials unless you specifically request one. However, the Notice contains instructions on how to request to receive printed copies of the proxy materials and a proxy card by mail.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 6, 2025

The accompanying proxy statement and our Annual Report on Form 10-K are available electronically at www.proxyvote.com.

| Skye Bioscience, Inc. | 1 |

2025 Proxy Statement | ||||||

Important Information About

the 2025 Annual Meeting of Stockholders and Voting

the 2025 Annual Meeting of Stockholders and Voting

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

Why am I receiving these materials?

We have prepared these proxy materials, including this proxy statement and the related proxy card, because our Board of Directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes information related to your vote at the Annual Meeting. All stockholders who find it convenient to do so are cordially invited to attend the Annual Meeting via live webcast. However, you do not need to attend the Annual Meeting virtually to vote your shares. Instead, you may simply submit your proxy via the Internet in accordance with the instructions provided on the Notice of Internet Availability of Proxy Materials or if you elected to receive printed copies of the proxy materials, you may submit your proxy via telephone or by completing, signing and returning the enclosed proxy card.

We intend to mail the Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 25, 2025 to all stockholders of record entitled to vote at the Annual Meeting.

How can I attend the Annual Meeting?

The Annual Meeting will be accessible only through the Internet via a live webcast. We adopted a virtual only format for our Annual Meeting.

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on our record date of April 11, 2025 or hold a valid proxy for the Annual Meeting. To be admitted to Annual Meeting’s live webcast, you must register at www.virtualshareholdermeeting.com/SKYE2025, as described in the Notice or proxy card. As part of the registration process, you must enter the Control Number shown on your Notice or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you.

| Skye Bioscience, Inc. | 2 |

2025 Proxy Statement | ||||||

What am I voting on?

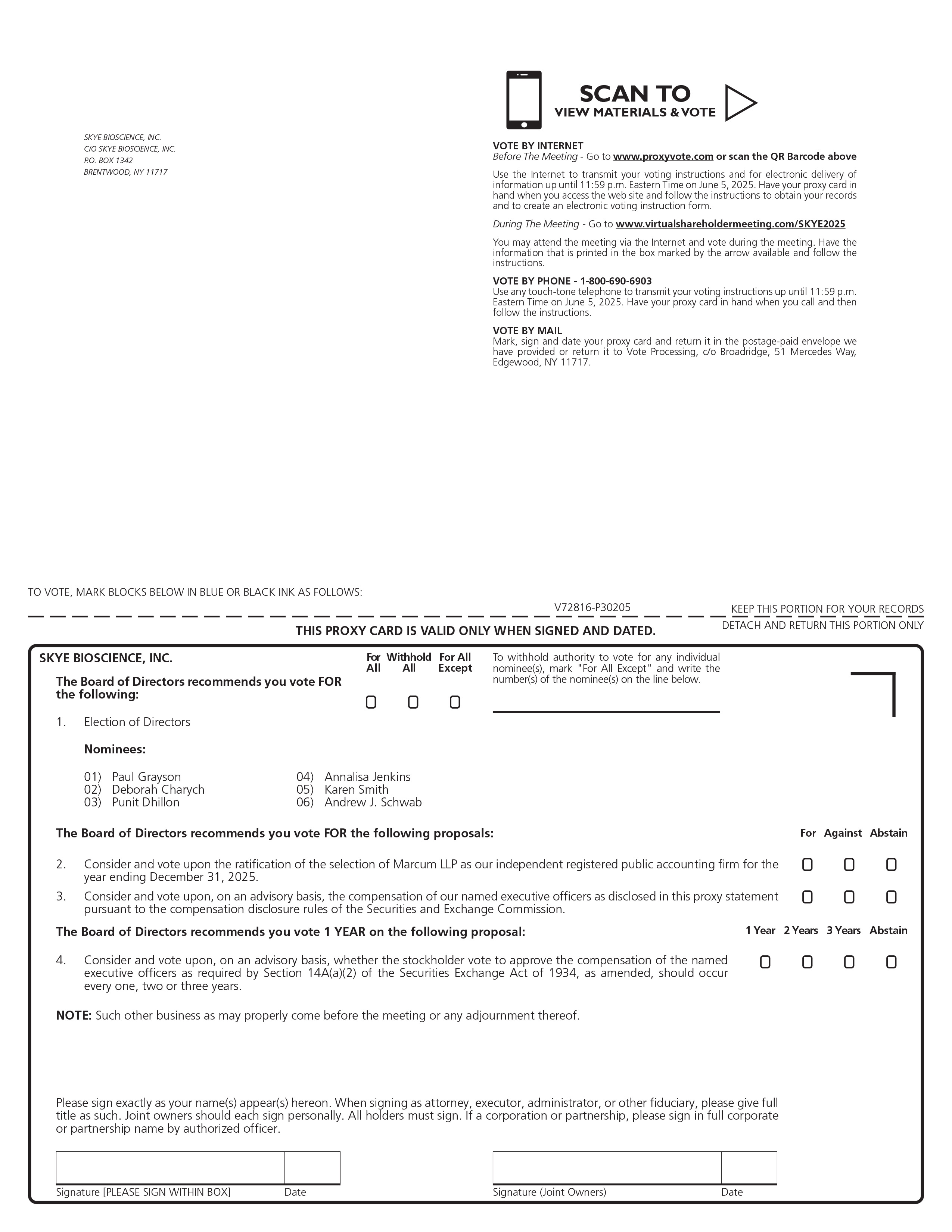

There are four proposals scheduled for a vote:

| 1 | To elect each of the six nominees as members of our Board of Directors for a one-year term expiring at the 2026 annual meeting of stockholders; | |||||||

| 2 | To consider and vote upon the ratification of the appointment of Marcum LLP as our independent registered public accountants for the year ending December 31, 2025. | |||||||

| 3 | To consider and vote upon, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (“ SEC”). | |||||||

| 4 | To consider and vote upon, on an advisory basis, whether the stockholder vote to approve the compensation of the named executive officers as required by Section 14A(a)(2) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), should occur every one, two or three years. | |||||||

How does the Board recommend that I vote?

The Board recommends that you vote:

•“For” each of the nominees for election as director;

•“For” the ratification of the selection of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2025;

•“For” the approval of, on an advisory basis, the compensation of our named executive officers; and

•For the selection of “one year” as the frequency of the stockholder vote to approve the compensation of our named executive officers.

If you vote via the Internet, by telephone, or sign and return the proxy card by mail but do not make specific choices, your shares, as permitted, will be voted as recommended by our Board of Directors. If any other matter is presented at the Annual Meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proxy statement, we know of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

Who can vote at the meeting?

Only stockholders of record as of the close of business on the record date for the Annual Meeting, April 11, 2025, are entitled to vote at the Annual Meeting. As of April 11, 2025, there were 30,974,558 shares of our common stock outstanding. Common stock is our only class of stock outstanding and entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If, on the record date, your shares were registered directly in your name with the transfer agent for our common stock, Broadridge Financial Solutions, Inc., then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting if you attend online or vote by proxy. Whether or not you plan to attend the Annual Meeting online, we encourage you to vote by proxy via the Internet, by telephone or by mail, as instructed below to ensure your vote is counted.

| Skye Bioscience, Inc. | 3 |

2025 Proxy Statement | ||||||

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on the record date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account.

See “How do I vote by proxy?” below.

How many votes do I have?

Each share of our common stock that you own as of the close of business on April 11, 2025, entitles you to one vote.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders who have not previously requested the receipt of paper proxy materials advising them that they can access this proxy statement, our annual report and voting instructions over the Internet at www.proxyvote.com.

If you would like to request a copy of the material(s) for this and/or future shareholder meetings, you may (1) visit www.ProxyVote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com. If sending an email, please include your Control Number (indicated below) in the subject line. Unless requested, you will not otherwise receive a paper or email copy of the material(s) for this and/or future shareholder meetings.

All stockholders will have the ability to access the proxy materials via the internet at www.proxyvote.com. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our Annual Meeting.

How do I vote by proxy?

With respect to the election of each director, you may vote “For All” to vote for the election of all of the nominees, “Withhold All” to withhold your vote with respect to all of the nominees, or “For All Except” to vote for all except any one or more of the nominees. With respect to the ratification of the appointment of Marcum LLP as our independent registered public accounting firm, you may vote “For” or “Against” or abstain from voting. With respect to the advisory vote on the compensation of our named executive officers, you may vote “For” or “Against” or abstain from voting. With respect to the advisory vote on whether the stockholder vote to approve the compensation of our named executive officers should occur every one, two or three years, you may vote for “one year,” “two years” or “three years” or abstain from voting.

| Skye Bioscience, Inc. | 4 |

2025 Proxy Statement | ||||||

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to participate in the meeting, we urge you to vote by proxy to ensure that your vote is counted.

|

Vote by Mail:

If you are a stockholder of record, and you elect to receive your proxy materials by mail, you may vote using your proxy card by completing, signing, dating and returning the proxy card in the self-addressed, postage-paid envelope provided. You should mail the proxy card ahead of the meeting with plenty of time to allow for delivery prior to the meeting. Do not mail the proxy card if you are voting over the Internet or by telephone. If you properly complete your proxy card and send it in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your shares, as permitted, will be voted as recommended by our Board of Directors. If any other matter is presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the meeting, other than those discussed in this proxy statement.

|

||||

|

Vote via the Internet: in Advance of the Annual Meeting:

You may vote at www.proxyvote.com, 24 hours a day, seven days a week. Use the 16 digit Control Number shown on your Notice, proxy card or voting instructions form that is sent to you.

|

||||

|

Vote by Telephone:

To vote over the telephone, dial toll-free 1-800-690-6903 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the Control Number from the enclosed Notice or proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on June 5, 2025, to be counted.

|

||||

|

Vote during the Annual Meeting:

You may still participate in the meeting and vote during the Annual Meeting even if you have already voted by proxy. Shareholders can vote via the virtual meeting by accessing the virtual meeting site, www.virtualshareholdermeeting.com/SKYE2025, with their 16 digit Control Number starting 15 minutes before the Annual Meeting through the closing of the polls.

|

||||

Beneficial Owners: Shares Registered in the name of a Broker or Banks

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received the Notice or, if you have requested physical copies, a voting instruction form with these proxy materials from that organization rather than directly from us. Simply follow the voting instructions on the voting instruction form to vote electronically via the internet, telephone or return the voting instruction form via business reply envelope that is included in your proxy materials that were mailed to you.

May I revoke my proxy?

If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the four following ways:

•you may send in another signed, timely-delivered proxy with a later date (only the latest signed proxy submitted prior to the Annual Meeting will be counted);

•you may authorize a proxy again on a later date on the Internet (only the latest Internet proxy submitted prior to the Annual Meeting will be counted);

•you may notify our corporate secretary at 11250 El Camino Real, Suite 100, San Diego, CA 92130, Attention: Corporate Secretary, in writing before the Annual Meeting that you have revoked your proxy after which you are entitled to submit a new proxy prior to the Annual Meeting or vote during the Annual Meeting; or

•you may submit an electronic ballot during the Annual Meeting.

| Skye Bioscience, Inc. | 5 |

2025 Proxy Statement | ||||||

General Information about the Annual Meeting and Voting – How can I participate in and vote at the Annual Meeting?

We will be hosting the Annual Meeting live via webcast. Any stockholder can participate or vote in the Annual Meeting at www.virtualshareholdermeeting.com/SKYE2025. Even if you plan to participate in the Annual Meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to participate in the Annual Meeting. A summary of the information you need to attend and participate in the Annual Meeting online is provided below:

•On the day of the Annual Meeting, follow the instructions in the email communication you will receive after you have registered to participate.

•Technical assistance for those having difficulty entering the meeting via the Internet will be provided to stockholders who have registered on the day of the Annual Meeting

•Webcast starts at 10:00 a.m. Pacific Time.

•Stockholders may submit questions while participating in the Annual Meeting via the Internet.

•Webcast replay of the Annual Meeting will be available until July 6, 2025.

To participate in the Annual Meeting, you will need the Control Number included in your Notice, your proxy card, or on the instructions that accompanied your proxy materials.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

What constitutes a quorum?

The presence at the Annual Meeting of stockholders, represented in person or by proxy (regardless of whether the proxy has authority to vote on all matters), holding at least a majority of the voting power of our outstanding common stock entitled to vote as of April 11, 2025, or 15,487,280 shares, constitutes a quorum at the Annual Meeting, permitting us to conduct our business. The inspector of election will determine whether a quorum is present and will tabulate the votes cast at the Annual Meeting.

What vote is required to approve each proposal?

Proposal One: Election of Directors. Directors are elected by a plurality of votes cast, which means that the six nominees who receive the most “For” votes (among votes properly cast during the meeting or by proxy) will be elected. Only votes “For” will affect the outcome. Votes “Withheld” and broker non-votes will have no effect on Proposal One because they are not considered votes cast for this purpose.

Proposal Two: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of Marcum LLP must receive a number of “For” votes from the holders of the shares of common stock present in person or represented by proxy and entitled to vote at the Annual Meeting in excess of the number of votes cast “Against” Proposal Two. Only “For” and “Against” votes will affect the outcome. Abstentions and broker non-votes, if any, will have no effect on Proposal Two because they are not considered votes cast for this purpose.

Proposal Three: Approval of the Compensation of the Named Executive Officers. The approval of the compensation of the named executive officers must receive a number of “For” votes from the holders of the shares of common stock present in person or represented by proxy and entitled to vote at the Annual Meeting in excess of the number of votes cast “Against” Proposal Three.

| Skye Bioscience, Inc. | 6 |

2025 Proxy Statement | ||||||

Only “For” and “Against” votes will affect the outcome. Abstentions and broker non-votes will have no effect on Proposal Three because they are not considered votes cast for this purpose.

Proposal Four: Frequency of Stockholder Vote on Executive Compensation. The alternative which receives the most “For” votes (among votes properly cast in person or by proxy) will be the stockholders’ recommendation, on an advisory basis, of the frequency of the stockholder vote on executive compensation. Abstentions and broker non-votes will have no effect on Proposal Four because they are not considered votes cast for this purpose.

Voting results will be tabulated and certified by Broadridge Financial Solutions.

What is the effect of abstentions?

Shares of common stock held by persons attending the Annual Meeting but not voting, and shares represented by proxies that reflect “Withhold” votes or abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum.

A vote “Withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the ratification of the appointment of Marcum LLP, the advisory vote to approve the compensation of the named executive officers and the advisory vote regarding the frequency of the stockholder vote to approve the compensation of the named executive officers, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld have no effect on the election of directors, as the six directors that receive the highest number of votes will be elected, and abstentions are not considered to be a vote cast and will have no effect on the ratification of the appointment of Marcum LLP, the advisory vote to approve the compensation of the named executive officers and the advisory vote regarding the frequency of the stockholder vote to approve the compensation of the named executive officers.

How will my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, then your shares will be voted at the Annual Meeting in accordance with the Board’s recommendation on all matters presented for a vote at the Annual Meeting. Similarly, if you sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for all of the proposals, then for any proposal for which you do not so indicate, your shares will be voted in accordance with the Board’s recommendation.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

What is the effect of broker non-votes?

A “broker non-vote” occurs when a bank, broker or other nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and either chooses not to vote those shares on a “routine” matter or is not permitted to exercise discretionary voting authority on a “non-routine” matter. Shares represented by proxies that reflect a “broker non-vote” will be counted for purposes of determining whether a quorum exists.

Proposal Two is considered a routine matter on which a broker, bank or other nominee has discretionary authority to vote. No broker non-votes are expected on this proposal. However, if there are any broker non-votes for Proposal Two, such broker non-votes will have no effect on the result of the vote as they are not considered votes cast for this purpose.

| Skye Bioscience, Inc. | 7 |

2025 Proxy Statement | ||||||

All other proposals scheduled for a vote at the Annual Meeting are considered non-routine, and accordingly, your broker, bank or other nominee may not exercise discretionary voting authority on those proposals. As a result, if you hold your shares with a broker, bank or other nominee and you do not provide timely voting instructions for the non-routine proposals, your shares will not be voted on those proposals at the Annual Meeting and will be considered “broker non-votes” on those proposals. Broker non-votes will have no effect on Proposals One, Three, and Four as they are not considered votes cast for this purpose.

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officers and other employees may solicit proxies in person or by mail, telephone, fax or email. We will not pay our directors, officers or other employees any additional compensation for these services. We will also ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Our costs for forwarding proxy materials will not be significant.

We intend to file this proxy statement and a proxy card with the SEC in connection with our solicitation of proxies for our Annual Meeting. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed by us with the SEC without charge from the SEC’s website at: www.sec.gov.

How do I obtain an Annual Report on Form 10-K?

If you would like a copy of our annual report on Form 10-K for the year ended December 31, 2024, we will send you one without charge. Please write to: Skye Bioscience, Inc., 11250 El Camino Real, Suite 100, San Diego CA 92130, Attn: Corporate Secretary.

All of our SEC filings are also available free of charge in the investor relations section of our website at www.skyebioscience.com.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except: (1) as necessary for applicable legal requirements, (2) to allow for the tabulation and certification of the votes and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to our management.

Do I have dissenters’ rights of appraisal?

Our stockholders do not have appraisal rights under Nevada law or under our governing documents with respect to the matters to be voted upon at the Special Meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

| Skye Bioscience, Inc. | 8 |

2025 Proxy Statement | ||||||

Proposal One:

Election of Directors

Election of Directors

Our Board of Directors is currently composed of six directors. Each of the nominees listed below is currently one of our directors. If elected at the Annual Meeting, each of these nominees would serve until the next annual meeting of stockholders and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, disability, resignation, retirement, disqualification or removal.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Abstentions and broker non-votes will not be treated as a vote cast for any particular director nominee and will not affect the outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the six nominees named below. The six director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six director nominees named below. If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board of Directors. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees for Election Until the 2026 Annual Meeting of Stockholders

The following table sets forth the name, age, position and tenure of each of our directors who are up for re-election at the Annual Meeting:

| Name | Age | Present Position | Director Since | ||||||||

| Paul Grayson | 60 | Chairman of the Board | 2023 | ||||||||

| Deborah Charych | 61 | Director | 2023 | ||||||||

| Punit Dhillon | 44 | Director and Chief Executive Officer | 2018 | ||||||||

| Annalisa Jenkins | 59 | Director | 2024 | ||||||||

| Karen Smith | 57 | Director | 2024 | ||||||||

| Andrew J. Schwab | 54 | Director | 2023 | ||||||||

The following includes a brief biography of each of the nominees standing for election to the Board of Directors at the Annual Meeting, based on information furnished to us by each director nominee, with each biography including information regarding the experiences, qualifications, attributes or skills that caused the nominating and corporate governance committee of the Board of Directors (the “Nominating and Corporate Governance Committee”) and the Board of Directors to determine that the applicable nominee should serve as a member of our Board of Directors.

| Skye Bioscience, Inc. | 9 |

2025 Proxy Statement | ||||||

Directors

Paul Grayson

Age: 60

Director Since: 2023

Paul Grayson has served on our Board of Directors since the closing of our merger with Bird Rock Bio, Inc. (“Bird Rock Bio”) in August 2023. Mr. Grayson was appointed as Chairman of the Board of Directors in October 2024. Mr. Grayson has served as President and Chief Executive Officer [and director] of Radionetics Oncology, Inc., a clinical stage biotechnology company focused on novel radiopharmaceutical products, since November 2023. From July 2020 to November 2023, Mr. Grayson served as President and Chief Executive Officer of Tentarix Biotherapeutics Inc., a biotechnology company. Mr .Grayson served as President and Chief Executive Officer of Bird Rock Bio, a clinical stage biopharmaceutical company, from June 2011 until its acquisition by the Company in August 2023. From November 2019 to July 2020, Mr. Grayson also served as a partner at Versant Ventures, a venture capital firm. Mr. Grayson received a Bachelor of Arts in Biochemistry and Computer Science from the University of California, Los Angeles and a Master of Business Administration from the University of California, Irvine.

We believe Mr. Grayson’s extensive experience in the biotechnology industry give him the qualifications and skills necessary to serve as a director of the Company.

| Skye Bioscience, Inc. | 10 |

2025 Proxy Statement | ||||||

Deborah Charych

Age: 61

Director Since: 2023

Deborah Charych, Ph.D., has served as member of our Board of Directors since February 2023. From October 2018 to September 2022, Dr. Charych served as the Co-Founder, Chief Technology Officer, and Advisor of RayzeBio, Inc, an oncology company focused on the targeted delivery of radionuclides. Dr. Charych conceived and led the scientific and operational R&D strategy for RayzeBio, acquired by BMS for $4.1 billion, leading a successful Series A financing and launch in August 2020, as well as subsequent Series B, C, and D rounds. Prior to launching RayzeBio, Dr. Charych held a number of scientific leadership positions in biotech companies focused on translational drug development. From 2017 to 2019, she founded Third Rock Ventures, creating new biotech companies based on strong science, co-founding Maze Therapeutics, which focuses on harnessing the power of human genetics, functional genomics, and data science to advance our understanding of how to more effectively treat patients with severe rare and common diseases. From 2010 to 2018, Dr. Charych served as Executive Director of Preclinical and Translational Research at Nektar Therapeutics. At FivePrime Therapeutics from 2007 to 2010, Dr. Charych was the Director of Biologics Process Development/CMC/Protein Chemistry. From 1998 to 2006, while at Chiron Corporation, she initiated and led a large proteomics effort to guide oncology target discovery, including the discovery of peptide-mimetic binders ('peptoids'). During her time at Lawrence Berkeley National Laboratory from 1993 to 1998, she assumed an academic leadership role as a tenured Principal Investigator, focusing on new biomaterials. Dr. Charych earned a PhD in Physical Chemistry from the University of California in Berkeley, CA and a B.S. in Chemistry from Carnegie- Mellon University in Pittsburgh, PA.

We believe Dr. Charych’s education and significant experience with a wide variety of life science companies give her the qualifications and skills necessary to serve as a director of the Company.

| Skye Bioscience, Inc. | 11 |

2025 Proxy Statement | ||||||

Punit Dhillon

Age: 44

Director Since: 2018

Punit Dhillon currently serves as a member of the Board of Directors and as the Company’s President and Chief Executive Officer. Mr. Dhillon was appointed as a member of the Board of Directors in January 2018. From December 2019 until October 2024, Mr. Dhillon was the Chairman of the Board of Directors. In August 2020, Mr. Dhillon was appointed as the Company's Chief Executive Officer. Mr. Dhillon was the co-founder and former President & CEO of OncoSec Medical, Inc. (NASDAQ: ONCS), a biopharmaceutical company developing cancer immunotherapies for the treatment of solid tumors, where he served as an executive until March 2018 and as a director until February 2020. He led OncoSec through over $250 million in capital raised, NASDAQ listing and launched the registration study, KEYNOTE695, of their proprietary immunotherapy product for melanoma in combination with Keytruda, based on a drug collaboration with Merck. Prior to that, from September 2003 to March 2011, Mr. Dhillon served as Vice President of Finance and Operations at Inovio Pharmaceuticals, Inc. (NASDAQ: INO), a DNA vaccine development company. Collectively, Mr. Dhillon has led and assisted in raising over $500 million through financings and mergers and acquisitions deals, as well as several licensing and development transactions with large pharmaceutical companies including Merck & Co., Inc. (NYSE: MRK), Bristol Myers Squibb Co (NYSE: BMY), and Pfizer Inc. (NYSE: PFE). Mr. Dhillon also co-founded and is the director of YELL Canada, a registered Canadian charity that partners with schools to support entrepreneurial learning.

Mr. Dhillon received his Bachelor of Arts Honors degree in Political Science with a minor in Business Administration from Simon Fraser University.

We believe Mr. Dhillon's experience in the biotechnology and pharmaceutical industry and his experience with publicly traded companies give him the qualifications necessary to serve as an officer and director of the Company.

| Skye Bioscience, Inc. | 12 |

2025 Proxy Statement | ||||||

Annalisa Jenkins

Age: 59

Director Since: 2024

Annalisa Jenkins, MBBS, FRCP, has served as a member of our Board of Directors since February 2024. From November 2017 until April 2019, Dr. Jenkins served as the Chief Executive Officer of PlaqueTec Ltd., a biotechnology company focusing on coronary artery disease treatment and prevention. Previously, Dr. Jenkins served as the Chief Executive Officer and a member of the board of directors of Dimension Therapeutics, Inc. (Nasdaq: DMTX), a gene therapy company focused on rare and metabolic diseases associated with the liver, from September 2014 until its sale to Ultragenyx Pharmaceutical Inc. (Nasdaq: RARE) in November 2017. From October 2013 to March 2014, Dr. Jenkins served as Executive Vice President, Head of Global Research and Development for Merck Serono Pharmaceuticals, a biopharmaceutical company. Previously, from September 2011 to October 2013, she served as Merck Serono’s Executive Vice President, Global Development and Medical, and was a member of Merck Serono’s executive committee. Prior to that, Dr. Jenkins pursued a 15-year career at Bristol-Myers Squibb Company, a biopharmaceutical company, where, from July 2009 to June 2011 she was a Senior Vice President and Head of Global Medical Affairs. Dr. Jenkins is currently a non-executive director of Genomics England. Dr. Jenkins serves on the board of directors of Affimed GmbH (Nasdaq: AFMD), Mereo BioPharma Group plc (Nasdaq: MREO), Compass Pathways PLC (Nasdaq: CMPS) and a number of privately held biotechnology and life science companies, including the board of directors of four privately listed European based fund platforms investing into the life sciences sector. Previously within the past five years, Dr. Jenkins served on the board of directors of Ardelyx, Inc. (Nasdaq: ARDX), AgeX Therapeutics, Inc. (NYSE American: AGE), Avrobio, Inc. (Nasdaq: AVRO) and Oncimmune Holdings plc (LSE: ONC). Dr. Jenkins serves on a number of charitable boards, advisory boards and contributes publicly on leadership with purpose, social entrepreneurship, diversity and innovation. Dr. Jenkins graduated with a degree in medicine from St. Bartholomew’s Hospital in the University of London and subsequently trained in cardiovascular medicine in the U.K. National Health Service. Earlier in her career, Dr. Jenkins served as a Medical Officer in the British Royal Navy during the Gulf Conflict, achieving the rank of Surgeon Lieutenant Commander.

We believe Dr. Jenkins is qualified to serve as a director of our Company based on her industry experience and her executive experience with companies in our industry.

| Skye Bioscience, Inc. | 13 |

2025 Proxy Statement | ||||||

Karen Smith

Age: 57

Director Since: 2024

Karen L. Smith, M.D., Ph.D., M.B.A., L.L.M., has served on our Board of Directors since July 2024. Dr. Smith is a life sciences thought leader with over 20 years of biopharmaceutical experience bringing drugs into the clinic and through commercialization. She has been a key contributor to the successful development of multiple FDA and EMA approved products in several therapeutic areas, including oncology (Herceptin, Vyxeos), rare disease (Defitelio), cardiology (Irbesartan), dermatology (Voluma, Botox), neuroscience (Abilify) and anti-infectives (Teflaro). Since November 2018, Dr. Smith has been providing consulting services internationally. Dr. Smith most recently served as Chief Medical Officer for Quince Therapeutics, Inc./Novosteo, Inc., a private biopharmaceutical company from January 2022 to September 2023, having previously served as Chief Medical Officer for Emergent BioSolutions, Inc. from April 2020 to December 2021. From May 2019 to January 2020, Dr. Smith served as President and Chief Executive Officer of Medeor Therapeutics, Inc., a biotechnology company. From June 2018 to May 2019, Dr. Smith served as Chief Executive Officer of Eliminate Cancer, Inc. From April 2015 to May 2018, she served as the Global Head of Research & Development and Chief Medical Officer of Jazz Pharmaceuticals plc, a biopharmaceutical company, where she built the R&D function into a pipeline of neuroscience and oncology products across all stages of discovery and development. From 2011 to 2015, she was Senior Vice President, Global Medical Affairs and Global Therapeutic Area Head (Dermatology) for Allergan, Inc., a multi-specialty health care company. Earlier in her career, she held senior leadership roles at AstraZeneca plc and Bristol Myers Squibb Company. Dr. Smith holds several degrees, including an M.D. from the University of Warwick, a Ph.D. in oncology from the University of Western Australia, an M.B.A. from the University of New England and an L.L.M. (Masters in Law) from the University of Salford. Dr. Smith serves on the board of directors of Sangamo Therapeutics, Inc. (Nasdaq: SGMO), Aurinia Pharmaceuticals, Inc. (Nasdaq: AUPH), a public pharmaceutical company, Context Therapeutics Inc. (Nasdaq: CNTX) and another private biotechnology company. Dr. Smith previously served on the board of directors of Talaris Therapeutics, Inc., a public biotechnology company from June 2022 to October 2023, Antares Pharma, Inc., a public pharmaceutical company from March 2019 to May 2022, Acceleron Pharma, Inc., a public biopharmaceutical company from November 2017 to December 2021, Sucampo Pharmaceuticals, Inc. from July 2017 to February 2018, and Forward Pharma A/S, from June 2016 to June 2017, and serves as the chair of the Strategic Advisory Board of Emyria Limited, a healthcare technology and services company.

We believe Dr. Smith is qualified to serve as a director of our Company based on extensive executive experience in global research and development and tenure on prior public company boards.

| Skye Bioscience, Inc. | 14 |

2025 Proxy Statement | ||||||

Andrew J. Schwab

Age: 54

Director Since: 2023

Andrew J. Schwab has served on our Board of Directors since the closing of our merger with Bird Rock Bio in August 2023 . Mr. Schwab is a Founding Partner and Managing Member of 5AM Venture Management, LLC, a venture capital firm focused on next generation life science investments founded in 2002. At 5AM, Mr. Schwab has led the firm’s investments in and currently also serves on the Board of Directors of Camp4 Therapeutics Corporation since March 2021, Fellow Health, Inc. since August 2022, Radionetics Oncology, Inc. since September 2021, Rarecyte, Inc. since December 2019, Scientist.com since November 2019, and TMRW Holdings, LLC since December 2019. Mr. Schwab previously served on the Board of Directors of Enliven Therapeutics, Inc. from January 2022 to June 2023, Escient Pharmaceuticals, Inc. (acquired by Incyte Corporation) from March 2018 to May 2024, Nido Biosciences, Inc. from August 2019 to August 2020, Novome Biotechnologies, Inc. from March 2018 to June 2024, Pear Therapeutics, Inc. from June 2014 to June 2022, and 5:01 Acquisition Corp. from September 2020 to October 2022. Mr. Schwab holds a B.S. degree with Honors in Genetics & Ethics from Davidson College.

We believe Mr. Schwab is qualified to serve as a director of our Company because of his vast investment experience, and his extensive experience in management positions and on the boards of companies in the life sciences industry.

Independence of the Board of Directors

Our Board of Directors currently consists of six members. As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of our Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors . In addition, Nasdaq rules require that, subject to specified exceptions, each member of the audit committee of the Board of Directors (the “Audit Committee”), compensation committee of the Board of Directors (the “Compensation Committee”), and Nominating and Corporate Governance Committee be independent within the meaning of Nasdaq rules. The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us.

Our Board of Directors undertook a review of the independence of each director and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that each of our current directors, other than Punit Dhillon, our President and Chief Executive Officer, and Andrew J. Schwab, an affiliate of one of our 5% beneficial owners, qualifies as an “independent” director within the meaning of the Nasdaq rules. Accordingly, a majority of our directors are independent, as required under Nasdaq rules.

Board Leadership Structure

Our Board of Directors is currently led by its Chairman, Paul Grayson. Our Board of Directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the Company continues to grow. We separate the roles of Chief Executive Officer and Chairman of the Board of Directors in in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting our strategic direction and day-to-day leadership and performance, while the Chairman of our Board of Directors provides guidance to the Chief Executive Officer and presides over meetings of the full Board of Directors. We believe that this separation of responsibilities provides a balanced approach to managing our Board of Directors and Company oversight.

| Skye Bioscience, Inc. | 15 |

2025 Proxy Statement | ||||||

The Board’s Role in Risk Oversight

Our Board of Directors has responsibility for the oversight of our risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from Board committees and members of senior management to enable our Board to understand our risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operational, financial, market, legal, regulatory, strategic and reputational risk.

Our Audit Committee reviews information regarding liquidity and operations and oversees our management of financial risks. Periodically, our Audit Committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by our Audit Committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures, including related to cybersecurity. The Compensation Committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The Nominating & Corporate Governance Committee manages risks associated with the independence of the Board of Directors, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our Board of Directors as a whole.

Board of Directors Meetings

During the year ended December 31, 2024, our Board of Directors held seven meetings (including regularly scheduled, telephonic and special meetings) and also acted by unanimous written consent. Each director attended at least 75% of the total meetings held by our Board of Directors and the committees of which he or she was a member during such director’s term of service in fiscal year 2024.

Committees of the Board of Directors

We have three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each of these committees has a written charter approved by our Board of Directors. A copy of each charter can be found under the “Investors – Governance” section of our website at www.skyebioscience.com.

Audit Committee

Our Audit Committee consists of three members: Dr. Jenkins (chair and financial expert), Dr. Smith and Mr. Grayson. Our Board of Directors has determined that Dr. Jenkins qualifies as an “audit committee financial expert” as that phrase is defined under the regulations promulgated by the SEC and has the requisite financial sophistication as defined under the applicable Nasdaq rules and regulations. Our Board of Directors has determined that all members of our Audit Committee are independent directors, as defined in the applicable SEC and Nasdaq rules. Our Audit Committee met five times during 2024 and also acted by unanimous written consent.

| Skye Bioscience, Inc. | 16 |

2025 Proxy Statement | ||||||

Our Audit Committee is governed by a written charter adopted by our Board of Directors. Our Audit Committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. Our Audit Committee is responsible for, among other things:

•appointing our independent registered public accounting firm;

•evaluating the qualifications, independence and performance of our independent registered public accounting firm;

•approving the audit and non-audit services to be performed by our independent registered public accounting firm;

•reviewing the design, implementation, adequacy and effectiveness of our internal accounting controls and our critical accounting policies;

•discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements;

•reviewing, overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

•reviewing on a periodic basis, or as appropriate, any investment policy and recommending to our Board of Directors any changes to such investment policy;

•reviewing with management and our auditors any earnings announcements and other public announcements regarding our results of operations;

•preparing the report that the SEC requires in our annual proxy statement;

•reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics;

•reviewing and evaluating, at least annually, the performance of the Audit Committee and its members including compliance of the Audit Committee with its charter; and

•the preparation of the Audit Committee report to be included in our annual proxy statement.

Compensation Committee

Our Compensation Committee consists of three members: Dr. Smith (chair), Dr. Jenkins, and Mr. Grayson. Our Board of Directors has determined that all members of our Compensation Committee are independent directors, as defined in the Nasdaq listing rules. Our Compensation Committee met five times during 2024 and also acted by unanimous written consent.

The Compensation Committee is governed by a written charter approved by our Board of Directors. The Compensation Committee’s purpose is to assist our Board of Directors overseeing the development plans and compensation for our senior management and directors and recommend these plans to our Board of Directors. The Compensation Committee’s responsibilities include, among other things:

•evaluating, recommending, approving and reviewing executive officer compensation arrangements, plans, policies and programs;

•administering our cash-based and equity-based compensation plans; and

•making recommendations to the Board regarding any other Board responsibilities relating to executive compensation.

| Skye Bioscience, Inc. | 17 |

2025 Proxy Statement | ||||||

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of four members: Dr. Charych (chair), Dr. Smith, Dr. Jenkins and Mr. Grayson. Our Board of Directors has determined that all members of our Nominating and Corporate Governance Committee are independent directors, as defined in the Nasdaq listing rules. Our Nominating and Corporate Governance Committee met four times during 2024 and also acted by unanimous written consent.

The Nominating and Corporate Governance Committee is governed by a written charter approved by our Board of Directors. The Nominating and Corporate Governance Committee’s purpose is to assist our Board of Directors by identifying individuals qualified to become members of our Board of Directors, consistent with criteria set by our Board, and to develop our corporate governance principles. The Nominating and Corporate Governance Committee’s responsibilities include, among other things:

•identifying, considering and recommending candidates for membership on our Board of Directors;

•overseeing the process of evaluating the performance of our Board of Directors; and

•advising our Board of Directors on other corporate governance matters.

Anti-Hedging Policies

Our insider trading policy prohibits employees, officers and directors from engaging in short-term or speculative securities transactions, including derivative transactions relating to our securities, such as exchanged traded options and hedging transactions.

Insider Trading Policy

We have adopted an insider trading policy governing the purchase, sale and/or other dispositions of our shares by our directors and officers that are reasonably designed to promote compliance with insider trading laws, rules and regulations. Our insider trading policy is filed as Exhibit 19.1 to our Annual Report on Form 10-K.

Director Selection Process

The Nominating and Corporate Governance Committee is responsible for, among other things, the selection and recommendation to the Board of Directors of nominees for election as directors. In accordance with the Nominating and Corporate Governance Committee charter and our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee develops guidelines and criteria for the selection of candidates for nominees for election as directors. The Nominating and Corporate Governance Committee considers whether a potential candidate for director has the time available, in light of other business and personal commitments, to perform the responsibilities required for effective service on the Board, along with their personal and professional integrity, demonstrated ability and judgment, experience, familiarity with the Company as well as certain other relevant factors. Applying these criteria, the Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and the Chairman of the Board of Directors and Chief Executive Officer as well as stockholders. After completing the identification and evaluation process described above, the Nominating and Corporate Governance Committee recommends the nominees for directorship to the Board. Taking the Nominating and Corporate Governance Committee’s recommendation into consideration, the Board then approves the nominees for directorship for stockholders to consider and vote upon at the annual stockholders’ meeting.

The Nominating and Corporate Governance Committee evaluates director candidate recommendations by stockholders in the same manner as it evaluates other director candidate recommendations. Any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by Board members, management or other parties are

| Skye Bioscience, Inc. | 18 |

2025 Proxy Statement | ||||||

evaluated. We do not intend to treat stockholder recommendations in any manner different from other recommendations. Any stockholder recommendations for additions to our Board of Directors should be sent to Skye Bioscience, Inc., 11250 El Camino Real, Suite 100, San Diego, CA 92130, Attention: Corporate Secretary in accordance with the requirements set forth under “Stockholder Proposals”.

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our Board of Directors at our Annual Meeting, we encourage all of our directors to attend. We did not hold an annual meeting of stockholders in 2024.

Communication with our Board of Directors

Stockholders seeking to communicate with our Board of Directors, a committee of our Board of Directors, or an individual director should submit their written comments to our corporate secretary at Skye Bioscience, Inc., Attn: Corporate Secretary, 11250 El Camino Real, Suite 100, San Diego, CA 92130. The corporate secretary will forward such communications to each member of our Board of Directors, the applicable committee or to the applicable director(s). Items that are unrelated to the duties and responsibilities of our Board of Directors will be excluded. In addition, material that is illegal, inappropriate or similarly unsuitable will be excluded. Any letter that is filtered out under these standards, however, will be made available to any director upon request.

Code of Business Conduct and Ethics

The Board of Directors has established a code of business conduct and ethics that applies to our officers, directors and employees. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

•full, fair, accurate, timely and understandable disclosure in the reports and documents the Company files with, or submits to, the SEC and in other public communications made by the Company;

•compliance with applicable governmental laws, rules and regulations;

•the prompt internal reporting to the appropriate person of violations of the code of business conduct and ethics; and

•accountability for adherence to the code of business conduct and ethics.

Any waiver of the code of business conduct and ethics for our executive officers or directors must be approved by the Board of Directors, and any such waiver shall be promptly disclosed to the stockholders. We will disclose amendments to the code of business conduct and ethics on our website within four business days from the date of such amendment.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines to assist and guide the Board of Directors in the exercise of its responsibilities and establish a framework for our corporate governance practices. The Corporate Governance Guidelines contain written standards pertaining to director qualifications, director responsibilities, structure of our Board of Directors, director access to management and independent advisors, director compensation, and performance evaluation of our Board and committees, among other things. The Corporate Governance Guidelines help to ensure that the Board of Directors is independent from management, the Board of Directors adequately performs its oversight functions, and the interests of the Board of Directors and management align with the interests of our stockholders.

| Skye Bioscience, Inc. | 19 |

2025 Proxy Statement | ||||||

Director Compensation

Under our director compensation program , each non-employee director receives the cash and equity compensation for board services described below. Our Compensation Committee and Board of Directors have primary responsibility for reviewing and approving the compensation paid to non-employee directors. Our Compensation Committee periodically reviews the type and form of compensation paid to our non-employee directors, which includes a market assessment and analysis by our independent compensation consulting firm, Anderson Pay Advisors, LLC (“Anderson”), regarding practices at comparable companies. As part of this analysis, Anderson, reviews non-employee director compensation trends and data from companies comprising the same peer group used by our Compensation Committee in connection with its review of executive compensation. Based on this review, our Compensation Committee makes adjustments to the non-employee director compensation program in an effort to provide competitive compensation to our non-employee directors.

In February 2024, our Compensation Committee, reviewed our director compensation program and recommended to the Board of Directors, and the Board of Directors approved, an amendment to our director compensation program to increase the number of shares subject to the initial option award and annual option award to be made to our non-employee directors to 40,000 and 35,000, respectively.

Additionally, in February 2024, the Board of Directors, based on the recommendation of the Compensation Committee, granted Mr. Grayson 100,000 restricted stock units (“RSUs”) that vest upon the achievement of the following milestones, subject to Mr. Grayson’s continued service with the Company on the applicable vesting date: (i) 25% vests upon the Company achieving a market capitalization of $750 million and a stock price of $20.00 per share, (ii) an additional 25% vests upon the Company achieving a market capitalization of $1 billion and a stock price of $25.00 per share, (iii) an additional 25% vests upon the Company achieving a market capitalization of $1.25 billion and a stock price of $30.00 per share and (iv) an additional 25% vests upon the Company achieving a market capitalization of $1.5 billion or greater and a stock price of $35.00 per share. Upon a Change in Control (as defined in the Skye Bioscience, Inc. Amended and Restated Omnibus Incentive Plan (the “Amended and Restated Plan”)), all of the restricted stock units will become fully vested. This grant was made in recognition of Mr. Grayson’s unique skills, experience and contributions to the Company.

In October 2024, our Compensation Committee, in consultation with Anderson, recommended to the Board of Directors for approval, and the Board of Directors approved, a director retention stock option award to purchase 70,000 shares of our common stock to each of our non-employee directors, with each such stock option award vesting in equal monthly installments during the one year following the grant date, subject to the director’s continued service on our Board of Directors.

In October 2024, our Compensation Committee, in consultation with Anderson, reviewed our non-employee director cash compensation program and recommended to the Board of Directors, and the Board of Directors approved, certain changes to the cash compensation for our non-employee directors to align with the level of compensation of directors in our 2024 peer group. Such changes are described in the “Cash Compensation” section below.

Compensation paid to our non-employee directors is subject to the annual limits on non-employee director compensation set forth in our Amended and Restated Plan. As provided in the Amended and Restated Plan, our Board of Directors or its authorized committee may make exceptions to this limit for individual non-employee directors, as the Board of Directors or its authorized committee may determine in its discretion.

We have reimbursed and will continue to reimburse our non-employee directors for their reasonable expenses incurred in attending meetings of our Board of Directors and committees of our Board of Directors.

| Skye Bioscience, Inc. | 20 |

2025 Proxy Statement | ||||||

Cash Compensation

Non-employee directors are entitled to receive the following cash compensation for their services under the program:

•$50,000 per year for service as a member of the Board of Directors (increased from $40,000 in October 2024)

•$50,000 per year for service as the chairman of the Board of Directors, if one is appointed as such and is a non-employee director

•$20,000 per year for service as chairperson of the Audit Committee

•$10,000 per year for service as a member of the Audit Committee

•$15,000 per year for service as chairperson of the Compensation Committee (increased from $10,000 in October 2024)

•$7,500 per year for service as a member of the Compensation Committee (increased from $3,500 in October 2024)

•$10,000 per year for service as chairperson of the Nominating and Corporate Governance Committee (increased from $5,000 in October 2024)

•$5,000 per year for service as a member of the Nominating and Corporate Governance Committee (increased from $2,500 in October 2024)

Each non-employee director who serves as the chairperson of a committee does not receive the additional annual cash fee for serving as a member of the committee.

Equity Compensation

Initial Option Award. Each person who first becomes a non-employee director is entitled to receive a one-time award of 40,000 stock options which vest in twelve equal monthly installments. This amount was increased from 20,000 stock options in February of 2024.

Annual Option Award. Each non-employee director is entitled to receive, an annual stock option award to purchase 35,000 stock options that vest in twelve equal monthly installments. This amount was increased from 20,000 stock options in February of 2024.

In the event of a Change in Control (as defined in our Amended and Restated Plan), each director is entitled to full accelerated vesting in their outstanding company equity awards, including any initial stock option award or annual stock option award, immediately prior to the consummation of the Change in Control. All initial stock option awards and annual stock option awards have an exercise price equal to the fair market value of a share of our common stock on the date of grant, and a maximum term of 10 years.

| Skye Bioscience, Inc. | 21 |

2025 Proxy Statement | ||||||

2024 Director Compensation Table

The following table summarizes cash and stock compensation received by our non-employee directors during the year ended December 31, 2024. Mr. Dhillon is not included in the following table as he served as an executive officer during 2024 and his compensation is included in the Summary Compensation Table in the “Executive Compensation and Other Information” section below.

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards

($)(1)

|

Option

Awards

($)(1)

|

All Other Compensation ($) |

Total ($) |

|||||||||||||||

| Deborah Charych | 47,245 | — | 642,936 | — | 690,180 | |||||||||||||||

| Paul Grayson | 58,465 | 1,421,250 | 699,316 | — | 2,179,031 | |||||||||||||||

Annalisa Jenkins (2)

|

50,427 | — | 699,316 | — | 749,743 | |||||||||||||||