PRE 14C: Preliminary information statement not related to a contested matter or merger/acquisition

Published on October 15, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14C INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

| Check the appropriate box: |

|

| x | Preliminary Information Statement |

| ¨ | Definitive Information Statement |

| ¨ | Confidential, of the Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| Nemus Bioscience, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| Payment of Filing Fee (Check the appropriate box): |

||

| x | No fee required. |

|

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

|

|

|

|

|

|

| 1) | Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

| 2) | Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

|

| 4) | Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

| 5) | Total fee paid: |

|

|

|

|

|

|

|

|

| ¨ | Fee paid previously with preliminary materials. |

|

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

| 1) | Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

| 2) | Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

|

| 3) | Filing Party: |

|

|

|

|

|

|

|

|

|

| 4) | Date Filed: |

|

|

|

|

NEMUS BIOSCIENCE, INC.

130 North Marina Drive

Long Beach, California 90803

| NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT October __, 2018 |

Dear Nemus Bioscience, Inc. Stockholders:

The accompanying Information Statement (the “Information Statement”) is furnished by the Board of Directors (the “Board”) of Nemus Bioscience, Inc., a Nevada corporation (the “Company”), to holders of record as of the close of business on October 5, 2018 (the “Stockholders”) of the Company’s common stock, $0.001 par value per share (the “Common Stock”), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of this Information Statement is to inform our Stockholders that, on October 5, 2018, the holder of a majority of the voting power of the outstanding capital stock of the Company acted by written consent in lieu of a special meeting of the Stockholders in accordance with Section 78.320 of the Nevada Revised Statutes (“NRS”) to authorize and approve the following:

|

| (1) | An amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of Common Stock from 236,000,000 to 500,000,000 shares (the “Authorized Common Stock Amendment”); and |

|

|

|

|

|

| (2) | An amendment to the Company’s 2014 Omnibus Incentive Plan (the “Plan”) increasing the number of shares authorized for issuance under the Plan (the “Plan Amendment”). |

The approval of the Authorized Common Stock Amendment will not become effective until at least 20 calendar days after the initial mailing of this Information Statement.

No action is required by you. The NRS permit holders of a majority of the voting power of a Nevada corporation to take stockholder action by written consent. Accordingly, the Company will not hold a meeting of its Stockholders to consider or vote upon the Authorized Common Stock Amendment or the Plan Amendment. This Information Statement is furnished solely for the purpose of informing our Stockholders of the actions described herein before such actions take effect in accordance with Rule 14c-2 promulgated under the Exchange Act. This Information Statement is being distributed to the Stockholders on or about October __, 2018. We encourage you to read the Information Statement carefully for further information regarding these actions.

Please note that the Company’s controlling stockholder has voted to approve the Authorized Common Stock Amendment and Plan Amendment. The number of votes held by the stockholder executing the written consent is sufficient to satisfy the stockholder vote requirement for these actions under applicable law and the Company’s charter documents, so no additional votes will consequently be needed to approve these actions.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

| By Order of the Board of Directors | ||

| /s/ Dr. Brian S. Murphy | ||

|

| Dr. Brian S. Murphy | |

| Chief Executive Officer | ||

| Long Beach, CA |

|

|

| October __, 2018 |

|

|

NEMUS BIOSCIENCE, INC.

130 North Marina Drive

Long Beach, California 90803

|

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C PROMULGATED THEREUNDER

|

INTRODUCTORY STATEMENT

Date and Purpose of Written Consent

Nemus Bioscience, Inc. (the “Company”) is a Nevada corporation with principal executive offices located at 130 North Marina Drive, Long Beach, California 90803. Our telephone number is (949) 396-0330. On October 5, 2018, a stockholder holding 73,116,250 shares of our Common Stock, which constitutes a majority of the voting power of the Company, and the Company’s Board of Directors (the “Board”) took action by written consent approving and adopting (i) an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of Common Stock from 236,000,000 to 500,000,000 (the “Authorized Common Stock Amendment”), and (ii) an amendment to our 2014 Omnibus Incentive Plan (the “Plan”) increasing the number of shares authorized for issuance under the Plan (the “Plan Amendment”).

This Information Statement is being distributed by the Board to the holders of record (the “Stockholders”) of the Company’s Common Stock as of October 5, 2018 (the “Record Date”) to notify the Stockholders that the holder of a majority of the voting power of the outstanding capital stock of the Company entitled to vote on the Authorized Common Stock Amendment and the Plan Amendment (the “Consenting Stockholder”) has taken action by written consent, in lieu of a special meeting of the Stockholders, approving the Authorized Common Stock Amendment and the Plan Amendment. The required vote was obtained on October 5, 2018 in accordance with the relevant sections of the Nevada Revised Statutes (“NRS”) and the Company’s Articles of Incorporation and Bylaws. This Information Statement is being delivered only to inform you of the corporate actions described herein in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Section 78.320 of the NRS generally provides that any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written consents is required.

Copies of this Information Statement are expected to be mailed on or about October __, 2018 to the Stockholders as of the Record Date. The filing of a Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State reflecting the Authorized Common Stock Amendment, will not be completed until at least 20 calendar days after the initial mailing of this Information Statement.

Proxies

No proxies are being solicited. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Dissenting Stockholders

Under the NRS, our dissenting stockholders are not entitled to appraisal rights with respect to the approval of the Authorized Common Stock Amendment or the Plan Amendment, and we will not independently provide our stockholders with any such right.

Information Statement Costs

The entire cost of furnishing this Information Statement, including the preparation, assembly and mailing of the Information Statement, will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them, and may reimburse such persons for their reasonable charges and expenses in connection therewith.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDER HAS VOTED TO APPROVE THE AUTHORIZED COMMON STOCK AMENDMENT AND PLAN AMENDMENT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDER EXECUTING THE WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH ACTIONS UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER DOCUMENTS, SO NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THESE ACTIONS. THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE APPROVAL OF THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT, AND TO PROVIDE YOU WITH INFORMATION ABOUT THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT AND THE BACKGROUND OF THESE CORPORATE ACTIONS.

THE AUTHORIZED COMMON STOCK AMENDMENT AND THE PLAN AMENDMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE FAIRNESS OR MERIT OF THESE ACTIONS NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT, AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

FORWARD-LOOKING STATEMENTS

This Information Statement and the other reports filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to differ materially from the results, performance or achievements expressed or implied by any such forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or other variations on these words or words of similar import. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light of these uncertainties, stockholders are cautioned not to place undue reliance on the information contained in forward-looking statements. Except as specified in applicable SEC regulations, the Company is not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

VOTE REQUIRED TO APPROVE THE PROPOSAL

The approval and adoption of the Authorized Common Stock Amendment and the Plan Amendment requires the consent of the holders of a majority of the voting power of the Company. Holders of the Company’s Common Stock are entitled to one (1) vote with respect to each share of Common Stock issued and outstanding. Each holder of the Company’s Series B Convertible Preferred Stock is entitled to voting rights equal to the number of shares of Common Stock into which such holder’s Series B Convertible Preferred Stock would be convertible on the Record Date.

As of the Record Date, there were 133,445,080 shares of Common Stock and no shares of Series B Convertible Preferred Stock issued and outstanding. For the approval of the Authorized Common Stock Amendment and the Plan Amendment, the affirmative vote of a majority of the shares of Common Stock outstanding and entitled to vote was required.

CONSENTING STOCKHOLDERS

On October 5, 2018, a stockholder holding 73,116,250 shares of Common Stock, or approximately 54.79% of the issued and outstanding Common Stock of the Company, delivered a written consent to us approving and adopting the actions described in this Information Statement. For a detailed breakdown of the beneficial ownership of our Common Stock, please see Security Ownership of Certain Beneficial Owners and Management below.

Pursuant to Section 14(c) of the Exchange Act and the rules promulgated thereunder, the Authorized Common Stock Amendment being subject to approval of the Stockholders cannot become effective until at least 20 calendar days after the initial mailing of this Information Statement to the Stockholders. The Plan Amendment is effective upon approval of the Board and Consenting Stockholder.

STOCKHOLDER ACTION NO. 1

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

General Information

As of the date hereof, pursuant to our Articles of Incorporation, we are authorized to issue up to two hundred thirty-six million (236,000,000) shares of Common Stock. Pursuant to the Authorized Common Stock Amendment, we propose to increase our authorized shares of Common Stock from two hundred thirty-six million (236,000,000) to five hundred million (500,000,000) shares of Common Stock.

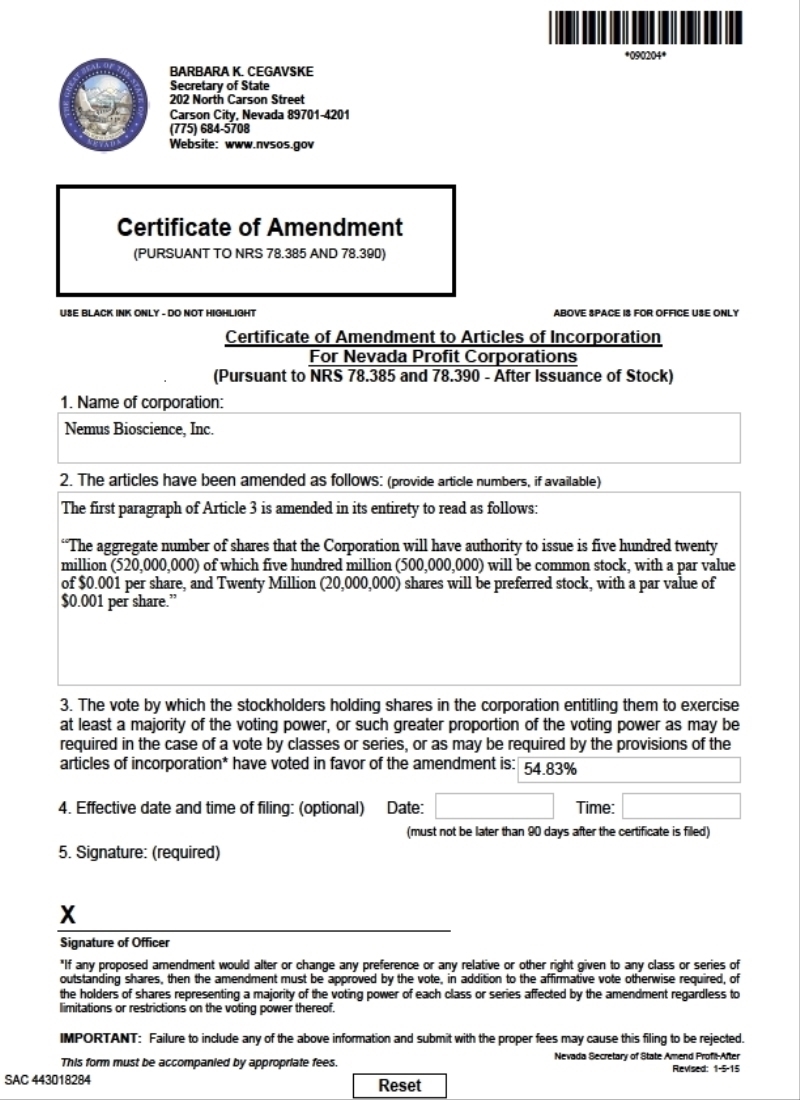

The Consenting Stockholder representing a majority of the Company’s outstanding voting stock has given its written consent to increase the authorized number of shares of Common Stock. Under the NRS, the consent of the holders of a majority of the voting power is effective as stockholders’ approval. We will file a Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State in order to increase the number of authorized shares of Common Stock to five hundred million (500,000,000) shares of Common Stock no earlier than (20) calendar days from the date of mailing of this Information Statement. A copy of the form of Certificate of Amendment to the Company’s Articles of Incorporation is attached hereto as Annex A.

The Amendment will not result in any changes to the issued and outstanding shares of Common Stock of the Company, and will only affect the number of shares that may be issued by the Company in the future.

Reasons for the Amendment

The primary purpose of the Authorized Common Stock Amendment is to make available for future issuance by us additional shares of Common Stock and to have a sufficient number of authorized and unissued shares of Common Stock to maintain flexibility in our corporate strategy and planning. We believe that it is in the best interests of our Company and our Stockholders to have additional authorized but unissued shares available for issuance to meet business needs as they arise. The Board believes that the availability of additional shares will provide our Company with the flexibility to issue Common Stock for possible future financings, stock dividends or distributions, acquisitions, stock option plans, and other proper corporate purposes that may be identified in the future by the Board, without the possible expense and delay of a special stockholders’ meeting. The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share and, for stockholders who do not purchase additional shares to maintain their pro rata interest in our Company, on such stockholders’ percentage voting power.

The authorized shares of Common Stock in excess of those issued will be available for issuance at such times and for such corporate purposes as the Board may deem advisable, without further action by our Stockholders, except as may be required by applicable law or by the rules of any stock exchange or national securities association trading system on which the securities may be listed or traded. Upon issuance, such shares will have the same rights as the outstanding shares of Common Stock. Holders of Common Stock have no preemptive rights. The availability of additional shares of Common Stock is particularly important in the event that the Board determines to undertake any actions on an expedited basis and thus to avoid the time, expense and delay of seeking stockholder approval in connection with any potential issuance of Common Stock, of which we have none contemplated at this time other than as discussed herein.

On October 5, 2018, the Board approved a Multi-Draw Credit Agreement, by and between the Company and Emerald Health Sciences Inc. (“Emerald Health”), pursuant to which the Company may borrow up to $20,000,000 from Emerald Health. Pursuant to the terms of the Multi-Draw Credit Agreement, the Company will issue warrants to Emerald Health, and Emerald Health may convert all or any part of the outstanding loan into shares of the Company’s Common Stock. The Authorized Common Stock Amendment will allow the Company to reserve for issuance a sufficient number of shares of the Company’s Common Stock that may be required to be issued upon any future conversion by Emerald Health of all or any portion of the outstanding loan, or upon exercise of the warrants issued to Emerald Health in connection therewith.

Other than as described herein, we have no arrangements, agreements, understandings, or plans at the current time for the issuance or use of the additional shares of Common Stock proposed to be authorized pursuant to the Authorized Common Stock Amendment. The Board does not intend to issue any Common Stock except on terms which the Board deems to be in the best interests of our Company and its then existing stockholders.

Principal Effects on Outstanding Common Stock

The proposal to increase the authorized Common Stock will affect the rights of existing holders of Common Stock to the extent that future issuances of Common Stock will reduce each existing stockholder’s proportionate ownership and may dilute earnings per share of the shares outstanding at the time of any such issuance. The Authorized Common Stock Amendment will be effective upon the filing of the Certificate of Amendment to the Company’s Articles of Incorporation with the Nevada Secretary of State.

Potential Anti-Takeover Aspects and Possible Disadvantages of Stockholder Approval of the Increase

The increase in the authorized number of shares of Common Stock could have possible anti-takeover effects. These authorized but unissued shares could, within the limits imposed by applicable law, be issued in one or more transactions that could make a change of control of the Company more difficult, and therefore more unlikely. The additional authorized shares could be used to discourage persons from attempting to gain control of the Company by diluting the voting power of shares then outstanding or increasing the voting power of persons that would support the Board in a potential takeover situation, including by preventing or delaying a proposed business combination that may be opposed by the Board although perceived to be desirable by some stockholders. The Board does not have any current knowledge of any effort by any third party to accumulate our securities or obtain control of the Company by means of a merger, tender offer, solicitation in opposition to management or otherwise.

While the Authorized Common Stock Amendment may have anti-takeover ramifications, our Board believes that the financial flexibility offered by the Authorized Common Stock Amendment outweighs any potential disadvantages. To the extent that the Authorized Common Stock Amendment may have anti-takeover effects, the Authorized Common Stock Amendment may encourage persons seeking to acquire our Company to negotiate directly with the Board, enabling the Board to consider the proposed transaction in a manner that best serves our Stockholders’ interests.

Other than as set forth above, there are currently no plans, arrangements, commitments or understandings for the issuance of additional shares of Common Stock.

Amendment

The first paragraph of Article 3 of the Company’s Articles of Incorporation will be amended to read as follows:

“The aggregate number of shares that the Corporation will have authority to issue is five hundred twenty million (520,000,000), of which five hundred million (500,000,000) will be common stock, with a par value of $0.001 per share, and twenty million (20,000,000) will be preferred stock, with a par value of $0.001 per share.”

A copy of the Certificate of Amendment to the Company’s Articles of Incorporation is attached hereto as Annex A.

Vote Required

The affirmative vote of a majority of the shares of outstanding Common Stock entitled to vote was required to approve the Authorized Common Stock Amendment.

No Dissenter’s Rights

Under the NRS, our dissenting stockholders are not entitled to appraisal rights with respect to the Authorized Common Stock Amendment, and we will not independently provide our stockholders with any such right.

STOCKHOLDER ACTION NO. 2

AMENDMENT TO THE COMPANY’S 2014 OMNIBUS INCENTIVE PLAN TO INCREASE THE

NUMBER OF SHARES AUTHORIZED FOR ISSUANCE UNDER THE PLAN

On October 5, 2018, the Consenting Stockholder and the Board approved an amendment to the Company’s 2014 Omnibus Incentive Plan (the “Plan”) to increase the aggregate number of shares of Common Stock authorized for issuance under the Plan to a number equal to ten percent (10%) of the outstanding shares of Common Stock (the “Plan Amendment”).

Our Plan is the only plan under which equity-based compensation may currently be awarded to our employees, officers, directors and consultants. In order to enable us to continue to offer meaningful equity-based incentives to our employees, officers, directors and consultants, the Consenting Stockholder and Board believe it is both necessary and appropriate and in the best interest of our Company and our Stockholders to increase the number of shares of our Common Stock available for these purposes. As a result, on October 5, 2018, the Consenting Stockholder and Board approved the Plan Amendment, which increases the number of shares of Common Stock authorized for issuance under the Plan to an aggregate number equal to ten percent (10%) of the outstanding shares of Common Stock. The increase in the number of shares authorized for issuance is the only change to the Plan, a summary of which is provided below.

Summary Description of 2014 Omnibus Incentive Plan

The following is a summary of the principal features of the Plan. All references to the Plan in this section refer to the Plan, as amended by the Plan Amendment. The following description is intended to be a summary of the material provisions of the Plan. It does not purport to be a complete description of all the provisions of the Plan, and is qualified in its entirety by reference to the complete text of the Plan, including the Plan Amendment evidenced by Amendment No. 1 to the Plan, which are attached hereto as Annex B. Capitalized terms used in the following summary and not otherwise defined in this Information Statement have the meanings set forth in the Plan.

Purpose and Eligible Participants. The purpose of the Plan is to attract, retain and reward high-quality executives, employees and consultants who provide services to the Company and its subsidiaries, and to motivate our executives, employees and consultants to achieve long-term corporate objectives, by enabling such persons to acquire a proprietary interest in the Company. All employees (including executive officers), non-employee directors, and consultants of the Company are eligible to participate in the Plan.

Types of Awards. The Plan permits the grant of the following types of awards, in the amounts and upon the terms determined by the Committee:

Options. Options may either be incentive stock options (“ISOs”) which are specifically designated as such for purposes of compliance with Section 422 of the Internal Revenue Code or non-qualified stock options (“NSOs”). Options may be granted in such number, at such price, and subject to such conditions as may be established by the Committee. The exercise price of each Option shall be determined by the Committee, provided that such price will not be less than the fair market value of a share on the date of the grant. The term for the Options may be set by the Committee, but in no event shall an Option be exercisable more than ten (10) years from the date of grant. Recipients of Options have no rights as stockholders with respect to any shares covered by the Options until the recipients or transferees have become holders of record of any such shares.

Stock Appreciation Rights. Generally, upon exercise of a stock appreciation right (“SAR”), the recipient will receive cash, shares of the Company’s Common Stock, or a combination of cash and Common Stock, with a value equal to the excess of: (i) the fair market value of a share of Common Stock on the date of the exercise, over (ii) the exercise price or grant price of such SAR. The exercise price or grant price of a SAR and all other terms and conditions will be established by the Committee in its sole discretion, subject to and in accordance with the terms of the Plan.

Restricted Stock Awards. Restricted stock awards consist of shares granted to a participant that are subject to one or more risks of forfeiture and/or transfer restriction, which may be based upon performance standards, periods of service, retention by the Participant of ownership of a specified number of shares of Common Stock, or other criteria as may be established by the Committee. Recipients of restricted stock awards are entitled to vote and receive dividends attributable to the shares underlying the Award beginning on the grant date, provided that any Common Stock distributed as a dividend or otherwise with respect to any restricted shares shall be subject to the same restrictions as such restricted shares.

Restricted Stock Units. Restricted stock units consist of a right to receive shares in the future subject to such terms, conditions and restrictions as the Committee may establish, which may be based on performance standards, periods of service, retention by the Participant of ownership of a specified number of shares of Common Stock, or other criteria. Recipients of restricted stock units have no rights as stockholder with respect to any shares covered by the Award until the lapse or release of all restrictions applicable to the Award and the issuance of shares of Common Stock in respect of such Award.

Performance Awards. Performance awards consist of the right to receive payment (in cash or shares of Common Stock, or a combination of cash and Common Stock) upon achievement of performance objectives during a performance period established by the Committee, which shall be two or more fiscal or calendar years. Recipients of performance awards have no rights as stockholders with respect to any shares covered by the Award until the issuance of shares of Common Stock, if any, in respect of such Award.

Number of Shares. Subject to adjustment as provided in the Plan, in 2014, the Board and stockholders approved the reservation of 3,200,000 shares of Common Stock to be available for issuance in connection with Awards granted under the Plan. The Plan Amendment increased the aggregate number of shares of Common Stock authorized for issuance under the Plan to a number equal to ten percent (10%) of the Company’s issued and outstanding shares of Common Stock. Any shares of Common Stock offered under the Plan shall consist of authorized and unissued shares of Common Stock, or issued Common Stock that shall have been reacquired by the Company.

Administration. Subject to the terms of the Plan, the Board or, at the discretion of the Board, a committee of the Board consisting of at least two directors (the “Committee”), shall have the sole discretionary authority to administer the Plan and to: interpret the provisions of the Plan; establish and modify administrative rules for the Plan; impose such conditions and restrictions on Awards as it deems appropriate; make factual determinations with respect to, and take such steps in connection with, the Plan and Awards granted under the Plan as it may deem necessary or advisable; and delegate its powers and authority under the Plan as it deems appropriate to a subcommittee of the Committee or designated officers or employees of the Company.

Amendments. The Board has the complete power and authority to amend the Plan at any time, provided that the Board shall not, without the requisite approval of the Company’s stockholders, make any amendment which requires stockholder approval under the Code or under any other applicable law or rule of any stock exchange on which the Company’s Common Stock is listed.

Term. The Plan shall remain in effect until October 31, 2024, or until terminated by action of the Board, whichever occurs earlier. The Board has the authority to terminate the Plan at any time.

Change in Control. Unless otherwise provided in the terms of the applicable Award Agreement, upon a Change in Control of the Company, as defined in the Plan, no accelerated vesting of any outstanding Options or SARs shall occur, no acceleration of the termination of any restrictions applicable to restricted stock awards and restricted stock units shall occur, and no accelerated vesting of any outstanding performance awards shall occur.

Transfer Restrictions. A Participant’s rights and interests under the Plan may not be assigned or transferred other than by will or the laws of descent and distribution, and during the lifetime of the Participant, only the Participant personally (or the Participant’s personal representative) may exercise rights under the Plan.

Federal Income Tax Matters

Options. Under present law, an optionee will not recognize any taxable income on the date an NSO is granted pursuant to the Plan. Upon exercise of the option, however, the optionee must recognize, in the year of exercise, compensation taxable as ordinary income in an amount equal to the difference between the option price and the fair market value of Company’s Common Stock on the date of exercise. Upon the sale of the shares, any resulting gain or loss will be treated as capital gain or loss. The Company will receive an income tax deduction in its fiscal year in which NSOs are exercised equal to the amount of ordinary income recognized by those optionees exercising options, and must comply with applicable tax withholding requirements.

ISOs granted under the Plan are intended to qualify for favorable tax treatment under Section 422 of the Internal Revenue Code. Under Section 422, an optionee recognizes no taxable income when the option is granted. Further, the optionee generally will not recognize any taxable income when the option is exercised if he or she has at all times from the date of the option’s grant until three months before the date of exercise been an employee of the Company. The Company ordinarily is not entitled to any income tax deduction upon the grant or exercise of an incentive stock option. This favorable tax treatment for the optionee, and the denial of a deduction for the Company, will not, however, apply if the optionee disposes of the shares acquired upon the exercise of an incentive stock option within two years from the granting of the option or one year from the receipt of the shares.

Restricted Stock Awards. Generally, no income is taxable to the recipient of a restricted stock award in the year that the award is granted. Instead, the recipient will recognize compensation taxable as ordinary income equal to the fair market value of the shares in the year in which the risks of forfeiture restrictions lapse. Alternatively, if a recipient makes an election under Section 83(b) of the Internal Revenue Code, the recipient will, in the year that the restricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date of the award. The Company normally will receive a corresponding deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Restricted Stock Units. A recipient of restricted stock units will generally recognize compensation taxable as ordinary income in an amount equal to the fair market value of the shares (or the amount of cash) distributed to settle the restricted stock units on the vesting date(s). The Company normally will receive a corresponding deduction at the time of vesting, equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Performance Awards. A recipient of performance awards will recognize compensation taxable as ordinary income equal to the value of the shares of Company Common Stock or the cash received, as the case may be, in the year that the recipient receives payment. The Company normally will receive a deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Stock Appreciation Rights. Generally, a recipient of a stock appreciation right will recognize compensation taxable as ordinary income equal to the value of the shares of Company Common Stock or the cash received in the year that the stock appreciation right is exercised. The Company normally will receive a corresponding deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF AN INDIVIDUAL’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE.

Future Awards under the Plan

Awards under the Plan are granted at the discretion of the Board or the Committee appointed to administer the Plan. Accordingly, future awards under the Plan are not determinable.

Vote Required

The affirmative vote of a majority of the shares of outstanding Common Stock entitled to vote was required to approve the Plan Amendment.

No Dissenter’s Rights

Under the NRS, our dissenting stockholders are not entitled to appraisal rights with respect to the Plan Amendment, and we will not independently provide our stockholders with any such right.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the compensation earned for services rendered to the Company for the fiscal years ended December 31, 2017 and 2016 of our named executive officers as determined in accordance with SEC rules.

| SUMMARY COMPENSATION TABLE |

||||||||||||||||||||||||||||||||||

| Name and Principal Position |

| Year Ended |

| Salary $ |

| Bonus $ |

| Stock Awards $ (1) |

| Option Awards $ (1) |

| Non-Equity Incentive Plan Compensation $ |

| Nonqualified Deferred Compensation Earnings $ |

| All Other Compensation $ |

| Total $ | ||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Dr. Brian S. Murphy, |

| 2017 |

| 448,846 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 448,846 |

|

|||||||||||||||

| CEO/CMO |

| 2016 |

| 253,846 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 253,846 | ||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Elizabeth M. Berecz, |

| 2017 |

| 294,712 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 294,712 |

|

|||||||||||||||

| CFO |

| 2016 |

| 173,077 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 173,077 | ||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Cosmas N. Lykos, |

| 2017 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 210,000 | (2) |

| 210,000 |

|

||||||||||||||

| Chairman |

| 2016 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 90,000 | (2) |

| 90,000 | |||||||||||||||

_________

| (1) | Amounts reflect the full grant date fair value of restricted stock awards and stock options, computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of restricted stock awards granted to our executives in Note 1 and 4 to our consolidated financial statements included elsewhere in this prospectus. |

| (2) | In June 2014, our subsidiary entered into an independent contractor agreement with K2C, Inc. (“K2C”), which is wholly owned by Mr. Lykos, pursuant to which we pay K2C a monthly fee for services performed by Mr. Lykos for our company. The agreement expired on June 1, 2016 and was automatically renewed for one year pursuant to the terms of the agreement. The monthly fee under the agreement was $10,000 until April 1, 2017, at which time it increased to a monthly fee of $20,000. Under the agreement, Mr. Lykos was also eligible to participate in our health, death and disability insurance plans. In addition, beginning in 2015, Mr. Lykos was a participant in our change in control severance plan. Effective February 28, 2018, the independent contractor agreement was terminated. |

Employment and Severance Arrangements

As of December 31, 2017 and 2016, we did not have employment agreements with any of our executive officers.

In February 2015, we adopted a change in control severance plan, in which our named executive officers participate, that provides for the payment of severance benefits if the executive’s service is terminated within twelve months following a change in control, either due to a termination without cause or upon a resignation for good reason (as each term is defined in the plan).

In either such event, and provided the executive timely executes and does not revoke a general release of claims against the Company, he or she will be entitled to receive: (i) a lump sum cash payment equal to at least six months’ of the executive’s monthly compensation, plus an additional month for each full year of service over six years, (ii) Company-paid premiums for continued health insurance for a period equal to length of the cash severance period or, if earlier, when executive becomes covered under a subsequent employer’s healthcare plan, and (iii) full vesting of all then-outstanding unvested stock options and restricted stock awards.

In addition, the restricted stock awards granted to Dr. Murphy and Ms. Berecz in October 2015 will vest in full on a change in control (as defined in our 2014 Omnibus Incentive Plan).

Outstanding Equity Awards at Fiscal Year-end

As of December 31, 2017, our named executive officers held the following outstanding Company equity awards.

|

|

| Option Awards |

| Stock Awards |

|

|||||||||||||||||||

| Name |

| Grant Date (1) |

| Number of Securities Underlying Unexercised Options (#) Exercisable |

|

| Number of Securities Underlying Unexercised Options (#) Un-exercisable |

|

| Option Exercise Price |

|

| Option Expiration Date |

| Number of Shares of Stock Not Vested (#) (2) |

|

| Market Value of Shares Not Vested ($) (3) |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Dr. Brian S. Murphy, |

| 10/31/2014 |

|

| 288,000 |

|

|

| 192,000 |

|

| $ | 0.42 |

|

| 10/31/2024 |

|

|

|

|

|

|

||

| CEO/MO |

| 11/21/2014 |

|

| 105,000 |

|

|

| 70,000 |

|

| $ | 0.42 |

|

| 11/21/2024 |

|

|

|

|

|

|

||

|

|

| 10/20/2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 375,000 |

|

|

| 113,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Elizabeth M. Berecz |

| 10/31/2014 |

|

| 60,000 |

|

|

| 40,000 |

|

| $ | 0.42 |

|

| 10/31/2024 |

|

|

|

|

|

|

|

|

| CFO |

| 11/21/2014 |

|

| 90,000 |

|

|

| 60,000 |

|

| $ | 0.42 |

|

| 11/21/2024 |

|

|

|

|

|

|

|

|

|

|

| 10/20/2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 350,000 |

|

|

| 105,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cosmas N. Lykos, |

| 11/21/2014 |

|

| 75,000 |

|

|

| 50,000 |

|

| $ | 0.42 |

|

| 11/21/2024 |

|

|

|

|

|

|

|

|

| Chairman |

| 10/20/2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 325,000 |

|

|

| 98,150 |

|

_____________

| (1) | All of the options specified above vest as follows: 20% of total vests on each anniversary of the grant date over five years, subject to the grantee’s continued service. The options granted expire 10 years after the date of grant. |

|

|

|

| (2) | Each award of restricted stock vests in full on the three-year anniversary of the grant date, subject to the grantee’s continued service. |

|

|

|

| (3) | The market value of shares that have not vested is calculated based on the per share closing price of our common stock on December 31, 2017. |

There were no exercises of stock options by our named executive officers during the year ended December 31, 2017.

Director Compensation

Our directors received the following compensation for their service as directors of the Company during the fiscal year ended December 31, 2017. Our directors generally received an annual cash retainer equal to $20,000. In addition, we grant stock options and restricted stock awards.

| DIRECTOR COMPENSATION (1) |

||||||||||||||||||||||||||||

| Name |

| Fees Earned or Paid in Cash |

|

| Stock Awards $ (2) (3) |

|

| Option Awards $ (3) |

|

| Non-Equity Incentive Plan Compensation $ |

|

| Non-Qualified Deferred Compensation Earnings $ |

|

| All Other Compensation $ |

|

| Total $ |

|

|||||||

| Douglas S. Ingram |

|

| 20,000 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 20,000 |

|

| Gerald W. McLaughlin |

|

| 20,000 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 20,000 |

|

| Thomas A. George |

|

| 20,000 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 20,000 |

|

_________

| (1) | Does not include compensation received for services provided as executive officers. |

|

|

|

| (2) | Amounts reflect the full grant date fair value of restricted stock awards, computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of restricted stock awards granted to our directors in Note 1 and 4 to our consolidated financial statements for the year ended December 31, 2016 included elsewhere in this prospectus. |

|

|

|

| (3) | As of December 31, 2017, Messrs. Ingram, McLaughlin and George held 60,000, 30,000 and 60,000, respectively, shares of restricted stock. In addition, Messrs. Ingram, McLaughlin and George held stock options covering 40,000, 20,000 and 40,000 shares of common stock, respectively. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of October 9, 2018, with respect to the beneficial ownership of our Common Stock for (i) each director and officer, (ii) all of our directors and officers as a group, and (iii) each person known to us to own beneficially five percent (5%) or more of the outstanding shares of our Common Stock. As of October 9, 2018, there were 133,445,080 shares of Common Stock outstanding.

To our knowledge, except as indicated in the footnotes to this table or pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to the shares of Common Stock indicated.

|

|

|

|

|

|

|

|||

| Name and Address of Beneficial Owner (1) |

| Amount and Nature of Beneficial Ownership |

|

| Percentage of Class Beneficially Owned |

|

||

| Directors and Executive Officers |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

| Brian S. Murphy 130 North Marina Drive Long Beach, CA 90803 |

|

| 1,668,000 | (2) |

|

| 1.25 | % |

|

|

|

|

|

|

|

|

|

|

| Punit Dhillon 130 North Marina Drive Long Beach, CA 90803 |

|

| 0 |

|

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

| James L. Heppell 130 North Marina Drive Long Beach, CA 90803 |

|

| 0 |

|

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

| Douglas Cesario 130 North Marina Drive Long Beach, CA 90803 |

|

| 996,591 | (3) |

|

| 0.74 | % |

|

|

|

|

|

|

|

|

|

|

| Avtar Dhillon 130 North Marina Drive Long Beach, CA 90803 |

|

| 0 |

|

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

| All Officers and Directors as a Group |

|

| 2,664,591 |

|

|

| 1.99 | % |

|

|

|

|

|

|

|

|

|

|

| 5% Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Emerald Health Sciences Inc. Office 8262, The Landing 200 – 375 Water Street Vancouver, BC, Canada V6B 0M9 |

|

| 113,916,250 | (4) |

|

| 65.38 | % |

___________

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Pursuant to the rules of the SEC, shares of common stock which an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be beneficially owned and outstanding for the purpose of computing the percentage ownership of any other person shown in the table. |

|

|

|

| (2) | Includes (i) 393,000 shares of Common Stock underlying options granted to Brian S. Murphy which may be exercised within 60 days of October 9, 2018, (ii) 375,000 shares of restricted Common Stock subject to three-year cliff vesting from October 20, 2015, and (iii) 900,000 shares of restricted Common Stock subject to 50% vesting on each of January 18, 2019 and January 18, 2020. |

|

|

|

| (3) | Includes (i) 643,501 shares of restricted Common Stock subject to 100% vesting on April 23, 2020, and (ii) 353,090 shares of Common Stock underlying options granted to Douglas Cesario which may be exercised within 60 days of October 9, 2018. |

|

|

|

| (4) | Includes 40,800,000 shares of Common Stock issuable upon exercise of warrants. |

REASONS WE USED STOCKHOLDER CONSENT AS OPPOSED TO SOLICITATION OF

STOCKHOLDER APPROVAL VIA PROXY STATEMENT AND SPECIAL MEETING

The Authorized Common Stock Amendment and the Plan Amendment require stockholder approval. Stockholder approval could have been obtained by us in one of two ways: (i) by the dissemination of a proxy statement and subsequent majority vote in favor of the actions at a stockholder meeting called for such purpose, or (ii) by a written consent of the holders of a majority of our voting securities. However, the latter method, while it represents the requisite stockholder approval, with regard to the Authorized Common Stock Amendment, is not deemed effective until twenty (20) days after this Information Statement has been sent to all of our stockholders giving them notice and informing them of the actions approved by such consent.

Given that we have already secured the affirmative consent of the holder of a majority of our voting securities to the Authorized Common Stock Amendment and the Plan Amendment, we determined that it would be a more efficient use of limited corporate resources to forego the dissemination of a proxy statement and subsequent majority vote in favor of the actions at a stockholders meeting called for such a purpose, and rather proceed through the written consent of the holder of a majority of our voting securities. Spending the additional company time, money and other resources required by the proxy and meeting approach would have been potentially wasteful and, consequently, detrimental to completing these actions in a manner that is timely and efficient for our Company and our stockholders.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS ACTED UPON

Except as described herein, no director, officer, nominee for election as a director, associate of any director, officer of nominee or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, resulting from the matters described herein which is not shared by all other stockholders pro rata in accordance with their respective interest. No director has informed the Company that he intends to oppose any of the corporate actions to be taken by the Company as set forth in this Information Statement.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one copy of this Information Statement is being delivered to multiple stockholders sharing an address, unless the Company has received contrary instructions from one or more of the stockholders. The Company will deliver promptly, upon written or oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information Statement was delivered. A stockholder may call our principal executive offices at (949) 396-0330 or mail a written request to Nemus Bioscience, Inc., Attention: Secretary, 130 North Marina Drive, Long Beach, CA 80803, to request:

|

| · | a separate copy of this Information Statement; |

|

|

|

|

|

| · | a separate copy of Information Statements in the future; or |

|

|

|

|

|

| · | delivery of a single copy of Information Statements, if such stockholder is receiving multiple copies of those documents. |

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

We are subject to the informational reporting requirements of the Exchange Act and file annual, quarterly, current and other reports, proxy statements and other information required under the Exchange Act with the SEC. Such reports, proxy statements and other information may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549. Copies of such materials and information from the SEC can be obtained at existing published rates from the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549. The SEC also maintains a site on the Internet at http://www.sec.gov containing reports, proxy and information statements and other information regarding registrants that file electronically with the SEC, which may be downloaded free of charge.

ANNEX A

CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION

ANNEX B

NEMUS BIOSCIENCE, INC. 2014 OMNIBUS INCENTIVE PLAN

AND AMENDMENT NO. 1 TO 2014 OMNIBUS INCENTIVE PLAN

NEMUS BIOSCIENCE, INC.

2014 OMNIBUS INCENTIVE PLAN

NEMUS BIOSCIENCE, INC.

2014 OMNIBUS INCENTIVE PLAN

ARTICLE I

PURPOSE AND ADOPTION OF THE PLAN

1.01. Purpose. The purpose of the Nemus Bioscience, Inc. 2014 Omnibus Incentive Plan (as amended from time to time, the “Plan”) is to assist in attracting and retaining highly competent employees, directors and consultants to act as an incentive in motivating selected employees, directors and consultants of the Company and its Subsidiaries to achieve long-term corporate objectives and to enable stock-based and cash-based incentive awards to qualify as performance-based compensation for purposes of the tax deduction limitations under Section 162(m) of the Code.

1.02. Adoption and Term. The Plan has been approved and adopted by the Board to be effective as of October 31, 2014 (the “Effective Date”). The Plan shall be subject to the approval of the stockholders of the Company within one (1) year from the date it was adopted. The Plan shall remain in effect until the tenth (10th) anniversary of the Effective Date, or until terminated by action of the Board, whichever occurs sooner.

ARTICLE II

DEFINITIONS

For the purpose of this Plan, capitalized terms shall have the following meanings:

2.01 Affiliate means an entity in which, directly or indirectly through one or more intermediaries, the Company has at least a fifty percent (50%) ownership interest or, where permissible under Section 409A of the Code, at least a twenty percent (20%) ownership interest; provided, however, for purposes of any grant of an Incentive Stock Option, “Affiliate” means a corporation which, for purposes of Section 424 of the Code, is a parent or subsidiary of the Company, directly or indirectly.

2.02. Award means any one or a combination of Non-Qualified Stock Options or Incentive Stock Options described in Article VI, Stock Appreciation Rights described in Article VI, Restricted Shares and Restricted Stock Units described in Article VII, Performance Awards described in Article VIII, other stock-based Awards described in Article IX, short-term cash incentive Awards described in Article X or any other Award made under the terms of the Plan.

2.03. Award Agreement means a written agreement between the Company and a Participant or a written acknowledgment from the Company to a Participant specifically setting forth the terms and conditions of an Award granted under the Plan.

2.04. Award Period means, with respect to an Award, the period of time, if any, set forth in the Award Agreement during which specified target performance goals must be achieved or other conditions set forth in the Award Agreement must be satisfied.

2.05. Beneficiary means an individual, trust or estate who or which, by a written designation of the Participant filed with the Company, or if no such written designation is filed, by operation of law, succeeds to the rights and obligations of the Participant under the Plan and the Award Agreement upon the Participant’s death.

2.06. Board means the Board of Directors of the Company.

2.07. Change in Control means, and shall be deemed to have occurred upon the occurrence of, any one of the following events:

(a) The acquisition in one or more transactions, other than from the Company, by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act), other than the Company, an Affiliate or any employee benefit plan (or related trust) sponsored or maintained by the Company or an Affiliate, of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of a number of Company Voting Securities in excess of 50% of the Company Voting Securities unless such acquisition has been approved by the Board;

(b) Any election has occurred of persons to the Board that causes two-thirds of the Board to consist of persons other than (i) persons who were members of the Board on the Effective Date of the Plan and (ii) persons who were nominated for elections as members of the Board at a time when two-thirds of the Board consisted of persons who were members of the Board on the effective date of the Plan, provided, however, that any person nominated for election by a Board at least two-thirds of whom constituted persons described in clauses (i) and/or (ii) or by persons who were themselves nominated by such Board shall, for this purpose, be deemed to have been nominated by a Board composed of persons described in clause (i);

(c) The consummation (i.e. closing) of a reorganization, merger or consolidation involving the Company, nless, following such reorganization, merger or consolidation, all or substantially all of the individuals and entities who were the respective beneficial owners of the Outstanding Common Stock and Company Voting Securities immediately prior to such reorganization, merger or consolidation, following such reorganization, merger or consolidation beneficially own, directly or indirectly, more than 75% of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors or trustees, as the case may be, of the entity resulting from such reorganization, merger or consolidation in substantially the same proportion as their ownership of the Outstanding Common Stock and Company Voting Securities immediately prior to such reorganization, merger or consolidation, as the case may be;

(d) The consummation (i.e. closing) of a sale or other disposition of all or substantially all the assets of the Company, unless, following such sale or disposition, all or substantially all of the individuals and entities who were the respective beneficial owners of the Outstanding Common Stock and Company Voting Securities immediately prior to such sale or disposition, following such sale or disposition beneficially own, directly or indirectly, more than 75% of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors or trustees, as the case may be, of the entity purchasing such assets in substantially the same proportion as their ownership of the Outstanding Common Stock and Company Voting Securities immediately prior to such sale or disposition, as the case may be; or

(e) a complete liquidation or dissolution of the Company.

2.08. Code means the Internal Revenue Code of 1986, as amended. References to a section of the Code shall include that section and any comparable section or sections of any future legislation that amends, supplements or supersedes said section.

2.9. Committee has the meaning specified in Section 3.

2.10. Common Stock means the common stock of the Company, par value $0.001 per share.

2.11. Company means Nemus, a California corporation, and its successors.

2.12. Company Voting Securities means the combined voting power of all outstanding voting securities of the Company entitled to vote generally in the election of directors to the Board.

2.13. Date of Grant means the date designated by the Committee as the date as of which it grants an Award, which shall not be earlier than the date on which the Committee approves the granting of such Award.

2.14. Dividend Equivalent Account means a bookkeeping account in accordance with under Section 11.17 and related to an Award that is credited with the amount of any cash dividends or stock distributions that would be payable with respect to the shares of Common Stock subject to such Awards had such shares been outstanding shares of Common Stock.

2.15. Exchange Act means the Securities Exchange Act of 1934, as amended.

2.16. Exercise Price means, with respect to a Stock Appreciation Right, the amount established by the Committee in the Award Agreement which is to be subtracted from the Fair Market Value on the date of exercise in order to determine the amount of the payment to be made to the Participant, as further described in Section 6.02(b).

2.17. Fair Market Value means, as of any applicable date: (i) if the Common Stock is listed on a national securities exchange or is authorized for quotation on the Nasdaq National Market System (“NMS”), the closing sales price of the Common Stock on the exchange or NMS, as the case may be, on that date, or, if no sale of the Common Stock occurred on that date, on the next preceding date on which there was a reported sale; or (ii) if none of the above apply, the closing bid price as reported by the Nasdaq Capital Market on that date, or if no price was reported for that date, on the next preceding date for which a price was reported; or (iii) if none of the above apply, the last reported bid price published in the “pink sheets” or displayed on the Financial Industry Regulatory Authority (“FINRA”), Electronic Bulletin Board, or OTC Markets, Inc. as the case may be; or (iv) if none of the above apply, the fair market value of the Common Stock as determined under procedures established by the Committee.

2.18. Incentive Stock Option means a stock option within the meaning of Section 422 of the Code.

2.19. Merger means any merger, reorganization, consolidation, exchange, transfer of assets or other transaction having similar effect involving the Company.

2.20. Non-Qualified Stock Option means a stock option which is not an Incentive Stock Option.

2.21. Non-Vested Share means shares of the Company Common Stock issued to a Participant in respect of the non-vested portion of an Option in the event of the early exercise of such Participant’s Options pursuant to such Participant’s Award Agreement, as permitted in Section 6.06 below.

2.22. Options means all Non-Qualified Stock Options and Incentive Stock Options granted at any time under the Plan.

2.23. Outstanding Common Stock means, at any time, the issued and outstanding shares of Common Stock.

2.24. Participant means a person designated to receive an Award under the Plan in accordance with Section 5.01.

2.25. Performance Awards means Awards granted in accordance with Article VIII.

2.26. Performance Goals means revenues, units sold or growth in units sold, return on stockholders’ equity, customer satisfaction or retention, return on investment or working capital, operating income, economic value added (the amount, if any, by which net operating income after tax exceeds a reference cost of capital), EBITDA (as net income (loss) before net interest expense, provision (benefit) for income taxes, and depreciation and amortization), expense targets, net income, earnings per share, share price, reductions in inventory, inventory turns, on-time delivery performance, operating efficiency, productivity ratios, market share or change in market share, any one of which may be measured with respect to the Company or any one or more of its Subsidiaries and divisions and either in absolute terms or as compared to another company or companies, and quantifiable, objective measures of individual performance relevant to the particular individual’s job responsibilities.

2.27. Plan has the meaning given to such term in Section 1.01.

2.28. Purchase Price, with respect to Options, shall have the meaning set forth in Section 6.01(b).

2.39. Restricted Shares means Common Stock subject to restrictions imposed in connection with Awards granted under Article VII.

2.30. Restricted Stock Unit means a unit representing the right to receive Common Stock or the value thereof in the future subject to restrictions imposed in connection with Awards granted under Article VII.

2.31. Rule 16b-3 means Rule 16b-3 promulgated by the Securities and Exchange Commission under Section 16 of the Exchange Act, as the same may be amended from time to time, and any successor rule.

2.32. Stock Appreciation Rights means awards granted in accordance with Article VI.

2.33. Termination of Service means the voluntary or involuntary termination of a Participant’s service as an employee, director or consultant with the Company or an Affiliate for any reason, including death, disability, retirement or as the result of the divestiture of the Participant’s employer or any similar transaction in which the Participant’s employer ceases to be the Company or one of its Subsidiaries. Whether entering military or other government service shall constitute Termination of Service, or whether and when a Termination of Service shall occur as a result of disability, shall be determined in each case by the Committee in its sole discretion.

ARTICLE III

ADMINISTRATION

3.01. Administrator.

(a) Duties and Authority. The Plan shall be administered by the Board, or at the discretion of the Board, by a committee of the Board consisting of not less than two (2) directors (the “Committee”); provided, however, that if any member of the Committee is not a “Non-Employee Director” within the meaning of Rule 16b-3, then any Awards granted to individuals subject to the reporting requirements of Section 16 of the Exchange Act shall be approved by the Board. The Committee shall have exclusive and final authority in each determination, interpretation or other action affecting the Plan and its Participants.

The Committee shall have the sole discretionary authority to interpret the Plan, to establish and modify administrative rules for the Plan, to impose such conditions and restrictions on Awards as it determines appropriate, and to make all factual determinations with respect to and take such steps in connection with the Plan and Awards granted hereunder as it may deem necessary or advisable. The Committee shall not, however, have or exercise any discretion that would disqualify amounts payable under Article X as performance-based compensation for purposes of Section 162(m) of the Code. The Committee may delegate such of its powers and authority under the Plan as it deems appropriate to a subcommittee of the Committee or designated officers or employees of the Company. In the event of such delegation of authority or exercise of authority by the Board, references in the Plan to the Committee shall be deemed to refer, as appropriate, to the delegate of the Committee or the Board. Actions taken by the Committee or any subcommittee thereof, and any delegation by the Committee to designated officers or employees, under this Section 3.01 shall comply with Section 16(b) of the Exchange Act, the performance-based provisions of Section 162(m) of the Code, and the regulations promulgated under each of such statutory provisions, or the respective successors to such statutory provisions or regulations, as in effect from time to time, to the extent applicable.

(b) Indemnification. Each person who is or shall have been a member of the Board or the Committee, or an officer or employee of the Company to whom authority was delegated in accordance with the Plan shall be indemnified and held harmless by the Company against and from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by such individual in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of any action taken or failure to act under the Plan and against and from any and all amounts paid by him or her in settlement thereof, with the Company’s approval, or paid by him or her in satisfaction of any judgment in any such action, suit, or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf; provided, however, that the foregoing indemnification shall not apply to any loss, cost, liability, or expense that is a result of his or her own willful misconduct. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company’s Articles of Incorporation or Bylaws, conferred in a separate agreement with the Company, as a matter of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

ARTICLE IV

SHARES

4.01. Number of Shares Issuable. The total number of shares initially authorized to be issued under the Plan shall be _________________ (___,000,000) shares of Common Stock. The foregoing share limit shall be subject to adjustment in accordance with Section 11.07. The shares to be offered under the Plan shall be authorized and unissued Common Stock, or issued Common Stock that shall have been reacquired by the Company. To the extent applicable, the total number of shares of authorized to be issued under the Plan shall be subject to Section 260.140.45 of Title 10 of the California Code of Regulations.

4.02. Shares Subject to Terminated Awards. Common Stock covered by any unexercised portions of terminated or forfeited Options (including canceled Options) granted under Article VI, Restricted Stock or Restricted Stock Units forfeited as provided in Article VII, other stock-based Awards terminated or forfeited as provided under the Plan, and Common Stock subject to any Awards that are otherwise surrendered by the Participant may again be subject to new Awards under the Plan. Shares of Common Stock surrendered to or withheld by the Company in payment or satisfaction of the Purchase Price of an Option or tax withholding obligation with respect to an Award shall be available for the grant of new Awards under the Plan. In the event of the exercise of Stock Appreciation Rights, whether or not granted in tandem with Options, only the number of shares of Common Stock actually issued in payment of such Stock Appreciation Rights shall be charged against the number of shares of Common Stock available for the grant of Awards hereunder.

ARTICLE V

PARTICIPATION

5.01. Eligible Participants. Participants in the Plan shall be such employees, directors and consultants of the Company and its Subsidiaries as the Committee, in its sole discretion, may designate from time to time. The Committee’s designation of a Participant in any year shall not require the Committee to designate such person to receive Awards or grants in any other year. The designation of a Participant to receive Awards or grants under one portion of the Plan does not require the Committee to include such Participant under other portions of the Plan. The Committee shall consider such factors as it deems pertinent in selecting Participants and in determining the type and amount of their respective Awards. Subject to adjustment in accordance with Section 11.07, in any calendar year, no Participant shall be granted Awards in respect of more than 1.0 million shares of Common Stock (whether through grants of Options or Stock Appreciation Rights or other Awards of Common Stock or rights with respect thereto) or cash-based Awards for more than $1 million.

ARTICLE VI

STOCK OPTIONS AND STOCK APPRECIATION RIGHTS

6.01. Option Awards.

(a) Grant of Options. The Committee may grant, to such Participants as the Committee may select, Options entitling the Participant to purchase shares of Common Stock from the Company in such number, at such price, and on such terms and subject to such conditions, not inconsistent with the terms of this Plan, as may be established by the Committee. The terms of any Option granted under this Plan shall be set forth in an Award Agreement.

(b) Purchase Price of Options. The Purchase Price of each share of Common Stock which may be purchased upon exercise of any Option granted under the Plan shall be determined by the Committee; provided, however, that in no event shall the Purchase Price be less than the Fair Market Value on the Date of Grant.

(c) Designation of Options. The Committee shall designate, at the time of the grant of each Option, the Option as an Incentive Stock Option or a Non-Qualified Stock Option; provided, however, that an Option may be designated as an Incentive Stock Option only if the applicable Participant is an employee of the Company on the Date of Grant.

(d) Option Term. The term of each Option shall be fixed by the Committee, but, subject to the special restrictions applicable to Incentive Stock Options specified in Section 6.01(e), no Option shall be exercisable more than ten (10) years after the Date of Grant.

(e) Special Incentive Stock Option Rules. No Participant may be granted Incentive Stock Options under the Plan (or any other plans of the Company) that would result in Incentive Stock Options to purchase shares of Common Stock with an aggregate Fair Market Value (measured on the Date of Grant) of more than $100,000 first becoming exercisable by the Participant in any one calendar year. Notwithstanding any other provision of the Plan to the contrary, the Exercise Price of each Incentive Stock Option shall be equal to or greater than the Fair Market Value of the Common Stock subject to the Incentive Stock Option as of the Date of Grant of the Incentive Stock Option; provided, however, that no Incentive Stock Option shall be granted to any person who, at the time the Option is granted, owns stock (including stock owned by application of the constructive ownership rules in Section 424(d) of the Code) possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company, unless at the time the Incentive Stock Option is granted the price of the Option is at least one hundred ten percent (110%) of the Fair Market Value of the Common Stock subject to the Incentive Stock Option and the Incentive Stock Option by its terms is not exercisable for more than five years from the Date of Grant.

(f) Rights As a Stockholder. A Participant or a transferee of an Option pursuant to Section 11.04 shall have no rights as a stockholder with respect to Common Stock covered by an Option until the Participant or transferee shall have become the holder of record of any such shares, and no adjustment shall be made for dividends in cash or other property or distributions or other rights with respect to any such Common Stock for which the record date is prior to the date on which the Participant or a transferee of the Option shall have become the holder of record of any such shares covered by the Option; provided, however, that Participants are entitled to share adjustments to reflect capital changes under Section 11.07.

(g) Exercise Due to Death or Disability. If an optionee’s employment with the Company terminates by reason of death or disability, the Option may thereafter be immediately exercised, to the extent then exercisable (or on such accelerated basis as the Committee shall determine at or after the grant), by the legal representative of the optionee, by the legal representative of the estate of the optionee, or by the legatee of the optionee under the will of the optionee, within such period of time as is specified in the Award Agreement (of at least six (6) months) from the date of such death or disability.

(h) Period of Exercise After Termination of Employment. Except as otherwise provided in this paragraph or otherwise determined by the Committee, if an optionee’s employment with the Company terminates for any reason other than death or disability (except for termination for cause as defined by applicable law), the optionee must exercise his or her Options, to the extent then exercisable (or on such accelerated basis as the Committee shall determine at or after grant), within such period of time as is specified in the Award Agreement (of at least thirty (30) days) from the date of such termination. If the optionee does not exercise his or her Options within such specified period, the Options automatically terminate, and such Options become null and void.