EX-3.1

Published on April 7, 2015

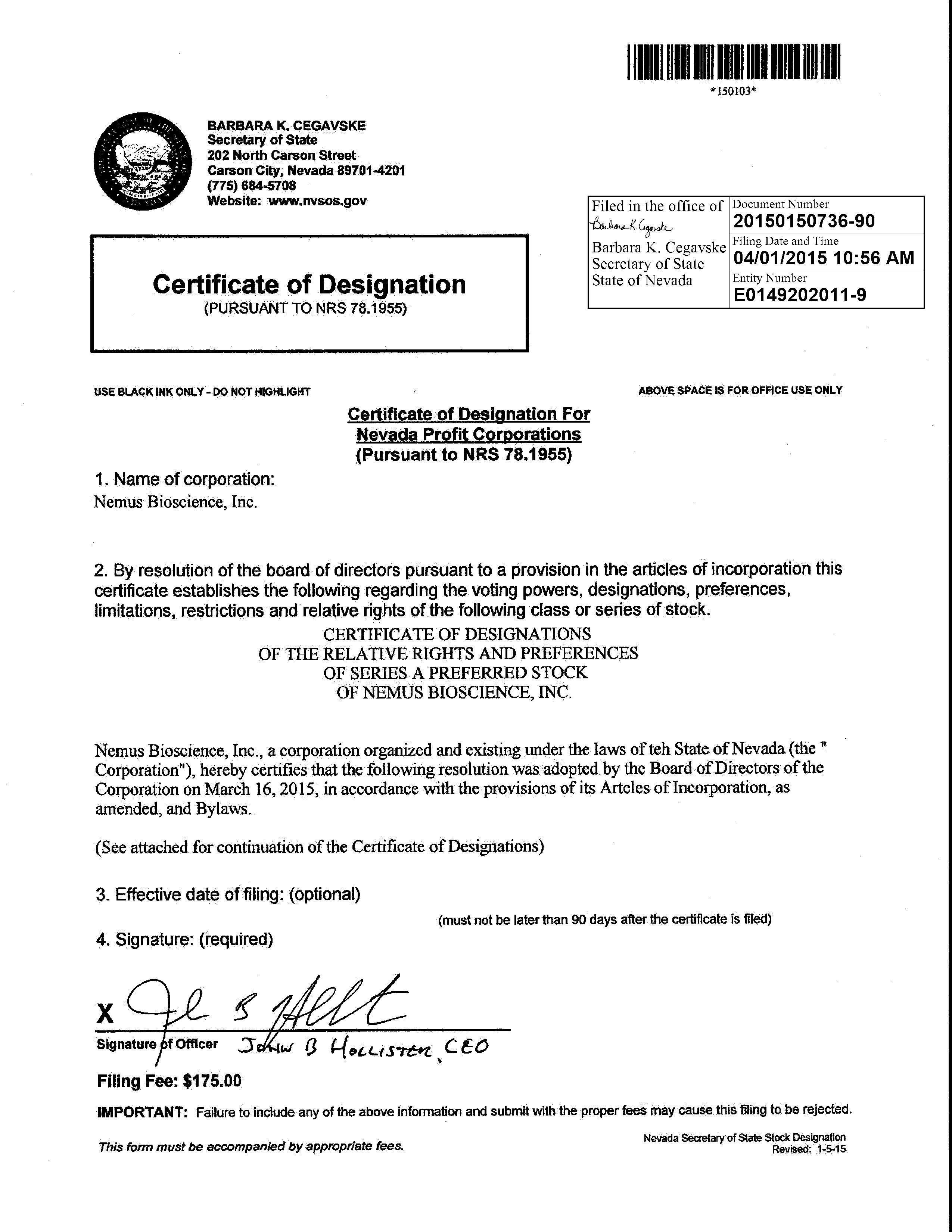

RESOLVED, that pursuant to the authority expressly granted to and vested in the Board of Directors of the Corporation by the provision of the Articles of Incorporation, a series of Preferred Stock consisting of One Million (1,000,000) shares is hereby created out of the Twenty Million (20,000,000) shares of the Corporation's preferred stock authorized in Section 1. of the Additional Articles of the Articles of Incorporation ("Preferred Stock"). As specified in the Certificate of Designation of the Relative Rights and Preferences of the Series A Preferred Stock ("Certificate of Designation"), the first Series of Preferred Stock shall be designated "Series A Preferred Stock" and shall have the following designations, powers, preferences and relative and other special rights and the following qualifications, limitations and restrictions:

The terms and provisions of the Preferred Stock are as follows:

1. Definitions. For purposes of this Certificate of Designation, the following definitions shall apply:

(a) "Common Stock" shall mean the $.001 par value common stock of the Corporation.

(b) "Conversion Price" shall mean the price per share equal to the lower of (i) the purchase price of (a) the acquisition of the Corporation by another entity ("Acquisition") or (b) the Corporation's next round of equity financing of at least $1,000,000 ("Next Equity Financing"); provided however that the Acquisition or Next Equity Financing is closed within six months after the Closing Date of the Securities Purchase Agreement or (ii) $2.50 in the event that (a) the price per share of the Acquisition or Next Equity Financing is more than $2.50 or (b) the Acquisition or Next Equity Financing is not closed within six months after the Closing Date of the Securities Purchase Agreement (subject to adjustment from time to time for Recapitalizations and as otherwise set forth elsewhere herein).

(c) "Convertible Securities" shall mean any evidences of indebtedness, shares or other securities convertible into or exchangeable for Common Stock.

(d) "Corporation" shall mean Nemus Bioscience, Inc.

(e) "Distribution" shall mean the transfer by the Corporation of cash or other property without consideration whether by way of dividend or otherwise, other than dividends on Common Stock payable in Common Stock, or the purchase or redemption of shares of the Corporation by the Corporation or its subsidiaries for cash or property other than: (i) repurchases at the lower of cost or fair market value of Common Stock issued to or held by employees, officers, directors or consultants of the Corporation or its subsidiaries upon termination of their employment or services pursuant to agreements approved by the Corporation's Board of Directors providing for the right of said repurchase and (ii) repurchases at the lower of cost or fair market value of Common Stock issued to or held by employees, officers, directors or consultants of the Corporation or its subsidiaries pursuant to rights of first refusal contained in agreements approved by the Corporation's Board of Directors providing for such right.

(f) "Liquidation Preference" shall mean $2.50 per share for the Series A Preferred Stock (subject to adjustment from time to time for Recapitalizations as set forth elsewhere herein).

(g) "Options" shall mean rights, options or warrants to subscribe for, purchase or otherwise acquire Common Stock or Convertible Securities.

1

(h) "Original Issue Price" shall mean $2.50 per share for the Series A Preferred Stock (subject to adjustment from time to time for Recapitalizations as set forth elsewhere herein).

(i) "Preferred Stock" shall mean the Series A Preferred Stock.

(j) "Recapitalization" shall mean any stock dividend, stock split, combination of shares, reorganization, recapitalization, reclassification, subdivision or other similar event.

(k) "Securities Purchase Agreement" shall mean the Securities Purchase Agreement dated March __, 2015, between the Corporation and the holders of the Preferred Stock.

For the purposes hereof, in addition to the terms defined elsewhere in this Certificate of Designation, capitalized terms not otherwise defined herein shall have the meanings set forth in the Securities Purchase Agreement.

2. Dividends. The holders of outstanding shares of Preferred Stock shall not be entitled to receive dividends and there shall be no dividends due or payable on the Preferred Stock.

3. Liquidation Rights.

(a) Liquidation Preference. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary (a "Liquidation Event"), the holders of the Preferred Stock shall be entitled to receive, prior and in preference to any Distribution of any of the assets of the Corporation to the holders of the Common Stock by reason of their ownership of such stock, an amount per share for each share of Preferred Stock held by them equal to the Liquidation Preference specified for such share of Preferred Stock. If upon the liquidation, dissolution or winding up of the Corporation, the assets of the Corporation legally available for distribution to the holders of the Preferred Stock are insufficient to permit the payment to such holders of the full amounts specified in this Section 3(a), then the entire assets of the Corporation legally available for distribution shall be distributed with equal priority and pro rata among the holders of the Preferred Stock in proportion to the full amounts they would otherwise be entitled to receive pursuant to this Section 3(a).

(b) Remaining Assets. After the payment or setting aside for payment to the holders of Preferred Stock of the full preferential amounts specified in Section 3(a) above, the entire remaining assets of the Corporation legally available for distribution by the Corporation shall be distributed pro rata to holders of the Common Stock of the Corporation in proportion to the number of shares of Common Stock of the Corporation held by them.. .

(c) Valuation of Non-Cash Consideration. If any assets of the Corporation distributed to stockholders in connection with any Liquidation Event are other than cash, then the value of such assets shall be their fair market value as determined in good faith by the Board of Directors, except that any publicly-traded securities to be distributed to stockholders in a Liquidation Event shall be valued as follows:

(i) If the securities are then traded on a national securities exchange, then the value of the securities shall be deemed to be the average of the Closing Prices of the securities on such exchange over the ten (10) Trading Day period ending five (5) Trading Days prior to the Distribution; or

(ii) if the securities are actively traded over-the-counter, then the value of the securities shall be deemed to be the average of the Closing Bid Prices (as defined below) of the securities over the ten (10) Trading Day period ending five (5) Trading Days prior to the Distribution.

2

For the purposes of subsection 2(a) and this subsection 3(d), "Trading Day" shall mean any day which the exchange or system on which the securities to be distributed are traded is open and "Closing Prices" or "Closing Bid Prices" shall be deemed to be: (i) for securities traded primarily on the New York Stock Exchange, the American Stock Exchange, a Nasdaq market, or the OTCQB (or equivalent trading market), the last reported trade price or sale price, as the case may be, at 4:00 p.m., New York time, on that day and (ii) for securities listed or traded on other exchanges, markets and systems, the market price as of the end of the regular hours trading period that is generally accepted as such for such exchange, market or system. If, after the date hereof, the benchmark times generally accepted in the securities industry for determining the market price of a stock as of a given Trading Day shall change from those set forth above, the fair market value shall be determined as of such other generally accepted benchmark times.

(d) Notional Conversion. Notwithstanding the above, for purposes of determining the amount each holder of shares of Preferred Stock is entitled to receive with respect to a Liquidation Event, each such holder of shares of Preferred Stock shall be deemed to have converted (regardless of whether such holder actually converted) such holder's shares of Preferred Stock into shares of Common Stock immediately prior to the Liquidation Event if, as a result of an actual conversion, such holder would receive, in the aggregate, an amount greater than the amount that would be distributed to such holder if such holder did not convert such shares of Preferred Stock into shares of Common Stock. If any such holder shall be deemed to have converted shares of Preferred Stock into Common Stock pursuant to this paragraph, then such holder shall not be entitled to receive any distribution that would otherwise be made to holders of Preferred Stock that have not converted (or have not been deemed to have converted) into shares of Common Stock.

(e) Notice. This Corporation shall give each holder of record of Preferred Stock written notice of any impending Liquidation Event not later than twenty (20) days prior to the date of the stockholders' meeting called or written consent to approve such transaction, or twenty (20) days prior to the closing of such transaction, whichever is earlier, and shall also notify such holders in writing of the final approval of such transaction. The first of such notices shall describe the material terms and conditions of the impending transaction and the provisions of this Section 3, and this Corporation shall thereafter give such holders prompt notice of any material changes. The transaction shall in no event take place sooner than twenty (20) days after this Corporation has given the first notice provided for herein or sooner than ten (10) days after this Corporation has given notice of any material changes provided for herein; provided, however, that subject to compliance with the Nevada Revised Statutes such periods may be shortened or waived upon the written consent of the holders of Preferred Stock that represent at least a majority of the voting power of all then outstanding shares of such Preferred Stock, voting together as a single class.

(f) Effect of Noncompliance. In the event the requirements of this Section 3 are not complied with, the Corporation shall forthwith cause the closing of the Liquidation Event to be postponed until the requirements of this Section 3 have been complied with, in which event the rights, preferences, privileges and restrictions of the holders of Preferred Stock shall revert to and be the same as such rights, preferences, privileges and restrictions existing immediately prior to the date of the first notice referred to in Section 3(f).

3

4. Conversion. The holders of the Preferred Stock shall have conversion rights as follows:

(a) Conversion Rate. Each share of Preferred Stock shall be convertible into that number of fully-paid, nonassessable shares of Common Stock determined by dividing the Original Issue Price by the Conversion Price. (The number of shares of Common Stock into which each share of Preferred Stock may be converted is hereinafter referred to as the "Conversion Rate".) Upon any decrease or increase in the Conversion Price for the Preferred Stock, as described in this Section 4, the Conversion Rate for such series shall be appropriately increased or decreased.

(b) Automatic Conversion. Each share of Preferred Stock shall automatically be converted into fully-paid, non-assessable shares of Common Stock at the then effective Conversion Rate for such share (i) immediately prior to an Acquisition or the Next Equity Financing; provided however that the Acquisition or Next Equity Financing is closed within six months after the Closing Date of the Securities Purchase Agreement, or (ii) on the six month anniversary after the Closing Date of the Securities Purchase Agreement (each of the events referred to in (i) and (ii) are referred to herein as an "Automatic Conversion Event").

(c) Mechanics of Conversion. No fractional shares of Common Stock shall be issued upon conversion of Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied by the then fair market value of a share of Common Stock as determined in good faith by the Board of Directors. For such purpose, all shares of Preferred Stock held by each holder of Preferred Stock shall be aggregated, and any resulting fractional share of Common Stock shall be paid in cash. Before any holder of Preferred Stock shall be entitled to convert the same into full shares of Common Stock, and to receive certificates therefor, the holder shall either (A) surrender the certificate or certificates therefor, duly endorsed, at the office of the Corporation or of any transfer agent for the Preferred Stock or (B) notify the Corporation or its transfer agent that such certificates have been lost, stolen or destroyed and execute an agreement satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificates, and shall give written notice to the Corporation at such office that the holder elects to convert the same; provided, however, that on the date of an Automatic Conversion Event, the outstanding shares of Preferred Stock shall be converted automatically without any further action by the holders of such shares and whether or not the certificates representing such shares are surrendered to the Corporation or its transfer agent; provided further, however, that the Corporation shall not be obligated to issue certificates evidencing the shares of Common Stock issuable upon such Automatic Conversion Event unless either the certificates evidencing such shares of Preferred Stock are delivered to the Corporation or its transfer agent as provided above, or the holder notifies the Corporation or its transfer agent that such certificates have been lost, stolen or destroyed and executes an agreement satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificates. On the date of the occurrence of an Automatic Conversion Event, each holder of record of shares of Preferred Stock shall be deemed to be the holder of record of the Common Stock issuable upon such conversion, notwithstanding that the certificates representing such shares of Preferred Stock shall not have been surrendered at the office of the Corporation, that notice from the Corporation shall not have been received by any holder of record of shares of Preferred Stock, or that the certificates evidencing such shares of Common Stock shall not then be actually delivered to such holder.

The Corporation shall, as soon as practicable after such delivery, or after such agreement and indemnification, issue and deliver at such office to such holder of Preferred Stock, a certificate or certificates for the number of shares of Common Stock to which the holder shall be entitled as aforesaid and a check payable to the holder in the amount of any cash amounts payable as the result of a conversion into fractional shares of Common Stock, plus any declared and unpaid dividends on the converted Preferred Stock. Such conversion shall be deemed to have been made immediately prior to the closing of or the occurrence of an Automatic Conversion Event, and the person or persons entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such shares of Common Stock on such date.

4

(d) Adjustments for Subdivisions or Combinations of Common Stock. In the event the outstanding shares of Common Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Common Stock, the Conversion Price of each series of Preferred Stock in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately decreased. In the event the outstanding shares of Common Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Common Stock, the Conversion Prices in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately increased.

(e) Adjustments for Subdivisions or Combinations of Preferred Stock. In the event the outstanding shares of Preferred Stock or a series of Preferred Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Preferred Stock, Original Issue Price and Liquidation Preference of the affected series of Preferred Stock in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately decreased. In the event the outstanding shares of Preferred Stock or a series of Preferred Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Preferred Stock, the Original Issue Price and Liquidation Preference of the affected series of Preferred Stock in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately increased.

(f) Adjustments for Reclassification, Exchange and Substitution. Subject to Section 3 above ("Liquidation Rights"), if the Common Stock issuable upon conversion of the Preferred Stock shall be changed into the same or a different number of shares of any other class or classes of stock, whether by capital reorganization, reclassification or otherwise (other than a subdivision or combination of shares provided for above), then, in any such event, in lieu of the number of shares of Common Stock which the holders would otherwise have been entitled to receive, each holder of such Preferred Stock shall have the right thereafter to convert such shares of Preferred Stock into a number of shares of such other class or classes of stock which a holder of the number of shares of Common Stock deliverable upon conversion of such series of Preferred Stock immediately before that change would have been entitled to receive in such reorganization or reclassification, all subject to further adjustment as provided herein with respect to such other shares.

(g) Recapitalizations. If at any time or from time to time there shall be a recapitalization of the Common Stock (other than a subdivision, combination or merger or sale of assets transaction provided for elsewhere in this Section 4 or in Section 2), provision shall be made so that the holders of the Preferred Stock shall thereafter be entitled to receive upon conversion of the Preferred Stock the number of shares of stock or other securities or property of the Corporation or otherwise, to which a holder of Common Stock deliverable upon conversion would have been entitled on such recapitalization. In any such case, appropriate adjustment shall be made in the application of the provisions of this Section 4 with respect to the rights of the holders of the Preferred Stock after the recapitalization to the end that the provisions of this Section 4 (including adjustment of the Conversion Price then in effect and the number of shares purchasable upon conversion of the Preferred Stock) shall be applicable after that event as nearly equivalently as may be practicable.

(h) Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this Section 4, the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Preferred Stock a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Preferred Stock, furnish or cause to be furnished to such holder a like certificate setting forth (i) such adjustments and readjustments, (ii) the Conversion Price at the time in effect and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of Preferred Stock.

5

(i) Waiver of Adjustment of Conversion Price. Notwithstanding anything herein to the contrary, any downward adjustment of the Conversion Price of any series of Preferred Stock may be waived by the consent or vote of the holders of the majority of the outstanding shares of such series either before or after the issuance causing the adjustment. Any such waiver shall bind all future holders of shares of such series of Preferred Stock.

(j) Notices of Record Date. In the event that this Corporation shall propose at any time:

(i) to declare any Distribution upon its Common Stock, whether in cash, property, stock or other securities, whether or not a regular cash dividend and whether or not out of earnings or earned surplus;

(ii) to effect any reclassification or recapitalization of its Common Stock outstanding involving a change in the Common Stock; or

(iii) to voluntarily liquidate or dissolve or to enter into any transaction deemed to be a liquidation, dissolution or winding up of the Corporation pursuant to Section 3(c);

then, in connection with each such event, this Corporation shall send to the holders of the Preferred Stock at least ten (10) days' prior written notice of the date on which a record shall be taken for such Distribution (and specifying the date on which the holders of Common Stock shall be entitled thereto and, if applicable, the amount and character of such Distribution) or for determining rights to vote in respect of the matters referred to in (ii) and (iii) above.

Such written notice shall be given by facsimile or first class mail (or express courier), postage prepaid, addressed to the holders of Preferred Stock at the address for each such holder as shown on the books of the Corporation and shall be deemed given on the date such notice is mailed.

The notice provisions set forth in this section may be shortened or waived prospectively or retrospectively by the consent or vote of the holders of a majority of the Preferred Stock, voting as a single class and on an as-converted basis.

(k) Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock solely for the purpose of effecting the conversion of the shares of the Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding shares of the Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Preferred Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

6

5. Redemption. The holders of outstanding shares of Preferred Stock shall not be entitled to any redemption rights and the Preferred Stock may not be redeemed by the Corporation at any time.

6. Voting. Except as otherwise expressly provided herein or as required by applicable law, the holders of the Preferred Stock shall have no right to vote their shares at any stockholders' meeting or provide consent to any action taken by stockholders in writing in lieu of a meeting, nor shall they be entitled to notice of any stockholders' meeting or solicitation of stockholders' consents.

7. Reissuance of Preferred Stock. In the event that any shares of Preferred Stock shall be converted pursuant to Section 4 or otherwise repurchased or redeemed by the Corporation, the shares so converted, repurchased or redeemed shall be cancelled and shall not be issuable by this Corporation.

8. Notices. Any notice required by the provisions of this Certificate of Designation to be given to the holders of Preferred Stock shall be deemed given by facsimile or if deposited in the United States mail, postage prepaid, and addressed to each holder of record at such holder's address appearing on the books of the Corporation.

7