10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 22, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

For the fiscal year ended December 31 , 2023

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

For the transition period from __________ to __________

Commission File Number: 000-55136

| (Exact name of registrant as specified in its charter) | ||||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||

|

|

||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (858 ) 410-0266

Securities registered pursuant to Section 12(b) of the Act:

Title of Class: |

Name of each exchange on which registered: | |||||||

None |

None |

|||||||

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001

(Title of Class)

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ |

Accelerated filer | ☐ |

|||||||||||

☒ |

Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ Yes ☐ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ Yes ☒ No

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐ Yes ☒ No

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $20,402,540 as of June 30, 2023, based upon the closing price of $5.25 per share of the registrant’s common stock on the OTCQB on June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter.

As of March 20, 2024, there were 28,062,907 shares of the registrant’s common stock issued and outstanding.

TABLE OF CONTENTS

| PAGE | ||||||||

Item 1A. |

Risk Factors |

|||||||

2

PART I

As used in this report, unless otherwise indicated, the terms “we,” “us,” “our,” “Company” and “Skye Bioscience” refer to Skye Bioscience, Inc., a Nevada corporation, together with its wholly owned subsidiaries, (i) Nemus, a California corporation, (ii) SKYE Bioscience Pty Ltd ("SKYE Bioscience Australia"), an Australian proprietary limited company, (iii) Emerald Health Therapeutics, Inc. ("EHT") a corporation governed by the Business Corporations Act (British Columbia), (iv) Bird Rock Bio Sub, Inc. ("BRB"), a Delaware corporation, (v) Ruiyi Acquisition Corp, a Delaware corporation and (vi) Avalite Sciences, Inc. ("AVI"), a corporation governed by the Business Corporations Act (British Columbia).

FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K contain forward-looking statements that are based on management’s current expectations and assumptions and information currently available to management and are subject to risks and uncertainties. If such risks or uncertainties materialize or such assumptions prove incorrect, our business, operating results, financial condition and stock price could be materially and negatively affected. In some cases, you can identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would” or the negative of these terms or other comparable terminology. Factors that could cause actual results to differ materially from those currently anticipated include those set forth in the section below titled “Risk Factors,” including, without limitation, risks relating to:

•the results of our research and development activities, including uncertainties relating to the discovery of potential product candidates and the preclinical and clinical testing of our product candidates;

•the timing, progress and results of our clinical studies for SBI-100 Ophthalmic Emulsion (SBI-100 OE) and nimacimab and our estimates regarding the market opportunity for SBI-100 OE and nimacimab if approved;

•the early stage of our product candidates presently under development;

•our ability to obtain and, if obtained, maintain regulatory approval of our current product candidates, and any of our other future product candidates, and any related restrictions, limitations, and/or warnings in the label of any approved product candidate;

•our ability to retain or hire key scientific or management personnel;

•our ability to protect our intellectual property rights that are valuable to our business, including patent and other intellectual property rights;

•our dependence on University of Mississippi, third party manufacturers, suppliers, research organizations, testing laboratories and other potential collaborators, including global supply chain disruptions;

•our ability to develop successful sales and marketing capabilities in the future as needed;

•the size and growth of the potential markets for any of our current product candidates, and the rate and degree of market acceptance of any of our current product candidates;

•competition in our industry;

•regulatory developments in the United States and foreign countries; and

•current pending litigation matters, including the Cunning Lawsuit.

We operate in a rapidly changing environment and new risks emerge from time to time. As a result, it is not possible for our management to predict all risks, including the current global economic environment, the impacts of the high inflationary environment, and associated business disruptions such as delayed clinical trials, laboratory resources and supply chain limitations, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements included in this report speak only as of the date hereof, and except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations.

3

Item 1. Business.

Overview

We are a clinical stage biopharmaceutical company with a mission to pioneer the development of new medicines that unlock the pharmaceutical potential of the endocannabinoid system ("ECS"). Our clinical assets focus on the modulation of cannabinoid receptor 1 ("CB1") to provide novel treatments and alternatives for diseases caused by metabolic disorders, inflammation, fibrosis and neurodegeneration, such as obesity and glaucoma. Our Phase 2 clinical candidates include nimacimab, a negative allosteric modulating antibody that inhibits peripheral CB1 receptors, currently being developed for the treatment of obesity and SBI-100 Ophthalmic Emulsion ("SBI-100 OE"), a CB1 agonist (activator), currently being developed for the treatment of glaucoma and ocular hypertension. Both of these differentiated drug candidates are focused on distinct opportunities with large unmet needs: 1) Obesity - where a patients now need additional treatments that have the ability to preserve muscle tissue and improve metabolic dysfunction either as new monotherapies or in combination which existing treatments, and 2) Glaucoma - where novel drugs with distinct mechanisms are needed, especially those that are safe, well-tolerated and have neuroprotective potential. We have filed and successfully opened an Investigational New Drug ("IND") application with the U.S. Food and Drug Administration ("FDA") for nimacimab in obesity, and we plan to launch a Phase 2 clinical trial to evaluate nimacimab for the treatment of obesity as monotherapy compared against placebo, as well as evaluate the combination of nimacimab and a GLP-1 agonist in Q3 2024, with final data in late 2025. We are also continuing clinical development of SBI-100 OE for glaucoma and ocular hypertension, with the first data read out from our recently completed Phase 2a trial anticipated in Q2 2024.

The Endocannabinoid System

Nimacimab: Peripheral CB1 Inhibitor

The exploration of the CB1 pathway as a therapeutic target has seen a resurgence of scientific interest, particularly for its role in modulating key physiological functions such as appetite regulation, weight loss and related metabolic processes. Interest in CB1 inhibition has grown in part due to the unprecedented efficacy and commercial success but also the limitations of glucagon-like peptide-1 receptor (GLP-1) agonists for the treatment of obesity due to its distinct mechanisms and poor tolerability. While Novo Nordisk's Wegovy® (semaglutide) once-weekly GLP-1 agonist injection for obesity had sales grow 442% to $4.7 billion in 2023, at the same time Novo Nordisk purchased Inversago, a clinical-stage company developing a peripherally-restricted CB1 inverse agonist therapy for weight loss. We believe this is in part because CB1 inhibition holds significant potential in obesity, and other metabolic diseases, as either a stand-alone drug or in combination with Novo Nordisk's GLP-1 agonist therapy, Wegovy®. The history of CB1 inhibition for the treatment of weight loss in obesity is long and well documented. It started with the clinical validation of an approved drug, Accomplia®, along with it's ultimate demise due to serious side effects. This was followed by a period of deep research into better understanding the mechanisms of weight loss, as well as, the corresponding side effects from CB1 inhibition - ultimately leading to a new class of "peripherally restricted" CB1 inhibitors. As a result, we now understand that inhibiting the CB1 receptor in peripheral tissues has the potential to not only cause weight loss, but may also, provide additional benefits such as improving insulin and leptin sensitivity, while specifically targeting fat loss and preserving lean muscle.

In 2006, Accomplia® (rimonabant) was approved for the treatment of obesity by the European Medicines Agency. Rimonabant was a CB1 inverse agonist that inhibited signaling both in the central nervous system and peripherally. Rimonabant consistently induced weight loss of 4-6 kg over 6-12 months vs. placebo, with accompanying improvements in metabolic control and hyperlipidemia (Van Gaal et al. Lancet, 2016, Astrup et al., Lancet, 2007). Subsequent meta-analyses showed that rimonabant increased risk of serious psychiatric adverse events such as anxiety, depression and suicidal ideation. It is believed that rimonabant's accumulation in the brain is the primary reason for the increased risk of serious psychiatric events. However, an increasing body of research suggests that the weight loss benefits of rimonabant may be achieved by targeting CB1 inhibition solely in the periphery and not in the brain, thereby avoiding risk of psychiatric adverse events. Although nimacimab is not in direct competition with GLP-1 agonists, a comparative analysis of rimonabant and semaglutide highlights significant differences in their gastrointestinal (GI) adverse event (AE) profiles. By evaluating rimonabant's GI tolerability and addressing the potential reduced risk of neuropsychiatric AEs with nimacimab—a peripherally acting antibody—nimacimab may emerge as an important next generation mechanisms beyond GLP-1 agonists for healthier, more sustainable weight loss and precision obesity including preserving muscle mass. (Van Gaal et al., Diabetes Care 2008 and Wilding et al., New England J Medicine 2021).

4

Several mouse model studies support the hypothesis that selectively targeting CB1 inhibition exclusively in the periphery results in weight loss as well as other potential benefits. For example, Jenrin Discovery developed JD5037 a CB1 antagonist from ibipinabant with limited brain penetrance. Preclinical studies in the diet-induced obese mouse demonstrated that treatment with 3mg/kg daily of JD5037 over a 28-day period reduced body weight to normal levels. (Tam et al., Cell Metabolism 2012) Mice treated with JD5037 reduced body fat without loss of lean muscle mass. Treated mice experienced restoration of leptin sensitivity by decreasing leptin excretion by fat tissue, which resulted in increased fat loss. When these data are taken together with data from rimonabant, we can conclude that peripheral inhibition of CB1 is sufficient to induce weight loss, while preserving lean muscle mass and avoiding risks associated with inhibiting CB1 in the brain and central nervous system. Additional preclinical evidence also suggests that targeting both GLP-1 and inhibiting CB1 in the periphery with JD-5037 results in restoration of insulin sensitivity that is not seen with GLP-1 agonist therapy alone. (Liu et al., ACS Pharmacol. Transl. Sci. 2021 and Tam et al., Molecular Metabolism 2017)

We are currently developing nimacimab, a patented peripherally-acting negative allosteric modulating CB1 inhibitor, initially for treatment of obesity. As a monoclonal antibody, nimacimab may offer a wider therapeutic window compared to competitive small-molecule peripheral CB1 inhibitors. Animal data generated positive safety data over 26 weeks and showed that, following dosing, nimacimab primarily remained in peripheral tissue outside the brain/central nervous system ("CNS") and the product candidate had a positive PK/PD supportive of once-monthly dosing.

SBI-100 Ophthalmic Emulsion: CB1 Agonist (Activator)

We are also developing a CB1 agonist for treatment of glaucoma and ocular hypertension. Approximately 7 million people in the United States and 60 million people worldwide suffer from glaucoma and ocular hypertension ("OH"), which is caused by slow drainage of the eye and leads to increases in intraocular pressure ("IOP"). Ultimately, increased IOP is believed to be a main cause of optic nerve damage in glaucoma. Currently, only IOP lowering has been proven to be a modifiable risk factor for glaucoma onset and progression, and thus is the only acceptable endpoint for marketing approval by the FDA (De Moraes et al., Sci. Rep. 2023 and Leske et al., Arch Ophthalmol 2003). We believe that the unmet need for treatments in glaucoma is high. Approximately 40% of patients fail first line therapy and approximately 50% of patients require more than one therapy.

SBI-100 OE is a CB1 agonist (activator) and is a patented prodrug of tetrahydrocannabinol ("THC") focused on lowering IOP related to glaucoma and ocular hypertension. Ophthalmology opinion leaders have described the unmet need for a new alternate class of medicine to lower intraocular pressure and ideally provide protection against detrimental neurodegenerative effects on the optic nerve. Third party research has demonstrated the utility of THC to lower intraocular pressure and also indicated its neuroprotective capabilities. In October 2023, Skye announced Phase 1 data indicating this differentiated eyedrop was safe and well tolerated, with a low rate of hyperaemia (red eyes) and no signs of intoxication from exposure to THC. Encouraging signs of reduction in IOP were also observed in the subset of healthy volunteers who had an elevated baseline IOP, indicating the potential utility of SBI-100 OE in reducing IOP in patients with glaucoma or ocular hypertension. We launched a Phase 2a clinical trial of SBI-100 OE in Q4 2023. Enrollment was completed in Q1 2024, with data expected in Q2 2024.

Strategy

Our aim is to be a leader in research and product development focused on the EC system. Our goal is to develop first-in-class products to treat significant unmet medical need in global markets. Our operating strategy emphasizes:

Advancing Our Differentiated CB1 Inhibitor, Nimacimab, with a Focus on Obesity as a Stand Alone and Adjunct Therapy to GLP-1 by:

•Continuing to build on Phase 1 clinical data supporting evidence demonstrating safety and evidence of weight loss through restoring leptin sensitivity and enhancing fat metabolism

•Developing clinical data in Phase 2 supporting our hypothesis that nimacimab may cause weight loss while preserving muscle mass, which is not possible with current GLP-1 and GIP (glucose-dependent insulinotropic peptide) agonist therapies where reduction of muscle mass is a known side effect.

•Showing through clinical data the potential for nimacimab to preserve muscle mass, and induce further reduction in weight loss when used in conjunction with GLP-1 and GIP agonist therapies

•Exploring strategic collaborations for further development and deployment of nimacimab by expanding the clinical trial pipeline

5

Advance Our First of Kind Eye Drop Formulation of CB1 Agonist SBI-100 OE as a New Treatment for Ocular Hypertension and Glaucoma by:

•Continuing our Phase 2a proof-of-concept study to develop evidence supporting our hypothesis that SBI-100 OE will lower IOP in patients with ocular hypertension and glaucoma as it did in healthy patients during our Phase 1 clinical trial

•Initiating a Phase 2b study evaluating SBI-100 OE against a current standard of care

By adhering to this strategy, Skye aims to create medicines that significantly improve the lives of patients around the world. Our focus on the ECS and CB1 modulation reflects our commitment to developing innovative treatments for chronic diseases with large unmet needs characterized by neuropathic, inflammatory, and metabolic processes.

Our Product Candidates

Nimacimab: Peripheral CB1 Inhibitor

Unmet Need & Market Opportunity

Global obesity rates have been rising dramatically, affecting more than one billion people worldwide (approximately 650 million adults). For example, approximately 42.4% of adults living in the United States are obese. This translates to more than 112.5 million American adults with a BMI of >30kg/m2, although it is likely that current rates and patient numbers are higher given obesity prevalence has increased 30.5% since 2000. Obesity is a complex disease characterized by excess and chronic inflammation of adipose tissues, and it results from a chronic energy surplus in which the body’s energy intake exceeds its energy expenditure. Other stressors and environmental factors contribute to this chronic imbalance. Today, obesity is the fifth-leading risk factor cited by the World Health Organization ("WHO") for contributing as a primary cause of death globally. Current estimates by the World Obesity Atlas suggest that over half the global population will be overweight or obese by 2035, compared to 38% in 2020.

Early-generation therapies for obesity offered only modest help in weight reduction, with some drugs being removed from the market due to safety concerns. More recently, a new class of drugs have proven very effective at achieving weight loss. These incretin mimetics, including GLP-1 agonists such as semaglutide and GLP-1/GIP combinations such as tirzepatide, have changed the paradigm for anti-obesity treatments. Products derived from these compounds suppress appetite and induce satiety, reduce gastric emptying, and thus reduce calorie intake, achieving weight-loss of up to 20% within one year. However, these drugs come with some potentially significant gastrointestinal side effects that may arise, including diarrhea, nausea, abdominal pain and bloating, and in some cases patients may suffer from a condition known as gastroparesis, or paralyzed stomach. Additional side effects, although infrequent, include instances of acute pancreatitis, gallbladder disease, hypoglycemia, acute kidney injury and diabetic retinopathy (in diabetics). Beyond these potential side effects, it has been observed that muscle mass loss accounts for up to 40% of the weight lost in patients using these drugs, which is higher than the typical loss of approximately 25% muscle mass loss in normal weight loss settings. As a result of these side effects many patients are intolerant to these incretin-mimetic drugs. In most cases, even when therapy is tolerated, patients are unable to get to a healthy weight. When taken off therapy, patients can gain a majority of their weight back within the first year. Nevertheless, the market for this class of drugs is projected to grow to $20 billion in sales by 2030. Despite this unprecedented efficacy and commercial success, we believe there remains room for improvement over these new therapies.

Potential of the Body's Endocannabinoid System for Pharmaceutical Drug Development in the Treatment of Obesity

The cloning of CB1, along with the discovery of its endogenous ligands, the endocannabinoids ("ECs"), anandamide ("AEA") and arachidonoylglycerol ("2- AG"), has illuminated some of the biological intricacies and mechanisms involved in fat storage and development of obesity. ECs, CB1, and closely related cannabinoid type-2 receptors constitute the endocannabinoid system ("ECS"). The ECS primarily functions to regulate energy storage and balance within the body, facilitated by CB1's activity in the brain and peripheral tissues. The ECS helps maintain many physiological processes by enabling different cellular functions, all with a role in achieving a global homeostasis despite fluctuations in the external environment. ECs are produced in the body, where their synthesis and degradation is regulated by different enzymes. These endocannabinoids act as agonists that can bind to and signal via specific endocannabinoid receptors expressed on various cell types and tissues.

6

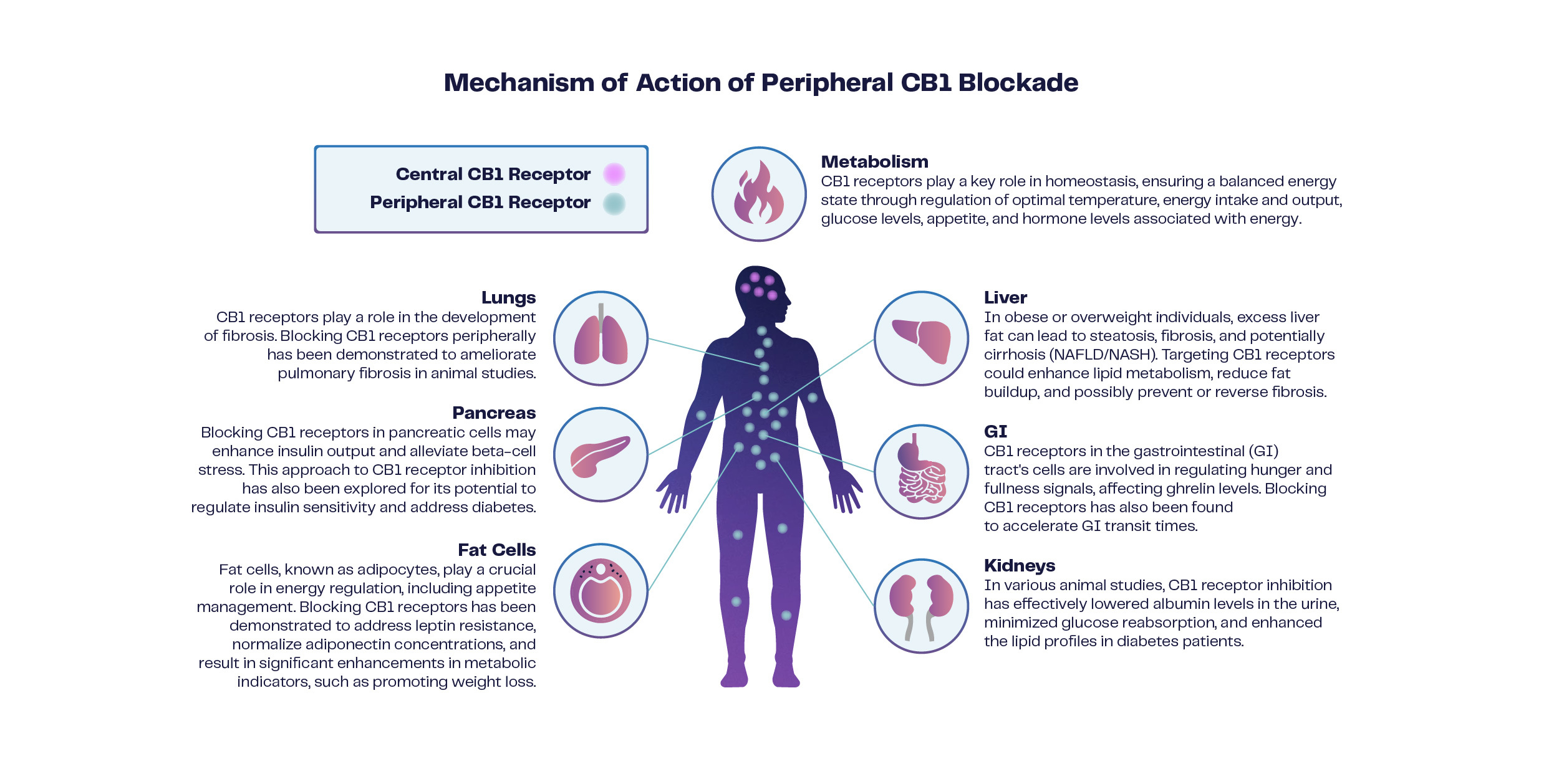

The CB1 receptor is one of the most abundant ECS receptors in the body. It is predominantly found in the CNS, where its role is associated with motor control, cognition, and emotional processing, and including modulation of processes of the eye. CB1 receptors are also found in peripheral tissues, or outside of the CNS, such as the liver, kidney, adipose tissue (fat cells), pancreas, and the gastrointestinal tract. One notable role of CB1 receptors in peripheral tissues is their involvement in metabolic regulation. In adipose tissue, activation of CB1 receptors has been linked to the promotion of fat storage, suggesting their role in the balance of energy storage and utilization. In the kidney, CB1 signaling helps modulate blood flow vital for the filtration of waste products and excess fluids, a process essential for maintaining proper electrolyte balance and blood pressure. CB1 in the liver is involved in the regulation of lipid metabolism and glucose homeostasis. Activation of CB1 receptors in the gastrointestinal tract can modulate the release of neurotransmitters and hormones that influence appetite, gastric motility, and nutrient absorption.

The distribution and function of the CB1 axis provides a strong rationale to target this critical physiological system as a therapeutic to treat different pathological states. Moreover, dysregulation of the CB1 axis in peripheral tissues has been associated with metabolic disorders such as obesity and kidney disease. Operating as a G-protein coupled receptor, CB1 typically associates with inhibitory Gi/o proteins to reduce cellular activity by inhibiting adenylyl cyclase and cAMP activity. Additionally, CB1 interaction with ß-arrestin can initiate a distinct signaling cascade, the full implications of which are not yet completely understood. This ß-arrestin pathway is known to affect receptor sensitivity and expression levels. Recent research highlights that inhibiting CB1 outside the brain can influence leptin sensitivity and adipocyte signaling, directly impacting fat cell physiology. Activation of CB1 promotes fat accumulation and disrupts mitochondrial function in obesity models, whereas inhibiting CB1 enhances mitochondrial biogenesis. This metabolic adjustment results in weight loss primarily through heightened energy expenditure, increased lipolysis, and fatty acid oxidation processes, particularly in brown adipose tissue, which serves as an energy source, contrasting white adipose tissue's role in long-term fat storage.

It has been previously demonstrated that inhibiting the CB1 receptor can significantly reduce weight in obese patients. In 2006, Sanofi developed a CB1 inverse agonist called rimonabant, which demonstrated 8-10% weight loss after one year. Despite being approved by the European Medicines Agency, the drug was soon taken off the market because it was shown to result in a higher risk of adverse psychiatric side effects. As a result, rimonabant was taken off the market in Europe and Sanofi, along with other large pharmaceutical companies like Merck and Pfizer, stopped all development of CB1 inhibitors.

Since the demise of rimonabant, a significant amount of research was conducted to better understand the CB1 blockade and why drugs like rimonabant failed. Ultimately it was determined that rimonabant readily entered the brain, resulting in significant psychiatric side effects. However, it was also discovered that blockade of CB1 receptors outside of the brain (i.e. peripheral CB1 receptors), could also result in meaningful weight loss and also improvement in other metabolic parameters. These studies have led to the development of "peripherally restricted" CB1 inhibitors that have significantly less penetration into the brain, resulting in a potentially safer drug while maintaining potentially similar weight loss characteristics. Moreover, researchers have shown that peripheral blockade of the CB1 receptors can also result in weight loss with less muscle mass loss (i.e. muscle wasting), while also improving metabolic parameters important in changing the course of the disease in obesity, such as improving insulin sensitivity.

7

We believe incretin mimetics, like GLP-1 agonists, have established themselves as a potential foundation for the therapeutic treatment of weight loss. However, with their potentially challenging safety profile and marked incidence of muscle wasting associated with weight loss, we believe it is imperative to develop new drugs that can be complimentary to GLP-1 agonists, such as in combination with, as a follow-on to standard-of-care GLP-1 therapies, or even as an alternative therapy for obese patients who can not tolerate the side effects of GLP-1 agonists. Peripheral CB1 inhibition represents an important new mechanism with potential to help reduce these challenges and create improved therapeutic outcomes.

Technology

In 2023, Skye acquired BRB along with its lead asset, nimacimab, a humanized IgG4 negative allosteric modulating (NAM) antibody that specifically binds to CB1 receptor and does not cross-react with other GPCRs including CB2. CB1 binding characteristics including specificity and affinity have been confirmed with both ELISA and flow cytometry-based assays. Assessing functional inhibition including demonstration of noncompetitive binding CB1 has been confirmed with both b-arrestin-based and GPCR-based endpoints. This functional and specific CB1 inhibiting antibody has also been characterized in multiple biodistribution assays, which collectively demonstrated a high degree of peripheral restriction with minimal detection in the CNS and brain in early time points as well as no accumulation in the brain over 28 days, despite nimacimab's 18-20 day half-life. This lack of blood-brain barrier (BBB) penetration, while not uncommon for a larger biologic such as an antibody therapeutic, is an important feature that helps underpin nimacimab's excellent safety profile.

While different strategies have been developed to limit CB1 signaling, nimacimab's negative allosteric approach is differentiated relative to an inverse agonist inhibitor in a few notable ways. A fundamental functional difference relates to the ability of nimacimab to inhibit in a non-competitive fashion. Since nimacimab limits the receptor activity by binding away (allosterically) from the agonist (endocannabinoid) receptor binding pocket, it is able to inhibit the CB1 signal independently of receptor engagement. In contrast, an inverse agonist competes with the endocannabinoid for receptor binding and thus inhibition of CB1 signaling.

While this distinction may not be as impactful in healthier patients with minimal pathology, this mechanistic distinction becomes more relevant in patients with notable disease progression where the CB1 axis (both receptor but importantly endocannabinoid density) can be significantly overactive in local tissues, enabling competition with an inverse agonist for receptor occupancy. This difference can be exaggerated when the bioavailability of an inverse agonist is limited, which highlights a second key distinction between nimacimab, an antibody therapeutic, and inverse agonists, which are currently all small molecule therapeutics.

Small molecule-based CB1 inverse agonists have been modified to discourage distribution in the CNS and brain by increasing the polarity of surface residues, which also impacts membranous trafficking and bioavailability. While this altered small molecule yields a notable improvement in CNS distribution relative to non-biased small molecules such as rimonabant, its presence and significant CB1 occupancy in the brain has still been noted in a chronic preclinical setting. Coupled with an impact on bioavailability, this may limit the therapeutic index and thus its relative density in local tissues.

In contrast, nimacimab has an excellent clinical safety profile with a large NOAEL (no observed adverse effect level) and an 18-20 day half-life which collectively supports a favorable pharmacologic profile capable of safely inhibiting CB1 signaling in relevant disease settings.

Nonclinical Data

Nonclinical studies were designed to characterize various pharmacodynamic aspects of nimacimab, including specificity and in vitro affinity binding, functional cell-based inhibition, as well as other mechanistic details. Key findings from these studies demonstrated that nimacimab is selective and does not bind to other GPCR targets while binding with low nM affinity to human CB1. The antibody was able to block CB1 activation by the natural endocannabinoid ligands AEA and 2-AG and demonstrated dose-dependent antagonist activity measured by both cAMP and b-arrestin signaling pathways. Pre-treatment with nimacimab blocked CB1 agonist-induced CB1 internalization and nimacimab did not induce internalization in the absence of agonist. Additionally, nimacimab had no effect on antibody-dependent cellular cytotoxicity (ADCC) or complement-dependent cytotoxicity (CDC), suggesting that nimacimab's mechanism of action is focused on blocking CB1 signaling and not any direct immune-mediated effects. Lastly, antibody blockade of CB1 on matured adipocytes from obese subjects significantly increased adiponectin production compared to vehicle control. These findings are of importance as adiponectin, an adipokine secreted by adipocytes, play a critical role in regulating glucose levels, lipid metabolism, and insulin sensitivity, which collectively support positive metabolomic regulation.

8

Clinical Data

In a Phase 1b entitled "Safety, Tolerability and Pharmacokinetics of Nimacimab after Repeat Dosing in Subjects with Non-Alcoholic Fatty Liver Disease (NAFLD)," the purpose was to evaluate the safety and tolerabilty of multiple doses of nimacimab after four weeks of dosing in subjects with NAFLD. Secondary objectives included determination of pharmacokinetics of nimacimab for multiple doses, and to determine levels of anti-drug antibodies (ADA) after dosing with nimacimab. In Part A of this study, 24 healthy volunteers were randomized to receive a single dose of either placebo or single ascending doses of nimacimab (0.6, 1.2 or 2.5 mg/kg). In Part B, 82 patients with pre-diabetes or diabetes and NAFLD were randomized to receive either placebo or multiple escalating doses of nimacimab (0.6, 1.2 or 2.5 mg/kg) once a week for four weeks.

There were no deaths, serious adverse events (SAEs) or treatment-emergent adverse events (TEAEs) that lead to discontinuation. All TEAEs were graded as mild to moderate in intensity except for 1 severe TEAE (dizziness) in the nimacimab 0.6 mg/kg dose group determined to have not been related to study drug. The majority of TEAEs were not related to study drug and there was no apparent relationship between the dose level and the type, severity, or incidence of the TEAEs.

For all subjects at all doses, concentrations of nimacimab were quantifiable in serum by 0.5 hours after the first dose and remained quantifiable in most subjects through the last time point (Day 67). Exposure to nimacimab as measured by AUC and Cmax increased with increasing doses of nimacimab. At all dose levels, median Tmax ranged from 0.5 to 2 hours and mean t1/2 ranged from 18 to 22 days.

Immunogenicity was assessed in all subjects throughout the study. Only two subjects had consistently elevated titers over multiple time points of ADA. These data suggest that nimacimab has overall low immunogenicity.

Decreases in mean alanine transaminase (ALT) and aspartate aminotransferase (AST) were observed during the study in the active treatment groups, but not in the placebo group. Numeric decreases in ELF score and statistically significant reduction in hyaluronic acid (HA) was observed in the 1.2 mg/kg dose group compared to placebo (p=0.02). Assessment of serum lipids indicated a dose-dependent trend towards reduction of low-density lipoprotein cholesterol (LDL-c) starting from Day 29; on Day 67 there was a mean 8.9 mg/dL decrease in LDL-c in the 2.5 mg/kg dose group compared with a mean 8.3 mg/dL increase in the placebo group (p=0.0073). No effect was observed in total cholesterol, high-density lipoprotein cholesterol (HDL-c), and triglycerides. No significant treatment effect was observed on liver fat percentage, DNL, inflammatory biomarkers and OGTT test.

Development Plan

IND-enabling studies of nimacimab in non-human primates demonstrated a strong safety profile with a NOAEL of 75 mg/kg. Our Phase 2 study in obesity is designed to evaluate nimacimab's weight loss potential either as a single agent or in combination with a GLP-1 agonist like semaglutide. We believe the complementary mechanism of action of CB1 inhibition with nimacimab in combination with a GLP-1 agonist has the potential to provide more meaningful weight loss, and potentially more durable weight loss, than a GLP-1 agonist alone.

Our Phase 2 clinical trial design will treat non-diabetic individuals with obesity (BMI≥30) or those overweight (BMI≥27) with at least one weight-related health issue. Participants will be treated with either nimacaimb, a GLP-1 agonist such as semaglutide, a combination of nimacimab plus a GLP-1 agonist, or placebo. This 26-week study will be followed by a 12-week observation period. The main goal is to measure the percentage of weight loss by week 26, with secondary goals assessing changes in waist size, body composition, fasting triglyceride levels, cholesterol, and A1c. The study will help us evaluate the effectiveness of nimacimab alone versus placebo, as well as compare the difference between nimcacimab and semaglutide and the potential enhanced effects of their combination. A key focus is the impact on body composition across different groups, especially since nimacimab is expected to better preserve muscle mass by promoting fat browning, a benefit observed in preclinical studies where CB1 inhibition led to significant weight reduction without muscle loss over 28 days. We plan to finalize the trial design and start the Phase 2 study in approximately mid-2024.

SBI-100 Ophthalmic Emulsion: CB1 Agonist (Activator)

Unmet Need & Market Opportunity

Glaucoma is characterized by progressive ocular neuropathy associated with the initiation of apoptosis of retinal ganglion cells ("RGCs") in the optic nerve, which can progress and cause irreversible loss of vision. While the pathology of glaucoma is in the back of the eye, a key driver of this disease is often found in the front of the eye. Specifically, elevated intraocular pressure ("IOP") resulting from dysregulated outflow, and to a lesser extent production of aqueous humor ("AH") in the anterior/posterior chambers in the front of the eye, readily promotes damage to RGC axons through vascular ischemia and physical crush injury as the elevated ocular pressure compresses these critical cells. IOP is currently the only modifiable risk factor and lowering IOP results in reduced risk of progression of damage to the optic nerve. Moreover, IOP has been identified as an important risk factor in the pathogenesis of this disease.

9

To reduce IOP, the current classes of glaucoma therapeutics target pathways that shift the balance of production or outflow of AH. This therapeutic landscape is made up of five drug classes focused on lowering IOP toward a target level whereby the rate of disease progression will be slowed sufficiently to avoid functional impairment from the disease. Prostaglandin analogues and β-blockers are the first-line therapies and the most commonly used medications for the management of glaucoma. There are other therapeutic agents less commonly used to reduce IOP, like cholinergic agonists, alpha agonists and ROCK inhibitors. While these treatments can be effective in some patients, side effects and lack of durable responses often lead to many patients progressing through multiple therapies in an effort to control IOP. Current treatments are legacy classes of drugs thus there is an unmet need for combinations and innovation in this therapeutic landscape. This unmet need is a potential opportunity for Skye's SBI-100 OE to have a positive impact in patients with glaucoma.

Technology

Cannabinoid receptors are highly concentrated in the eye, especially in the anterior compartment that helps regulate IOP, and in the posterior compartment in the area of the retina and optic nerve. Activation of CB1 has previously been shown to lower IOP in both animal and human studies. SBI-100 OE represents a novel treatment option for glaucoma. The active pharmaceutical ingredient ("API"), SBI-100, is synthetically created using rational drug design and biochemical engineering to increase the hydrophilic properties of Δ9-tetrahydrocannabinol. This increased solubility coupled with a proprietary formulation to increase stability and residency time on the ocular surface allows for increased ocular tissue penetration. Once inside the eye, abundant esterases release the prodrug moiety, allowing for an active THC molecule to bind to abundant CB1 receptors throughout key ocular tissues such as the trabecular meshwork and ciliary body. Engagement of these receptors has been demonstrated to promote AH outflow via the trabecular meshwork as well as limit production via the ciliary body. Importantly, the active component of SBI-100 OE has been shown to have neuroprotective effects in both in vitro and in vivo studies. Since SBI-100 OE has been detected in retinal tissues in biodistribution studies, we are investigating if SBI-100 OE may additionally demonstrate a neuroprotective aspect in its treatment of glaucoma, providing further differentiation from the current therapies on the market.

We licensed SBI-100, the active pharmaceutical ingredient in SBI-100 OE, from the University of Mississippi ("UM"). SBI-100 OE is initially being developed to treat glaucoma and ocular hypertension. SBI-100 is Δ9-tetrahydrocannabinol-valine-hemisuccinate (Δ9-THCVHS), a synthetically manufactured amide ester prodrug of Δ9-tetrahydrocannabinol molecule formulated in a proprietary nanoemulsion formulation. In contrast to the parental Δ9-tetrahydrocannabinol molecule, which has very poor bioavailability, this novel synthetic molecule has been shown to penetrate into ocular tissue, where the prodrug moiety is quickly removed, allowing for the delivery of measurable amounts of active drug (Δ9-tetrahydrocannabinol) to the cornea, AH, iris-ciliary body, and retina choroid (RC), permitting interaction with cannabinoid receptors involved in regulating IOP.

Preclinical Data

In 2019, UM completed experiments showing that SBI-100 was statistically superior in lowering IOP compared to the prostaglandin-based therapy latanoprost, the current standard-of-care for treating glaucoma. Statistical significance was reached across multiple time points during a seven-day course of dosing using a validated rabbit normotensive ocular model and SBI-100 exerted pharmacologic activity consistent with once-daily to twice-daily dosing. Skye subsequently developed a proprietary nanoemulsion formulation to optimize the amount of SBI-100 that can be delivered to the eye in a single drop while also improving the duration of activity. Importantly, this formulation can be sterilized by filtration without impacting the attributes of SBI-100. This final formulation of the API, known as SBI-100 Ophthalmic Emulsion, significantly reduced IOP compared to other commercially available ophthalmic solutions and is now being evaluated in clinical trials.

We evaluated the mechanism of action and IOP-lowering ability of the active moiety of SBI-100 when administered into an ex vivo model of a 3D-human trabecular meshwork using both healthy and glaucomatous-induced tissues. The trabecular meshwork plays a key role in removing a vital functional liquid in the eye, called aqueous humor, in order to maintain a healthy balance of pressure in the eye (an imbalance can lead to a detrimental increase in IOP). This study validated the mechanism of action of SBI-100 in lowering IOP, a defining disease process of hypertensive glaucoma. Moreover, biomarkers associated with inflammation and fibrosis in both normal tissue and tissues affected by glaucoma were significantly decreased, pointing to anti-inflammatory and anti-fibrotic activities often associated with cannabinoids in other disease states. Data also revealed that biomarkers associated with neovascularization, a disease process of new blood vessel formation that can damage the retina in a variety of ocular diseases, was also inhibited by the active moiety, prompting further study for the utility of this drug in diseases of the retina.

10

Clinical Data

We commenced dosing of the Phase 1 clinical study in December 2022 and in November 2023 we reported that our Phase 1 data demonstrated that SBI-100 OE was safe and well-tolerated. Importantly, we determined that there was minimal systemic exposure of the active metabolite of SBI-100 OE, THC, thus resulting in little to no side effects related to THC intoxication. Moreover, it was determined that after multiple days of dosing we saw minimal hyperaemia (i.e. redness of the eyes) following administration of SBI-100 OE.

In December 2022, we obtained FDA clearance of our Investigational New Drug application to conduct clinical studies in the US and in January 2023, our Phase 2 clinical trial protocol received study level approval from a central institutional review board (“IRB”). In February 2024, we announced that we completed enrollment of our Phase 2a clinical study for glaucoma and ocular hypertension. Due to the early completion of enrollment of our Phase 2a study, topline data will be available in Q2 2024.

Development Plan

As a novel agent for the potential treatment of glaucoma and ocular hypertension, SBI-100 OE may represent a new treatment opportunity for physicians and patients and we are leading the field in this area of research.

We are currently advancing a Phase 2a trial of SBI-100 targeting primary open-angle glaucoma (POAG) and OH. This study enrolled 56 patients with POAG and OH, presenting intraocular pressures (IOP) between 21-34mmHg, and with no history of surgical interventions. Participants were randomized to receive either 0.5% SBI-100, 1% SBI-100, or a placebo, administered twice daily over a 14-day period. The study's main goal is to assess changes in diurnal IOP compared to placebo. Secondary objectives are to evaluate safety, tolerability, any psychotropic effects, changes in diurnal IOP from the study's start, and to explore potential biomarkers.

Following the data release of our proof-of-concept Phase 2a study, we expect to initiate a Phase 2b study evaluating SBI-100 OE against a current standard of care such as timolol. Successful completion of this Phase 2b study by the end of 2025 may present an opportunity to hold an end-of-Phase 2 meeting with the US FDA to discuss our plan for Phase 3 studies for marketing authorization in glaucoma.

Competition

Our industry is characterized by rapidly advancing technologies, intense competition, rapid pace of new innovation, and a strong emphasis on proprietary products and defense of intellectual property. We face competition from pharmaceutical companies, including generic drug companies, biotechnology companies, drug delivery companies, and academic and research institutions, among others.

Competitors to nimacimab that are targeting peripheral inhibition of CB1 for the treatment of obesity and metabolic conditions include Inversago (acquired by Novo Nordisk in 2023) and Corbus Pharmaceuticals. We are not aware of any competitor attempting to inhibit CB1 in the periphery via a monoclonal antibody. There is also significant interest in and competitive activity targeting obesity and metabolic disorders from companies including Novo Nordisk, Eli Lilly, Boehringer Ingelheim, Zealand Pharma, Pfizer, AstraZeneca, Regeneron, Carmot Therapeutics (acquired by Roche), Amgen, Viking Therapeutics, Structure Therapeutics, Versanis (acquired by Eli Lilly), Biohaven, Keros Therapeutics, Scholar Rock, Terns Pharmaceuticals, Altimmune, Omega Therapeutics, Kallyope, Rivus and others including several privately financed companies whose information is not regularly disclosed to the public.

We are not currently aware of any competitors to SBI-100 Ophthalmic Emulsion that are developing a CB1 agonist for the treatment of glaucoma and OH. Merck, Novartis, Abbvie, Bausch + Lomb, and Alcon are generally known competitors currently offering treatments for glaucoma and ocular hypertension.

Manufacturing

We do not own or operate manufacturing facilities and we rely on third-party contract manufacturing organizations to supply Skye with drugs for pre-clinical and clinical studies.

Nimacimab

Nimacimab is a monoclonal antibody and we have developed a manufacturing process under current good manufacturing practice ("cGMP") to produce batches of drug substance and drug product for pre-clinical and clinical studies. Drug substance for nimacimab will be produced by a contract manufacturer through recombinant DNA technology utilizing genetically engineered host cells, upstream cell culture processes and downstream purification methods as required to manufacture the drug substance. Drug product will be produced by a contract manufacturer whereby nimacimab drug substance will be formulated and filled in to pre-filled syringes.

11

SBI-100 Ophthalmic Emulsion

Manufacturing of SBI-100 OE's active pharmaceutical ingredient, SBI-100, has been conducted in the United States by contract manufacturers under cGMP. Formulation and packaging of SBI-100 OE for nonclinical and clinical use is manufactured by contract manufacturers with necessary controlled substance licenses with appropriate local, state and federal government agencies to conduct research, manufacture and distribute controlled substances like THC.

Intellectual Property

The success of most of our product candidates will depend in large part on our ability to:

•Obtain and maintain patent and other legal protection for the proprietary technology, inventions and improvements we consider important to our business

•Prosecute our patent applications and defend any issued patents we obtain

•Preserve the confidentiality of our trade secrets

•Operate without infringing the patents and proprietary rights of third parties.

We intend to continue to seek patent protection for certain of our product candidates, drug delivery systems, molecular modifications, as well as other proprietary technologies and their uses by filing patent applications in the United States and other selected global territories. We intend for these patent applications to cover, where possible, claims for composition of matter, medical uses, processes for isolation and preparation, processes for delivery and formulations.

We also rely upon trade secrets and know-how and continuing technological innovation to develop and maintain our proprietary and intellectual property position. We seek to protect our proprietary information in part using confidentiality agreements with our collaborators, scientific advisors, employees and consultants, and invention assignment agreements with our employees and selected consultants, scientific advisors and collaborators. The confidentiality agreements are designed to protect our proprietary information and, in the case of agreements or clauses requiring invention assignment, to grant us ownership of technologies that are developed through a relationship with a third party.

Nimacimab

The Company owns three granted U.S. patents, 32 granted foreign patents, and 25 pending US and foreign patent applications directed to the compositions of matter for the nimacimab antibody and molecular variants, and to methods of treatment and uses of nimacimab and its variants for treating a number of diseases responsive to the modulation of the CB1. The patents and applications, once granted, will expire between 2035 and 2036 and may be eligible for up to five years of extension (Hatch-Waxman).

SBI-100 and SBI-100 OE

As of the date of this Annual Report, we have licensed an invention from UM which include U.S. patents as well as a number of foreign counterparts, including the European Union, Japan, Canada and Australia. The patents that we license cover composition of matter and preparation of SBI-100, and their methods of use. The US patent for SBI-100 is expected to expire in 2029. Under our license agreement, UM retains ownership over the licensed patents and control over the maintenance and prosecution of the licensed patents and patent applications.

Licensing and Other Agreements

Nimacimab

Skye wholly owns nimacimab. There are no in- or out-licensing arrangements, no contingent value rights and no royalties payable or due to Skye relating to this molecule.

Under the terms of the securities purchase agreement (the "January PIPE SPA") entered into in connection with the January PIPE Financing, so long as the investors in the January PIPE Financing continue to beneficially own in the aggregate at least 40% of the securities issued in the January PIPE Financing (such securities, the "Closing Securities"), the Company may not transfer, license (other than in the ordinary course of business), encumber, or sell a royalty interest in any intellectual property relating to nimacimab unless Skye obtains the written consent of Qualified Investors that, together with their respective affiliates, beneficially own at least a majority of the then outstanding Closing Securities owned by the Qualified Investors and their respective affiliates. The term "Qualified Investors" means any investor that, together with its affiliates, continues to own at least 80% of the securities originally purchased by it under the January PIPE SPA.

12

SBI-100

University of Mississippi granted Skye an exclusive license for all fields of use related to UM 5050 (referred to by Skye as SBI-100) and including, with the prior written consent of UM, the right to sublicense the intellectual property for UM 5050. All fields of use means no restrictions on use of the underlying inventions, including developing UM 5050 to treat any disease through any form of delivery under the license agreement.

The license for SBI-100, a CB1 agonist, is expected to allow us to explore related uses for the active moiety of SBI-100.

In 2022, after notifying the Australian Therapeutics Goods Administration through the Clinical Trial Notification scheme of our intent to initiate our Phase 1 clinical trial for SBI-100 OE, we triggered and paid the first milestone payment under our License Agreement for UM 5050 with UM.

In 2023, we granted to Tautomer Bioscience an exclusive license to develop and commercialize SBI-100 as a novel suppository formulation for chronic intractable pain and other indications in South Africa and the rest of Africa. We have retained certain rights and options to obtain rights to the future use of new jointly developed intellectual property and other intellectual property owned or controlled by Tautomer Bioscience related to SBI-100.

Government Regulation

Government authorities in the United States, at the federal, state and local level, and in other countries, extensively regulate, among other things, the research, development, testing, manufacture, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, import and export of pharmaceutical products such as those we are developing. The processes for obtaining regulatory approvals in the United States and in foreign countries, along with subsequent compliance with applicable statutes and regulations, require the expenditure of substantial time and financial resources. A failure to comply with such laws and regulations or prevail in any enforcement action or litigation related to noncompliance could have a material adverse impact on our business, financial condition and results of operations and could cause the market value of our common stock to decline.

U.S. Food and Drug Administration (FDA)

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The FDA regulates drugs under the Federal Food, Drug and Cosmetic Act ("FDCA") and its implementing regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject us to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending NDAs, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties.

The process required by the FDA before a drug may be legally marketed in the United States, generally involves the following:

•conduct of laboratory tests, animal studies and formulation studies in compliance with GLP regulations;

•submission of an Investigational New Drug application ("IND") to the FDA , which must be found acceptable to proceed before clinical trials may begin;

•approval and oversight of each study by an IRB before each clinical site may initiate the trial(s);

•conduct of adequate and well-controlled clinical trials in accordance with good clinical practice ("GCP") requirements to establish the safety and efficacy of the proposed drug for each indication;

•submission of an NDA to the FDA;

•satisfactory development and completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with cGMP requirements and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity;

•satisfactory development and completion of an FDA BioResearch Monitoring (BIMO) inspection of the clinical study sites which participated in the studies supporting the NDA application; and

•FDA review and approval of marketing authorization application (NDA, BLA, etc).

13

Nonclinical Studies

Nonclinical studies include laboratory evaluation of product chemistry, toxicity and formulation, as well as animal studies to assess potential safety and efficacy. An IND sponsor must submit the results of the nonclinical tests, together with manufacturing information, analytical data and any available clinical data or literature, among other things, to the FDA as part of an IND. Some nonclinical testing may continue even after the IND is submitted. An IND generally becomes effective 30 days after receipt by the FDA unless, before that time, the FDA raises concerns or questions related to nonclinical or manufacturing documentation or one or more proposed clinical trials and places the IND on clinical hold. In such a case, the IND sponsor and the FDA work to resolve any outstanding concerns before the hold can be lifted and the clinical trial(s) can begin. As a result, submission of an IND does not always result in the FDA allowing clinical trials to commence.

Clinical Trials

Clinical trials involve the administration of the investigational new drug candidate to humans under the supervision of qualified investigators in accordance with GCP requirements. This includes the requirement that all research subjects/patients provide their informed consent in writing for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the trial, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. In addition, an IRB, either central or at each institution participating in the clinical trial must review and approve the plan for any clinical trial before the study commences at a site. Information about certain clinical trials must be submitted within specific timeframes to the NIH for public dissemination on the www.clinicaltrials.gov website.

Before marketing authorization, human clinical trials are typically conducted in three sequential phases, which may overlap or be combined:

•Phase 1: The drug is initially introduced into a small number of healthy human subjects or patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness.

•Phase 2: The drug is administered to a specific patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy and safety of the product for specific diseases and to determine dosage tolerance and optimal dosage.

•Phase 3: The drug is administered to the established patient population expected to benefit based upon the risk/benefit profile. Generally, this phase of studies are conducted at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product.

Reports detailing the results of the clinical trials must be submitted at least annually to the FDA and IND safety reports are submitted more frequently if serious adverse events possibly related to the investigational product occur. Phase 1, Phase 2 and Phase 3 clinical trials may not be completed successfully within any specified period, or at all. Furthermore, the FDA or the Sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk or due to a business decision. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients.

Marketing Approval

Assuming successful completion of the required clinical testing, the results of the nonclinical and clinical studies, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things, are submitted to the FDA as part of an marketing authorization application requesting approval to market the product for one or more indications. For drug products, or biologic products under the review of Center for Drug Evaluation and Research (CDER), the marketing authorization application is an NDA or a BLA, and submission is subject to a substantial application user fee. Under the Prescription Drug User Fee Act ("PDUFA") commitments that are currently in effect, the FDA has a goal of reviewing and responding to a submission within ten months from the date of “filing” of a standard NDA for a new molecular entity. This review typically takes at least twelve months from the date the NDA is submitted to the FDA because the FDA has approximately two months to make a “filing” decision. However, if issues arise during the review, the FDA may request additional information and the review period may be extended to permit the applicant to provide and the FDA to review that information, which may significantly extend this time period. The process for review and issuance of a license for a BLA is similar to the NDA review path..

14

In addition, under the Pediatric Research Equity Act of 2003 ("PREA"), as amended and reauthorized, certain marketing authorizations or supplements to marketing authorizations must contain data that is adequate to assess the safety and effectiveness of the approved product for the claimed indications in all relevant pediatric subpopulations, and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective. The FDA may, on its own initiative or at the request of the applicant, grant deferrals for submission of some or all pediatric data until after approval of the product for use in adults, or full or partial waivers from the pediatric data requirements.

The FDA also may require submission of a Risk Evaluation and Mitigation Strategy (REMS) plan to ensure that the benefits of the drug outweigh its risks. The REMS plan could include medication guides, physician communication plans, assessment plans, and/or elements to assure safe use, such as restricted distribution methods, patient registries, or other risk minimization tools.

The FDA conducts a preliminary review of all pending marketing authorizations within the first 60 days after submission, before accepting them for filing, to determine whether they are sufficiently complete to permit substantive review. The FDA may refuse to file the application and request additional information rather than accept marketing authorization application for filing. In this event, the application must be resubmitted with the additional information requested. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA reviews an NDA to determine, among other things, whether the drug is safe and effective and whether the facility in which it is manufactured, processed, packaged or held meets standards designed to assure the product’s continued safety, quality and purity.

The FDA may refer an application for a novel product and/or first-in-class product to an advisory committee. The FDA may also refer to the advisory committee certain scientific questions raised by an application. An advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Before approving a marketing authorization application, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, within the review period and before approving a marketing authorization application, the FDA will likely inspect one or more clinical trial sites to assure compliance with GCP requirements.

The testing and approval process for an NDA/BLA requires substantial time, effort and financial resources, and each may take several years to complete. Data obtained from nonclinical and clinical testing are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA may not grant approval on a timely basis, or at all.

After evaluating the NDA/BLA and all related information, including the advisory committee recommendation, if any, and inspection reports regarding the manufacturing facilities and clinical trial sites, the FDA may issue an approval letter, or, in some cases, a complete response letter. A complete response letter generally contains a statement of specific conditions that must be met to secure final approval of the NDA/BLA and may require additional clinical or nonclinical testing in order for the FDA to reconsider the application. Even with submission of this additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval. If and when those conditions have been met to the FDA’s satisfaction, the FDA will typically issue an approval letter for the NDA/BLA. An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. For some products, such as our product candidates where abuse potential is a possibility, an additional step of Drug Enforcement Administration (DEA) review and scheduling is required.

Post-Approval Requirements

Products manufactured or distributed pursuant to FDA approvals are subject to pervasive and continuing regulation by the FDA, including, among other things, requirements relating to recordkeeping, periodic reporting, product sampling and distribution, advertising and promotion, and reporting of adverse experiences with the product. After approval, most changes to the approved product, such as adding new indications or other labeling claims are subject to FDA review and approval prior to implementation. There also are continuing annual product fee requirements for any marketed products and the establishments at which such products are manufactured, as well as new application fees for supplemental applications with clinical data.

The FDA may impose a number of post-approval requirements as a condition of approval of an NDA/BLA. For example, the FDA may require post-marketing testing, including Phase 4 clinical trials, and surveillance to further assess and monitor the product’s safety and effectiveness after commercialization.

15

In addition, drug manufacturers and other entities involved in the manufacture and distribution of approved drugs are required to register their establishments with the FDA and state agencies and are subject to periodic unannounced inspections by the FDA and these state agencies for compliance with cGMP requirements. Changes to the manufacturing process are strictly regulated and often require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP requirements and impose reporting and documentation requirements upon the sponsor and any third party manufacturers that the sponsor may decide to use. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain cGMP compliance.

Once an approval is granted, the FDA may withdraw the approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the product reaches the market.

Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with manufacturing processes, or failure to comply with regulatory requirements, may result in mandatory revisions to the approved labeling to add new safety information; imposition of post-market studies or clinical trials to assess new safety risks; or imposition of distribution or other restrictions under a REMS program.

Other potential consequences include, among other things:

•restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls;

•fines, warning letters or holds on post-approval clinical trials;

•refusal of the FDA to approve pending NDAs/BLAs or supplements to approved NDAs/BLAs, or suspension or revocation of product licenses or approvals;

•product seizure or detention, or refusal to permit the import or export of products; or

•injunctions or the imposition of civil or criminal penalties.

The FDA strictly regulates marketing, labeling, advertising and promotion of products that are placed on the market. Drugs may be promoted only for the approved indications and in accordance with the provisions of the approved label. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability.

In addition, the distribution of prescription pharmaceutical products is subject to the Prescription Drug Marketing Act ("PDMA"), which regulates the distribution of drugs and drug samples at the federal level and sets minimum standards for the registration and regulation of drug distributors by the states. Both the PDMA and state laws limit the distribution of prescription pharmaceutical product samples and impose requirements to ensure accountability in distribution.

Exclusivity and Approval of Competing Products

Hatch Waxman Act

Section 505 of the FDCA describes three types of marketing applications that may be submitted to the FDA to request marketing authorization for a new drug. A Section 505(b)(1) NDA is an application that contains full reports of investigations of safety and efficacy. A 505(b)(2) NDA is an application that contains full reports of investigations of safety and efficacy but where at least some of the information required for approval comes from investigations that were not conducted by or for the applicant and for which the applicant has not obtained a right of reference or use from the person by or for whom the investigations were conducted. This regulatory pathway enables the applicant to rely, in part, on the FDA’s prior findings of safety and efficacy for an existing product, or published literature, in support of its application. Section 505(j) establishes an abbreviated approval process for a generic version of approved drug products through the submission of an Abbreviated New Drug Application ("ANDA"). An ANDA provides for marketing of a generic drug product that has the same active ingredients, dosage form, strength, route of administration, labeling, performance characteristics and intended use, among other things, to a previously approved product. ANDAs are termed “abbreviated” because they are generally not required to include preclinical (animal) and clinical (human) data to establish safety and efficacy. Instead, generic applicants must scientifically demonstrate that their product is bioequivalent to, or performs in the same manner as, the innovator drug through in vitro, in vivo, or other testing. The generic version must deliver the same amount of active ingredients into a subject’s bloodstream in the same amount of time as the innovator drug and can often be substituted by pharmacists under prescriptions written for the reference listed drug.

16

Hatch Waxman Patent Exclusivity

In seeking approval for a drug through a NDA, applicants are required to list with the FDA each patent with claims that cover the applicant’s product or a method of using the product. Upon approval of a drug, each of the patents listed in the application for the drug is then published in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential competitors in support of approval of an ANDA or 505(b)(2) NDA.

The ANDA or 505(b)(2) NDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book, except for patents covering methods of use for which the ANDA applicant is not seeking approval. Specifically, the applicant must certify with respect to each patent that:

•the required patent information has not been filed;

•the listed patent has expired;

•the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or

•the listed patent is invalid, unenforceable or will not be infringed by the new product.

Generally, the ANDA or 505(b)(2) NDA cannot be approved until all listed patents have expired, except when the ANDA or 505(b)(2) NDA applicant challenges a listed drug. A certification that the proposed product will not infringe the already approved product’s listed patents or that such patents are invalid or unenforceable is called a Paragraph IV certification. If the applicant does not challenge the listed patents or indicate that it is not seeking approval of a patented method of use, the ANDA or 505(b)(2) NDA application will not be approved until all the listed patents claiming the referenced product have expired.

If the ANDA or 505(b)(2) NDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the NDA and patent holders once the application has been accepted for filing by the FDA. The NDA and patent holders may then initiate a patent infringement lawsuit in response to the notice of the Paragraph IV certification. The filing of a patent infringement lawsuit within 45 days after the receipt of notice of the Paragraph IV certification automatically prevents the FDA from approving the ANDA or 505(b)(2) NDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit or a decision in the infringement case that is favorable to the ANDA applicant.

Hatch Waxman Non-Patent Exclusivity